*amex platinum card* is one of the best travel rewards credit cards on the market today, period.

While many travelers understandably shy away from the card’s hefty $695 annual fee (see rates & fees), it offers a ton of benefits that can easily offset that high dollar amount (and then some), if you’re willing to put in a bit of work. In fact, even occasional travelers who play their cards right can come out way ahead with the Platinum Card.

Interested in applying? We’ll run through all the benefits of the card and help you decide if it’s the right fit for your wallet.

Learn more about *amex platinum card*

Amex Platinum Benefits

Welcome Offer Bonus

You can currently earn 80,000 Membership Rewards points after spending $8,000 in purchases in the first six months of card membership. But you may be able to get much, much more.

If you have never had an American Express credit card, you may be targeted for a welcome offer for up to 175,000 points via CardMatch! Otherwise, keep your eyes peeled for bigger bonuses via personal referral links … or just try searching for the Platinum Card in an incognito browser to see if you can beat the standard 80,000-point welcome offer bonus.

Read More: How to Get the Biggest Offer on the Amex Platinum Card

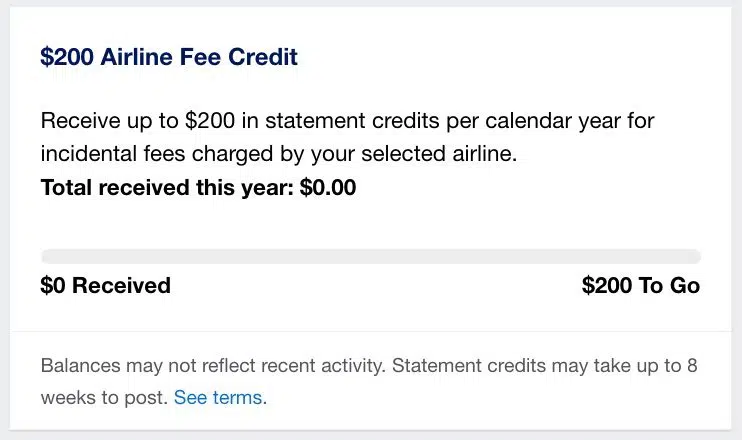

$200 in Annual Airline Credits

Each year you hold the Platinum Card®, you get up to a $200 credit to use with one selected airline. The credit is intended to be used for things like checked bags, change or cancellation fees, seat assignments, lounge access, and more.

On paper, that means you can’t simply buy airfare with these credits. But in practice, there are workarounds you can use to put your credits toward booking flights – especially with Delta, Southwest, and United. Otherwise, using these credits to cover the taxes and fees when booking award tickets is our go-to.

![]()

The benefit follows the calendar year, so you will receive $200 to use each January. Any remaining credit from the previous year will not carry over.

So, what airlines can you select for your credit? All the big U.S. carriers are eligible. Keep in mind you’ll need to select one of these airlines in advance in order to use up the credits at the start of the year.

- Delta Air Lines

- United Airlines

- Hawaiian Airlines

- Frontier Airlines

- Spirit Airlines

- American Airlines

- JetBlue Airways

- Southwest Airlines

- Alaska Airlines

Make sure to read our whole guide on the best ways to maximize your Amex Airline credits!

Up to $200 of Annual Uber Cash

Each year you hold the Platinum Card, you get up to $200 in Uber cash. It’s doled out in increments of $15 each month except for December, when you get $35 to round out the year.

You must use the full amount each month or you will lose any remaining value: The Uber Cash does not carry over from month to month. If you don’t often take Uber rides, the credit can also be used on Uber Eats, Uber’s food delivery platform. If Uber Eats is available in your area, it makes it relatively easy to maximize this benefit each and every month.

Up to $240 in Annual Entertainment Credits

After a major refresh in 2021, Amex Platinum cardholders now receive up to $240 in annual statement credits for select entertainment services, split into monthly installments of up to $20. But this benefit is incredibly restrictive: It only applies to purchases or subscriptions with the following services:

- Peacock

- The New York Times

- Disney+

- The Disney Bundle

- ESPN+

- Hulu

- The Wall Street Journal

Get a “Free” Walmart+ Membership

Nothing says “premium travel credit card” like a Walmart subscription, right?

