With a huge welcome bonus, great travel perks, and a reasonable annual fee, the *capital one venture x* is without a doubt one of the most exciting travel rewards credit cards on the market.

But all the points and perks in the world don’t mean a thing if you can’t actually get approved for it. So who is eligible to apply for the Venture X card, anyway?

Like every bank, Capital One has its own rules and restrictions you’ll need to be aware of if you are thinking about applying for the Venture X … or any Capital One card, for that matter. And to complicate matters further, Capital One is notoriously secretive about exactly what it takes. While there’s no one-size-fits-all answer, we’ve managed to learn a lot about what it takes to get approved for the Venture X card.

From credit score to income and much more, here’s everything you need to know before applying for the Capital One Venture X Card.

Learn more about the *capital one venture x*

Application Restrictions

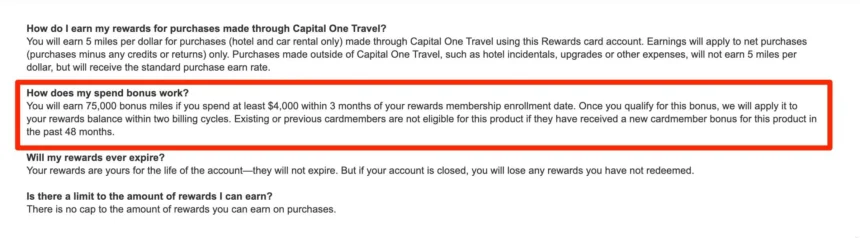

When it comes to getting approved for the Venture X, Capital One has just one officially published restriction: Existing or previous cardmembers are not eligible if they have received a new cardmember bonus in the past 48 months.

This restriction was just added last year and considering the Venture X only debuted in November 2021, it means anyone who’s ever had the card (not counting authorized users) is currently ineligible to get it again.

But beyond that single written rule, enough data points and trends have emerged over the years to give us a bit more information that can help you improve your chances of getting approved. Here’s a look at what we know about some of Capital One’s more … unofficial rules.

Do You Have Other Capital One Cards?

Generally speaking, Capital One only allows you to hold two of its personal credit cards at any given time. Co-branded credit cards, like the Capital One Walmart Card, and business cards like the *venture x business* and the *CapOne Spark Miles* are excluded from this count.

But that means if you currently hold the *capital one venture card* and the *Capital One Savor*, for example, you probably won’t be approved for the Venture X card. But then again, this is an unofficial rule: We’ve heard of some travelers getting approved for the Venture X despite already having two or more Capital One cards. Still, it’s a good rule of thumb to keep in mind.

Critically, travelers who currently have Capital One’s ever-popular Venture Rewards card in their wallets are still eligible for the Venture X. Capital One confirmed this detail as fact in an interview with Thrifty Traveler back when the card first launched. There’s no restriction on holding both cards at the same time – though, given the overlap in benefits, you may not want to keep them both long-term.

Have You Recently Been Approved for Another Capital One Card?

If you have applied and been approved for any other Capital One credit card in the past six months, it’s unlikely that you’ll be approved for the Venture X … or any Capital One card, for that matter. There are, of course, exceptions to this rule. But generally speaking, taking a six month breather with Capital One will give you the best chances of getting approved.

And if you really want to boost your odds of getting approved, that six month break should extend to other banks, too. It’s in your best interest to limit any and all credit checks for at least a few months before you decide to apply with Capital One.

What Credit Score Do You Need?

Capital One indicates that you will need an “Excellent Credit” score to be approved for the Venture X card. That means those with a credit score above 740 will have the best chances of being approved.

However, we have also seen reports of travelers with “Good Credit,” between 700 and 740, getting approved. Like most of these unwritten rules, nothing is set in stone. That being said, if your score is under 700, you’re better off working on improving your credit before applying for the Venture X.

Read More: How Your Credit Score Really Works

One last thing to note when you are applying for Capital One cards: They are one of the only card issuers that pulls credit history from all three credit bureaus (Equifax, TransUnion, and Experian). That means if you have your credit report frozen at any of the three credit bureaus, you’ll need to thaw your credit (with each of them) before applying.

Related reading: How to Freeze Your Credit (& Why You Should)

What If You Get Denied?

Even if you meet all the requirements laid out above and have enough income to generally support a credit card approval, getting approved still isn’t a slam-dunk. We’ve heard from many readers who were mystified at why they weren’t approved for the Venture X Card … including yours truly. Welcome to the world of Capital One.

When the card first launched, I jumped at the chance to apply and I figured I’d be a shoo-in for an instant approval.

At the time of application, my credit score was 798 and I hadn’t had any credit inquiries in the previous six months. What’s more, I had just one Capital One credit card, with many years of account history, and never carried a balance on it or had any late payments. With everything we know about Capital One’s approval standards, I should have been a lock – in fact, many others in a similar situation had already been approved for the card. That just goes to show that even with all we know about Capital One’s application requirements, it remains unpredictable at best.

Any time you’re denied for a new card, we always suggest calling the bank’s reconsideration phone line right away – the reason could be something simple, or the bank just might need more information from you.

So I dialed up their credit card reconsideration phone line on not one, but two different occasions, and both times I got the same answer: They couldn’t tell me why my application was denied, and I’d need to wait for my letter in the mail. Only then could I go through the reconsideration process and even that proved fruitless…

I’m no quitter, though: About two months later I tried again and was instantly approved for the Venture X on my second try. It’s unclear what changed between my two applications – my financial situation and credit score were nearly identical to when I first applied. The whole thing seemed to have less to do with my personal situation and more to do with Capital One’s decision-making process.

That just goes to show, even if you don’t get approved at first, you can always apply again in the future. Outside of a temporary ding, getting declined for a credit card doesn’t have a lasting impact on your credit score.

Read next: Denied for a New Credit Card? Here’s Why You Shouldn’t Fret

Bottom Line

Capital One is a historically secretive bank when it comes to their credit card approval process and this makes it tough to know whether or not applying for a new card like the Venture X is worth the hassle. But if you follow these tips, and make sure you check the boxes before applying, you should have a leg-up in getting approved for the Venture X … or any other Capital One card.

Learn more about the *capital one venture x*