- Bitwise CIO Matt Hougan believes Bitcoin’s four-year cycle is over, with macroeconomic factors now playing a bigger role.

- Institutional interest in Bitcoin remains strong, with ETFs accumulating 1.163 million BTC, representing 5.94% of its market capitalization.

According to Matt Hougan, CIO of Bitwise, Bitcoin’s four-year cycle, which has long been used as the primary benchmark for market movements, may have come to an end. He claims that the halving—which used to be the key driver of price rises—is no longer the major influence. Macroeconomic conditions and institutional acceptance now, however, have more influence.

Hougan remarked in his most recent comment, “institutional investors and policy changes in Washington could extend Bitcoin’s uptrend into 2026 and beyond.” This implies that the standard trend following halving could not be applicable anymore.

Bitwise CIO Matt Hougan said that Bitcoin's traditional 4-year cycle has ended. 2025 is expected to be a strong year, but 2026 may be different from previous cycles. The main driving force of the Bitcoin market is not the halving event, but macroeconomic factors.…

— Wu Blockchain (@WuBlockchain) February 1, 2025

2025 Predicted to be Strong, But 2026 Could Be Different

Hougan believes that 2025 will be a great year for Bitcoin as more and more big companies embrace this cryptocurrency. The key causes behind this are the rising institutional investor count and the release of highly sought-after Bitcoin ETFs.

Hougan also cautioned, though, that 2026 might not show the same trends as past ones. While volatility may remain as the market ages, price action will not necessarily follow the well-known four-year pattern.

Institutional Interest Remains Strong

According to CNF, CryptoQuant CEO Ki Young Ju highlights two key signals suggesting Bitcoin’s bull run could continue. One of them is the Grayscale Bitcoin Trust (GBTC), which reflects institutional interest in Bitcoin.

Ju pointed out that once inflows into GBTC stopped, Bitcoin dropped sharply in 2021. Notably, GBTC was trading at a premium of more than 100%, therefore its stock price was substantially more than the value of the Bitcoin it possessed.

But in February 2021 this premium became a discount, suggesting institutional investor demand was dropping. Should this tendency continue, GBTC’s movement could be an indication of approaching future changes in the price trend for Bitcoin.

Young Ju also pointed out that Bitcoin holdings in ETFs have been growing fast. Since October 2024, they’ve surged to about 1.163 million BTC—worth over $123 billion, or nearly 6% of Bitcoin’s market value.

Bullish Speculation Still Dominates

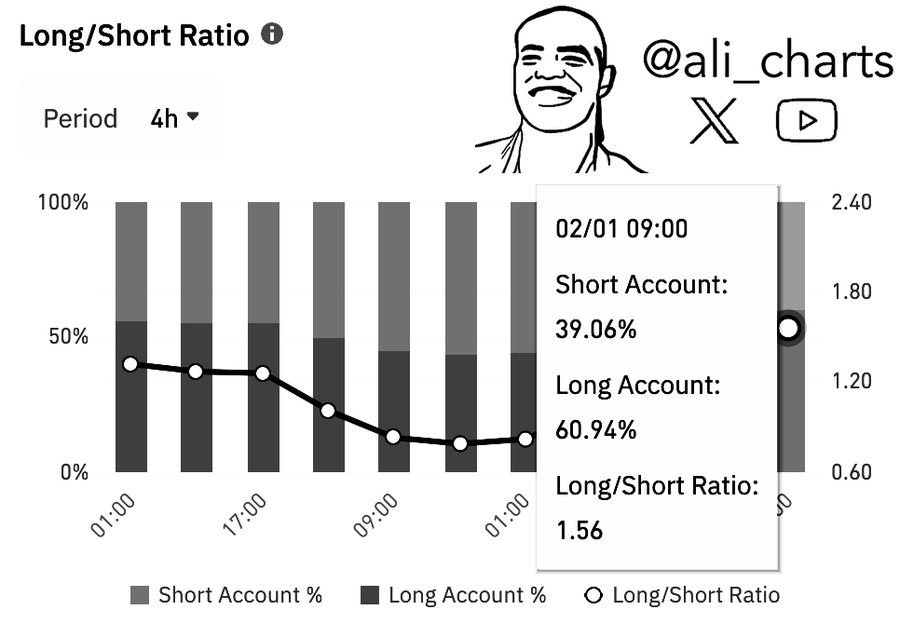

Binance data suggests that most traders stay optimistic about Bitcoin’s direction, even with differing opinions on cycle changes. According to on-chain analyst Ali Martinez, about 60.94% of traders opening futures positions on Binance are betting on Bitcoin’s price increase. This indicates that optimism remains strong among market participants.

Nonetheless, Bitcoin remains volatile. After a 2.29% pullback in the past 24 hours and a 4.60% drop over the last 7 days, BTC is currently trading at about $100,195. This shows that price swings are a natural part of Bitcoin, even though its long-term outlook still looks promising.

Is Bitcoin’s Future Shaped by Macroeconomics?

If Matt Hougan is right, Bitcoin’s price movements might start following economic trends rather than its familiar four-year cycle. Institutional investors are playing a bigger role, and the market seems less wild than before, which could lead to fewer extreme swings.

For long-term investors, that’s probably a good thing—it means less chaos. But for those who’ve relied on the four-year cycle, figuring out a new game plan might not be so simple.