On the heels of its summer 2021 overhaul when Amex hiked the Platinum Card’s annual fee with additional benefits, the bank added several more perks, including a monthly credit of up to $12.95 for … a Walmart+ membership.

Odd or not, there are some solid perks with a Walmart+ membership that could make it worth signing up for, including:

- Free next-day shipping from Walmart.com, with no order minimums

- Free local delivery of groceries and other items, with a $35 order minimum

- Discounts on prescriptions from Walmart pharmacies, with savings of up to 85%, according to Walmart

- Save 5 cents per gallon on gasoline from Walmart and Murphy stations.

- Skip the checkout lane: Scan your items with your phone using the Walmart app, pay, and go.

- 25% discount (and free whoppers) at Burger King

- 24/7 telehealth for your pets

- A Paramount Plus membership for at-home streaming of popular channels like CBS, Comedy Central, MTV, BET, and Nickelodeon, as well as many live sports events and movies.

Like many others on this list, this is a monthly credit … and it’s “use it or lose it.”

Read More: Walmart+ is Low-Key One of the Amex Platinum Card’s Best Perks

$100 Annual Credit for Saks Fifth Avenue

You get two credits of up to $50 each year to use at Saks Fifth Avenue: One $50 credit will be available from January through June and another from July through December. Like the other credits available on the Platinum card, you will lose any remaining balance after the expiration date. Enrollment is required for this benefit.

The offer can be used in-store and online. However, per the terms and conditions of this offer, it will not work to purchase gift cards.

Saks Fifth Avenue isn’t the cheapest place to shop, but you should be able to find a few things each year to use your credit on.

Earn 5x Points on Airfare & Prepaid Hotel Stays

If you spend a lot on airfare, you won’t find a more rewarding card than the Platinum Card.

That’s because it earns 5x Amex Membership Rewards points for every dollar spent directly with any airline or through the American Express travel portal at amextravel.com (up to $500,000 spent each year). Combined with some excellent built-in travel insurance, it easily makes the Amex Platinum Card the best option for booking flights.

You’ll also earn 5x points per dollar when booking prepaid hotel stays through AmexTravel.com.

Otherwise, you’ll earn just 1x point per dollar on all other spending, which means that other than flights, there is likely a better option for your everyday spending.

The Best Airport Lounge Access, Period

The Platinum Card is one of the best credit cards for airport lounge access, and no other travel rewards credit cards come particularly close. Just for holding the Platinum card, you will get access to the following lounge networks through the Amex Global Lounge Collection:

Amex Centurion Lounges: These are American Express’s flagship lounges, available only to Platinum (and invite-only Centurion) cardholders. Your card gets you in free, but if you want to bring a friend with you, that’ll cost an extra $50 per guest. Alternatively, you can get two free guests each visit by spending $75,000 per calendar year on your card.

Centurion Lounges are available in more than a dozen U.S. airports and several international locations, including Hong Kong (HKG) and London Heathrow (LHR).

Read our master guide to the Amex Centurion Lounges.

Delta Sky Clubs: The Platinum Card is a no-brainer if you often fly Delta. Just for holding the card, you will receive 10 complimentary visits to any Delta Sky Club as long as you are flying Delta that day. You can’t bring guests in for free – they’ll also cost $50 each.

After you’ve used up your ten complimentary passes each year, each additional visit will cost you $50, but it’s possible to use your airline credit to get up to four more visits.

Priority Pass: The Amex Platinum Card also offers a Priority Pass Select membership, getting you and up to two guests into an additional 1,400-plus lounges around the world.

Plaza Premium: Plaza Premium Lounges are a collection of more than 300 lounges around the world, with higher-end finishes and food than you’ll find in your standard airline club or Priority Pass Lounge. They’re mostly found overseas, though the company is building more and more of them in North America. For now, it also includes access to the excellent Virgin Atlantic Clubhouse lounges in the U.S.

The Escape Lounge: Escape Lounges, the American Express Studio are a partnership with American Express. They’re typically much smaller than your typical Amex lounge but also regularly less crowded. You’ll find them at airports across the country, even smaller regional airports. The Escape Lounge allows Amex Platinum cardholders to bring in up to two guests at no additional cost.

Check out our reviews of the MSP Escape Lounge and the Escape Lounge in Phoenix!

