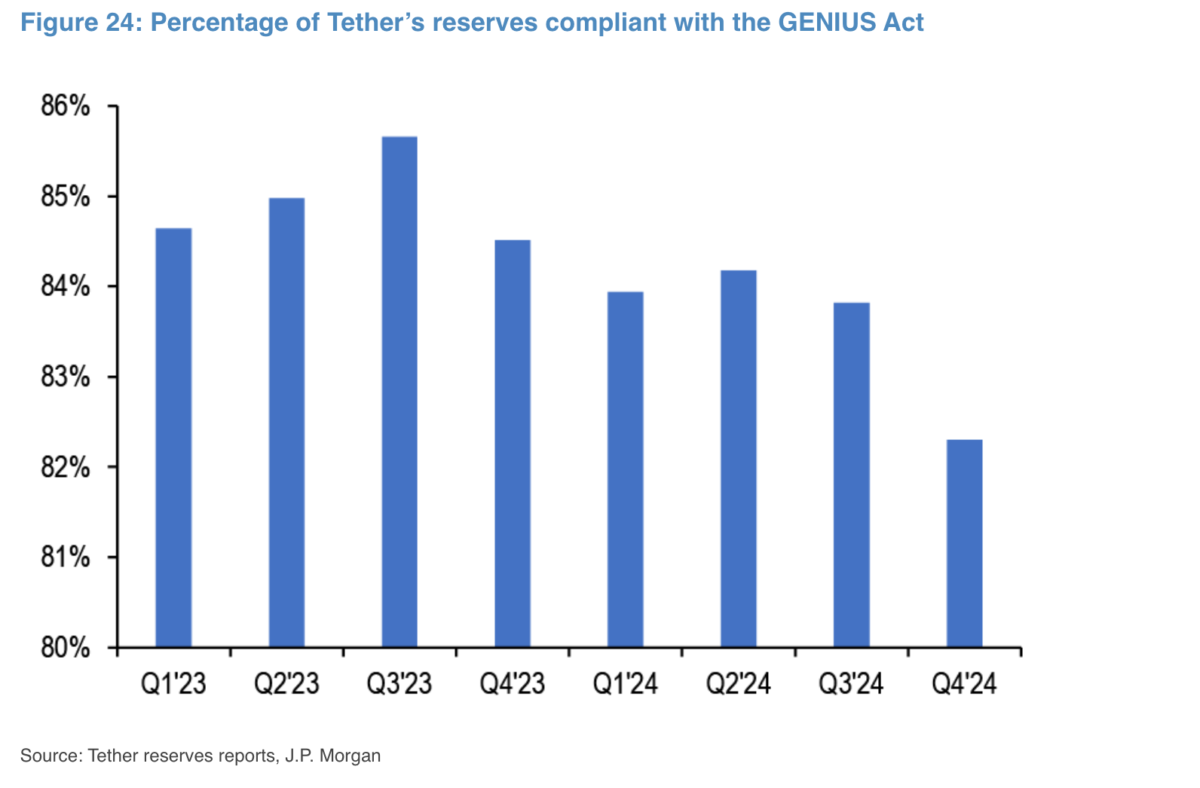

- Under the STABLE Act, only 66% of Tether’s reserves are compliant, while the GENIUS Act sees 83% compliance.

- Analysts warn that declining compliance ratios, alongside the rising stablecoin supply, could force Tether to restructure its reserves, shifting holdings into U.S. Treasuries and more liquid assets.

JPMorgan analysts have recently pointed out that USDT stablecoin issuer Tether may have to sell its non-compliant assets including Bitcoin (BTC), corporate paper, precious metals, and other secured loans, in order to comply with the stablecoin regulations of the United States.

Recently, the U.S. introduced two stablecoin bills. This includes the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act in the House. The other is the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act introduced in the Senate.

These two bills look to regulate stablecoin issuers such as Tether, Circle, with risk management rules, licensing requirements, and 1:1 reserve backing. Tether CTO Paolo Ardoino responded to these developments in an X post noting: “JPM analysts are salty because they don’t own Bitcoin”.

Tether Needs to Step Up Its Compliance Game

JPMorgan analysts, led by Nikolaos Panigirtzoglou, reported on Wednesday that under the House’s STABLE Act, only 66% of Tether’s reserves are compliant. Similarly, according to the Senate’s GENIUS Act, 83% of Tether’s reserves meet the required standards. However, the analysts pointed out concerns that both the figures show a declining compliance ratio since mid-2024 and that it coincides with the surge in stablecoin supply.

On the other hand, the STABLE Act enforces stricter reserve requirements, allowing state-level regulation, while the GENIUS Act mandates federal oversight for large issuers and permits them to hold a wider range of reserve assets. Analysts stated that if either bill passes, Tether would be required to restructure its reserves by reallocating holdings into U.S. Treasuries and other liquid assets. Recently, Tether reported strong Q4 2024 earnings due to the growth of its reserve assets, as highlighted in our previous article.

According to its Bitcoin address, stablecoin issuer Tether currently holds 83,758 Bitcoins, valued at over $8 billion based on current prices, as part of its reserves. Previously, the company announced its plans to allocate nearly 15% of its quarterly profits toward purchasing BTC.

In recent times, Tether CTO Paolo Ardoino expressed interest in exploring the artificial intelligence (AI) sector. He recently gave a preview of AI features that the company is currently developing, along with its own AI SDK platform, as outlined in our recent blog post.

Key Challenges Faced By the USDT Issuer

The USDT stablecoin issuer has been facing major compliance challenges not only in the US but other regions. As the European Union’s Markets in Crypto Assets (MiCA) regulations kicked in by the end of December 2024, several firms operational in the region started delisting Tether’s USDT from their platform, as reported by CNF earlier.

According to JPMorgan analysts, the U.S. market presents a much greater regulatory challenge for Tether due to the company’s larger market share in the region. With both proposed bills demanding high-quality and liquid assets as reserves, Tether’s dominant position in the U.S. could face increasing pressure. “U.S. stablecoin regulations requiring more transparency and frequent reserve audits pose additional challenges to Tether,” they said.