- The latest data shows that XRP’s institutional inflow has become the third largest behind Bitcoin and Ethereum, as $530 million flowed into the market last week.

- The US is reported to have contributed the biggest share with $474 million inflows, while Europe provided $78 million.

XRP has become the second most sought-after altcoin by institutional investors, just behind Ethereum, according to the latest report by crypto asset management giant CoinShares.

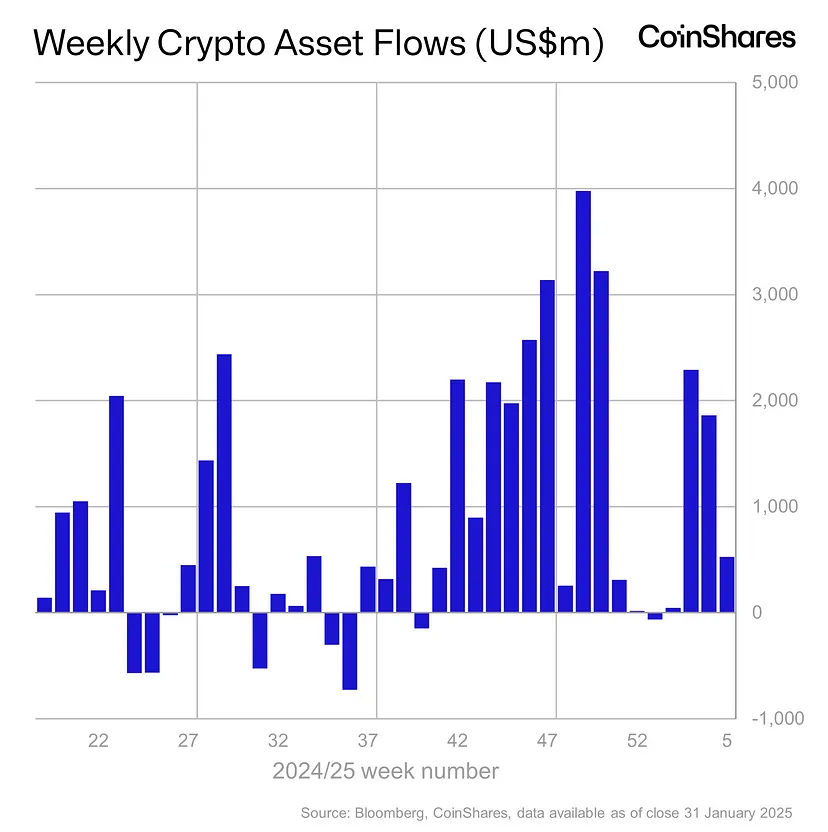

As published on their official website, the crypto market saw a $530 million investment last week by institutions. Fascinatingly, this was recorded against the severe market downturn. Later, the market bounced back with an inflow of $1 billion, taking the year-to-date amount to $5.3 billion. Comparatively, 2024 recorded a total inflow of $44 billion.

Digital asset investment products saw inflows totalling $527m last week. However, intraweek flows reflected volatile investor sentiment, heavily influenced by broader market concerns, such as the DeepSeek news, which triggered $530m in outflows on Monday. Despite this initial sell-off, the market rebounded with over $1 billion in inflows later in the week. Given the $44 billion in inflows seen in 2024, US$5.3 billion inflows year-to-date (YTD) and significant price gains, the current sell-off is not unexpected.

Breakdown of the Data

As usual, Bitcoin recorded the lion’s share with a total inflow of $486 million, followed by Ethereum. According to the report, XRP had an inflow of $14.7 million, taking its year-to-date amount to $105 million, just behind Ethereum, which recorded a yearly inflow of $177 million. In terms of regions, the US contributed a total inflow of $474 million, while Europe had $78 million

Aligning with this development, XRP’s Total Value Locked (TVL) is also reported to have surpassed $80 million, as indicated in our earlier discussion.

Amid the backdrop of these, the price of XRP has staged a 9% surge on its daily chart, bouncing from the $2.3 recorded in the previous trading session. According to our market data, XRP is currently trading at $2.6 with a market cap of $149 billion. Meanwhile, its 24-hour trading volume remains 41% down as $20.3 billion changes hands at press time.

XRP Price Analysis

Commenting on the asset class, an analyst identified as Crypto Beast believes that the asset has the potential to hit $15 before the year-end. According to him, XRP’s tokenomics indicate that this level of surge is realistic given its circulating supply of 57.7 billion. A surge around this predicted level implies that the market cap needs to reach $865.5 billion. Meanwhile, analyst Dark Defender anticipates an immediate surge to surpass the $3 level once bulls seize control, as explained in our last analysis.

Further elaborating on its potential, Dark Defender highlighted that XRP could technically reach $5.8, which aligns with the 261.8% Fibonacci extension.

According to analysts, a continuation from the current level to above the $3.3 resistance level could see the asset breaching the $4.20 level to $5.8. Meanwhile, analyst JD believes that XRP could rise by 10x to hit $26, as mentioned in our previous news brief.