A $199 Annual Credit for CLEAR Plus

Platinum cardholders get a $199 annual credit for the privately run CLEAR® Plus security program. Memberships start at $199 a year. Just pay for your membership with your Platinum Card, and the credit should kick in automatically.

You can easily lower the cost of CLEAR to just $179 by being a Delta SkyMiles or United MileagePlus member, or even $149 if you hold a co-branded credit card from United or Delta or have status with either airline. That leaves some extra money on the table with this new credit, which you could use to add up to three family members to your account for an additional $119 each.

CLEAR Plus may not make sense for every traveler, but there’s no denying this is a nice benefit. CLEAR Plus allows you to cut to the front of the security line at a growing number of U.S. airports.

Read more: Is CLEAR Worth the Cost Anymore? Our Full Review

Global Entry or TSA PreCheck Fee Credit

If you apply for either Global Entry or TSA PreCheck and pay with the Platinum Card, a credit will kick in to cover the entire cost (up to $120). You are eligible to receive this credit once every four years, and membership in either program is good for five years.

Global Entry also includes a TSA PreCheck membership, so if you plan to travel internationally, that’s likely the best option. Just beware: Backlogs in processing applications and trouble securing a Global Entry interview appointment can make signing up a lengthy process.

Not sure which option is best for you? See our guide on Global Entry vs TSA PreCheck.

Amex International Airline Program

The Amex International Airline Program (IAP) is an exclusive benefit available to both Platinum and Business Platinum cardholders that allows you to get exclusive savings on select airlines when you book your airfare through the American Express travel portal. It is only valid for international itineraries booked in first class, business class, and premium economy – so there are no additional savings here when flying economy.

American Express claims that the average savings are $150 on premium economy, $300 in business class, and $600 on international first-class round-trip fares. In practice, we’ve seen these numbers vary depending on the routing, fare class, and airline.

The discount will only apply on flights originating in the U.S., and from select Canadian airports. Additionally, Amex will allow you to apply the international airline program discount on up to eight tickets booked on the same flight.

Read More: Our full guide on the American Express International Airline Program.

Hilton Honors & Marriott Bonvoy Gold Elite Status

Just for holding the Platinum Card, you get automatic Marriott Bonvoy and Hilton Honors Gold Elite status without meeting any stay requirements. You’ll just need to enroll on the benefits tab of your online account.

Marriott Bonvoy Gold Elite status typically requires 25 eligible stays in a calendar year. With this status, you’ll earn 25% more points on stays, receive enhanced room upgrades upon availability, and enjoy a late checkout during your stays.

Hilton Honors Gold Elite status typically requires 20 stays or 40 nights in a calendar year. With the status, you’ll earn 80% more points on stays, complimentary space-available upgrades.

Hilton Gold status includes free breakfast for you and a guest during your travels abroad. In the U.S., Hilton has replaced this with a daily food and beverage credit.

$200 Hotel Credit

Each year, you’ll have up to a $200 credit to use at either Fine Hotels and Resorts or Hotel Collection properties.

All you need to do to get started is search for hotels through the Amex Travel booking portal. This credit only applies to Fine Hotels + Resorts® (FHR) or Hotel Collection properties. Notably, Hotel Collection properties require a two-night minimum stay.

Booking through these programs can provide some great value – especially when putting your $200 credit to use. Whether you are booking a Fine Hotels & Resorts or a Hotel Collection property, you’ll get great benefits like daily breakfast for two, complimentary space-available room upgrades, late checkout, and credits of up to $100 to spend at the property’s spa or restaurants.

Unlike some of the other Amex Platinum benefits, there’s no need to enroll for the credit before you use it. All you need to do is log in at Amextravel.com, search for a participating property, pay with your Platinum Card, and that $200 credit will kick in automatically.

But like many other credits on this list, this Amex hotel credit resets each calendar year, right on Jan. 1. But since this is a prepaid credit, you only need to book before the end of the year. You’ll still be able to use it even if your stay is far into the following year, so long as the charge posts to your account on or before Dec. 31 each year.

Check out our full guide on using the Amex Platinum hotel credit!

Trip Delay & Cancellation Coverage

The Platinum Card offers trip delay and cancellation coverage. Add in the 5x points per dollar you earn when booking flights directly with the airline, and it makes it one of the absolute best ways to book flights.

