- A structured trading plan helps traders improve consistency and manage emotional challenges effectively in financial markets.

- Risk management and trade journaling are essential components of a trading plan for sustainable long-term success.

Trading in financial markets may appear appealing, but it is far from easy. Whether you trade regularly between short gains and terrible losses or are a seasoned trader, the difficulties experienced by traders remain somewhat similar.

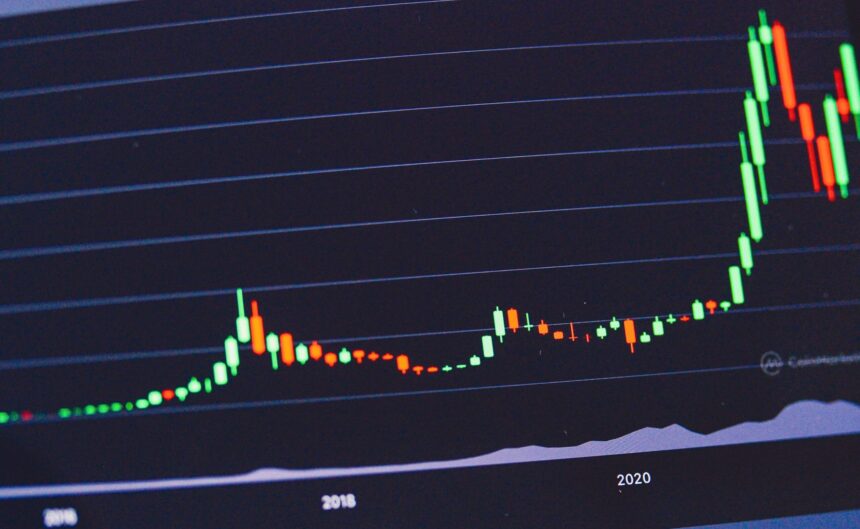

Often-recurring challenges are consistency, emotional control, and risk management. Based on analysis provided by CoinGecko, a trading strategy is not only useful but also very necessary.

Choosing Between Scalping and Swing Trading: What Suits You Best?

Finding your trading style comes first in developing a trading plan. Traders can be divided generally into either scalpers or swing traders. While scalpers concentrate on short-term trades, usually lasting only minutes or hours, swing traders occupy positions for days, weeks, or even months.

Two main determinants of the appropriate style are psychological temperament and time dedication. Swing trading may be more appropriate for those who work full-time since it involves less regular market monitoring. Conversely, scalping calls for sharp decisions, great concentration, and the capacity to control stress under duress.

Equally crucial is awareness of your degree of patience. Do you demand instantaneous results or are you at ease waiting for long-term setups? Knowing your psychological make-up can help you choose a trading approach fit for your style.

Mastering Risk Management

Any effective trading plan is built mostly on a strong risk management technique. First, evaluate your risk tolerance—that is, the capital loss you are okay with on one trade. Starting beginners, a popular piece of advice is to risk no more than 1% of total trading capital each trade involves.

Another quite important factor is the amount of your trading account. While a too-large account may make you reluctant to make trades, a too-small account could entice you to overleverage. Your trading capital should ideally be enough to count but not so great that losses cause paralysis.

Setting stop-loss levels and following them also constitutes part of risk management. For scalpers, the more transactions mean strict risk limitations are absolutely necessary.

Swing traders, on the other hand, might change risk tolerance in line with longer timescales involved. Whatever the style, the aim is to withstand unavoidable losses and save capital for next chances.

Crafting and Testing Your Trading Plan Effectively

The roadmap for decision-making is your trading plan. A good plan calls for well-defined guidelines for profit-taking, stop-loss placement, and trade entrance. On a daily basis, for example, a trend-following approach might use moving averages as indicators together with particular entry and exit criteria.

Backtesting is crucial even before you implement your plan in active markets. Examining past pricing data helps you assess how your approach works under many market scenarios. With tools like TradingView’s “Bar Replay,” which provides insightful analysis, historical events can be simulated. Recall, though, that backtesting cannot exactly duplicate the emotional demands of real-time trading.

The Power of Trade Journaling: Boosting Consistency and Growth

Maintaining discipline and tracking your results depend much on a trading log. Recording specifics of every trade—including entry and exit points, position sizes, and the justification for your choices—helps you spot trends and grow from mistakes.

Although trade journaling systems like CoinMarketManager help to simplify this process, even a basic spreadsheet can be quite successful. See your journal as your diary, carefully recording every deal. This behavior can help you stay consistent over time and remind you that trading calls for meticulous preparation rather than rash decisions.

Apart from the fundamental components of a trading strategy, one has other considerations. Important steps include choosing the markets you want to trade, developing a daily timetable, and organizing your activities around trading. These components help to define structure and lower emotional decision-making.