The Consumer Price Index (CPI) came in with inflation higher than expected today, particularly in the month-to-month data, which caused the 10-year yield to spike sharply within seconds after the report.

This is what I discussed on today’s episode of the HousingWire Daily podcast — that there are risks associated with the CPI reports released early in the year as they often exceed expectations. This time was no different, as the month-to-month inflation figures came in unexpectedly high, which resulted in a 10-basis-point increase in the 10-year yield.

Today’s report does not change my perspective on the Federal Reserve‘s actions; I still expect two rate cuts, and if labor data worsens, I anticipate more cuts. It’s also important to note that mortgage rates were already above 7% before this report was released. For me, labor considerations take precedence over inflation, which I explain below.

From BLS: The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent on a seasonally adjusted basis in January, after rising 0.4 percent in December, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.0 percent before seasonal adjustment.

Core CPI increased by 0.4% monthly, which was higher than expected. Since 44.2% of the CPI index consists of the Shelter component, it contributed significantly — 41.5% of the month-to-month move — to the core reading. The transportation sector accounted for 36% of the month-to-month move. Recently, inflation in the used car market has been increasing for several months. Additionally, the impact of bird flu has driven up egg prices.

When analyzing CPI inflation, rent data is particularly noteworthy. More current and up-to-date rent index data from the BLS shows a disinflation trend. However, labor data is more crucial than inflation data, as we have made significant progress in CPI and PCE inflation.

Unfortunately, mortgage rates have remained above 7% even before this report came out. The Federal Reserve anticipates rent disinflation later this year since the Bureau of Labor Statistics’ new rent index has recently declined significantly, and the CoreLogic single-family rent index is at a 14-year low.

Homebuilders are still the wild card

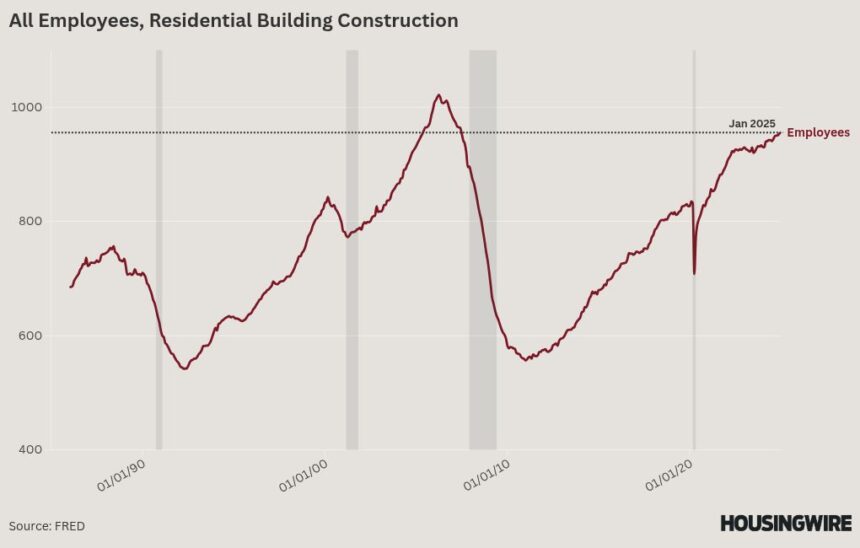

In December I began talking about the homebuilders as the wild card for the U.S. economy in 2025 because the supply and demand equilibrium in homebuilding and residential construction is much different now and the outlook is more challenging than in 2023 and 2024.

Why is this important to understanding the economic cycle? It’s because people for 14 years have been calling for a recession in America but don’t understand that the real recessionary data lines come from labor triggers. That would be residential construction workers and jobless claims data.

Jobless claims need to head toward 323,000 on the four-week moving average to really start talking about a job loss recession, so far that hasn’t happened at all the past few years.

Currently, builders are facing challenges due to higher interest rates, increased supply, and concerns about margins. They have expressed their worries regarding tariffs that could further raise their costs, and recently sent a letter to President Trump addressing this issue. As a result, 2025 presents a significantly different landscape for builders compared to previous years.

If mortgage rates can get closer to 6%, it would alleviate some of the builders’ difficulties. However, we have not yet reached that stage in the economic cycle. Historically, mortgage rates dip toward 6% during periods when the market anticipated a recession or when there were significant concerns about economic growth.

The bigger picture

After today’s CPI report, the 10-year yield surged, leading to higher mortgage pricing. However, it’s important to consider the bigger picture. Interest rates have been elevated for some time. Despite progress made on inflation in 2023, rates reached 8% in a year when inflation declined more rapidly than the Fed’s own model anticipated. Always keep in mind that labor is a critical factor over inflation, and pay close attention to homebuilders as they reflect the economic cycle.