If you pay for your round-trip flight with the Platinum Card – or put the taxes and fees from an award flight on it – you will be eligible for:

- Trip Cancellation Insurance: You can get reimbursed for up to $10,000 of nonrefundable expenses – and up to $20,000 a year total – if your flight is cancelled due to weather, an injury or illness, and other “covered reasons.”

- Trip Delay Insurance: If your flight is delayed by more than six hours, you are eligible for up to $500 in reimbursement for lodging, food, and other associated expenses.

To qualify for coverage, flights must be round-trip, though booking a multi-city trip and sometimes even two one-way flights would still qualify.

- Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by New Hampshire Insurance Company, an AIG Company.

Cell Phone Insurance Protection

If a card member’s cell phone is stolen or damaged (damage even includes a cracked screen), American Express will reimburse the cost of repair or replacement for up to two approved claims for a maximum of $800 per claim or $1,600 over a 12-month period.

Your phone line must be listed on the wireless bill, and the prior month’s wireless bill must have been paid with one of the eligible cards listed above.

Each claim will require the cardholder to pay a $50 deductible – a relatively small cost.

- Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by New Hampshire Insurance Company, an AIG Company.

Amex Platinum Concierge

Just for holding the card, you will receive around-the-clock assistance with travel planning and booking, shopping advice, and other personal requests through their Platinum cardholder concierge service. Simply email the Platinum concierge at platinum@concierge.americanexpress.com or call them at 1-800-525-3355.

Amex Platinum Cardholders can also search, book, and manage restaurant reservations from more than 10,000 restaurants (and growing) around the world through the American Express mobile app thanks to their recent acquisition of the restaurant reservation service, Resy.

If you hold the Platinum card, head to the “Membership” tab in the mobile app. You will see the “Access Top Restaurants” button in your account.

Adding Authorized Users to Your Amex Platinum

Adding authorized users to your travel credit card can be a great way to share travel perks with loved ones.

But if you want to add an authorized user, it will cost you. After a benefits update, adding an authorized user to your Platinum Card will cost another $195 per card each year – which certainly isn’t cheap.

But there are some alluring reasons why you should consider adding an authorized user.

Your new authorized user won’t get every single benefit that you do. Namely, some of the big-dollar credits don’t pass over to your guest. But there’s more than enough value here to offset the additional fee for many travelers. Here’s a brief rundown of what your authorized users will get.

- American Express Centurion Lounge Access: Yes.

- Priority Pass Select Lounge Membership: Yes.

- Delta SkyClub Access (When Flying Delta): Yes.

- Up to $120 Credit for TSA PreCheck or Global Entry: Yes.

- Earn 5x Points on Airfare Booked Directly with Airlines and Hotels Booked Through Amextravel.com: Yes.

- $200 in Annual Airline Fee Credits: No.

- $200 in Annual Uber Ride Credits: No.

- $200 Hote Credit: No.

- $199 CLEAR Credit: No.

- $240 Digital Entertainment Credit: No.

- $100 in Annual Saks 5th Ave. Credits: No.

- Instant Hotel Status with Marriott and Hilton: Yes.

- Instant Rental Car Agency Status with Hertz, Avis, and National: Yes.

One additional note: you can add a “Companion Platinum Card” to your account at no additional cost. These users won’t get nearly as many benefits, but they will get their own reimbursements for TSA PreCheck or Global Entry.

Read More: Get TSA PreCheck for the Whole Family with 1 Credit Card

Is the Amex Platinum Annual Fee Actually Worth It?

The Platinum Card boasts an annual fee of $695 (see rates & fees).

Because of all the benefits the card offers listed above, that can easily be a fair price … but it depends on you and your travels. If you are using the benefits, you should get far more value out of the card than you pay for the annual fee. And because of the big welcome offer bonus, that alone could make it a no-brainer for at least the first year.

If you can’t maximize those benefits or don’t want to put in the (admittedly substantial) effort to do so, this card could be worth skipping.

Read More: Is the $695 Amex Platinum Annual Fee Worth It? An Honest Review

Learn more about *amex platinum card*

Bottom Line

Year in and year out, the American Express Platinum Card is one of our favorite travel rewards credit cards.

While the large annual fee isn’t for everyone, there is no single credit card that can improve your airport and travel experience more than the Platinum Card. Throw in the big bonus, and it’s easily worth considering.