- Rex Shares and Osprey Funds have filed for multiple crypto ETFs, including one linked to Donald Trump’s memecoin, amid shifting U.S. regulations.

- Trump’s memecoin, TRUMP, surged 540% in a week, reaching an $8.31 billion market cap, while Melania’s token faced significant declines.

Investment management firms Rex Shares and Osprey Funds submitted filings for a series of cryptocurrency-focused exchange-traded funds (ETFs), including one tied to a memecoin launched by Donald Trump. The proposal came just days after the former president’s inauguration.

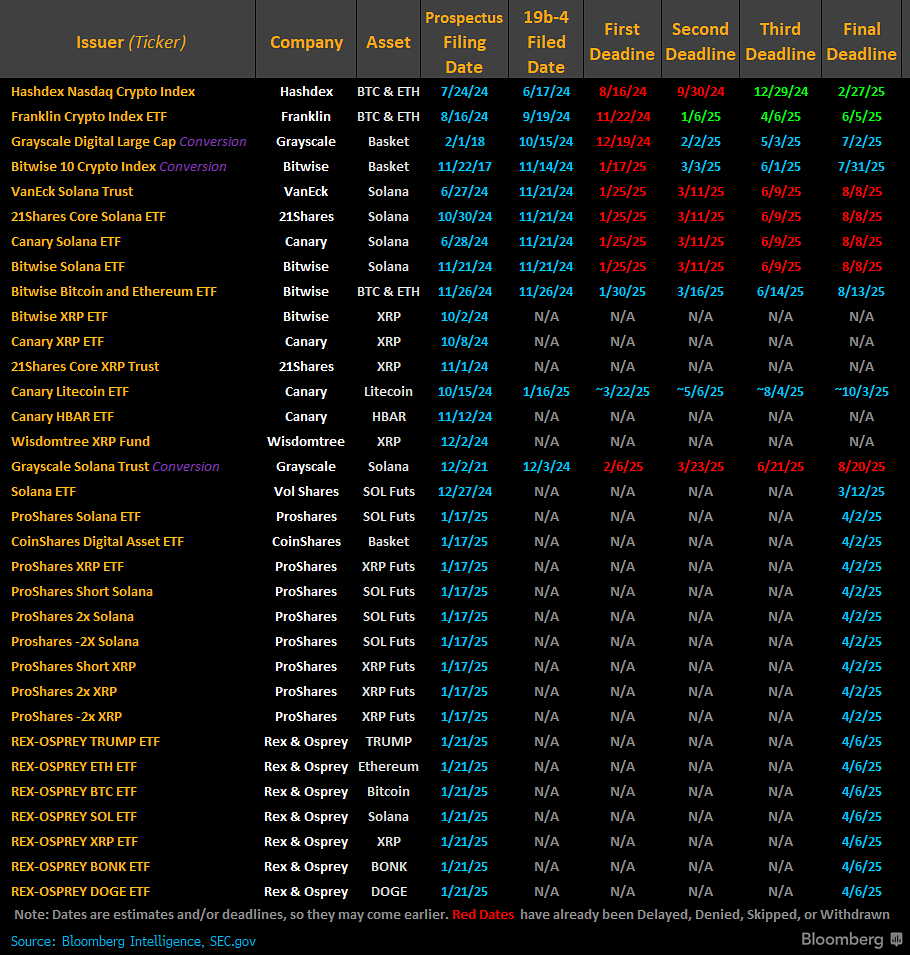

Wow. That was fast. @REXShares and Osprey have filed for a bunch of crypto ETFs including memecoins TRUMP, BONK, and DOGE.

Also includes ETFs for Bitcoin, Ether, Solana, and XRP. pic.twitter.com/A4FzTdaBOj

— James Seyffart (@JSeyff) January 21, 2025

Trump’s memecoin, named TRUMP, has already gained significant attention. The token has gained 8.40% in the last 24 hours, with the market cap surging by 8.60% and reaching $8.31 billion in the same period. TRUMP token recorded an impressive gain of 540% over the past week.

First Lady Melania Trump also entered the crypto space with her token, MELANIA, which trades at around $3.90. Contrasting to the TRUMP token’s uptrend, the Melania token faces a bearish trend, with an 11.20% and 46% decline in the weekly and monthly frames, respectively.

“This to me seems like issuers pushing the envelope with a new SEC administration while at the same time trying a novel structure for providing exposure to digital assets in an ETF wrapper,” said James Seyffart, ETF analyst at Bloomberg Intelligence.

Crypto ETF Frenzy Hits SEC — Memecoins, Leverage, and More

The proposed Rex-Osprey Trump ETF is part of a broader wave of recent crypto ETF applications. Alongside TRUMP, the filings include ETFs tracking Bitcoin, Ethereum, Dogecoin, and Bonk. Proposals for XRP and Solana-focused ETFs also appeared, signaling a potential expansion of crypto products in the U.S. Analyst James Seyffart shared the list of all ETFs filing.

However, not all proposals focus on memecoins. A series of leveraged and inverse XRP funds from ProShares and a multi-token CoinShares Digital Asset ETF were also part of Friday’s filings. The interest suggests growing confidence in crypto as a financial product despite its volatile reputation.

Under the previous Securities and Exchange Commission (SEC) leadership of Gary Gensler, cryptocurrency ETFs faced significant regulatory hurdles. Approval for spot bitcoin and Ethereum ETFs took years, reflecting regulators’ cautious approach. With the Trump administration’s promise to position the U.S. as a “crypto capital,” optimism is rising, though hurdles remain.

Trump Administration’s Crypto Ambitions

The new administration has already made moves suggesting a shift in regulatory tone. In one of his first executive actions, Trump renamed the U.S. Digital Service to the “Department of Government Efficiency,” tasked with streamlining agencies. Curiously, its website now features a dogecoin mascot, blending the serious with the surreal.

Acting SEC Chair Mark Uyeda recently announced the launch of a “crypto task force” aimed at crafting clearer rules around digital assets. While this could pave the way for innovative products like the Trump ETF, questions linger about the approval process for memecoins, given their speculative nature.

Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, described the Trump ETF filing as “surreal.” He reflected the skepticism shared by many, even as excitement grows about the potential for a more crypto-friendly regulatory environment.