- Solana has struggled after a 30% drop but saw a $16 million inflow, hinting at renewed investor confidence and a potential price rebound.

- Bullish momentum is building, with Solana holding above $205, supported by technical indicators suggesting a move toward $220 if strength persists.

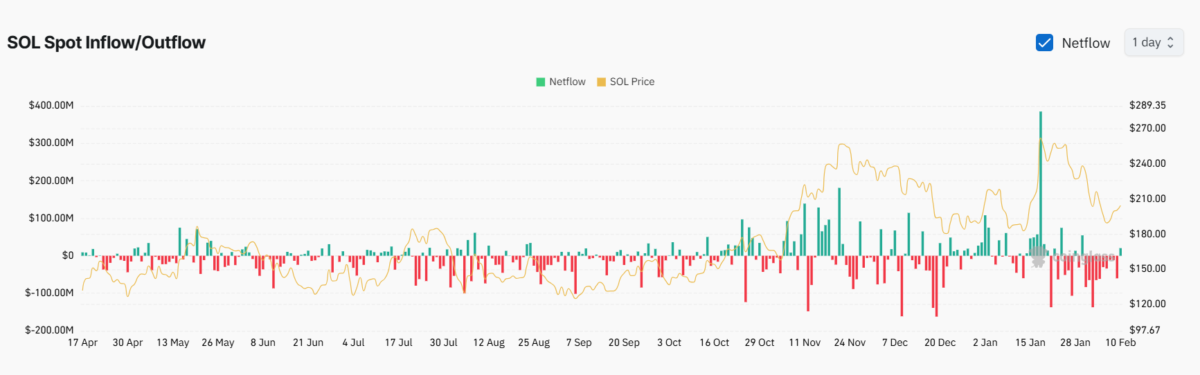

Solana has been struggling to maintain its footing after dropping nearly 30% since hitting $294.33 on January 19. But fresh signs of accumulation suggest that sentiment could shift in a more positive direction. A significant inflow of $16 million into Solana’s spot market on Monday indicates growing investor interest, marking the first major inflow in ten days.

That renewed buying pressure has allowed Solana to hold above $200, a critical psychological and technical level. According to Coinglass, this influx of funds could signal a potential turnaround as investors step in to take advantage of lower prices.

Spot inflows are often seen as a measure of confidence, suggesting that more traders are willing to acquire Solana at current levels as buyers outweigh sellers, and the likelihood of a price recovery increases, strengthening the argument for a bullish continuation.

Solana Eyes $220 After Breakout

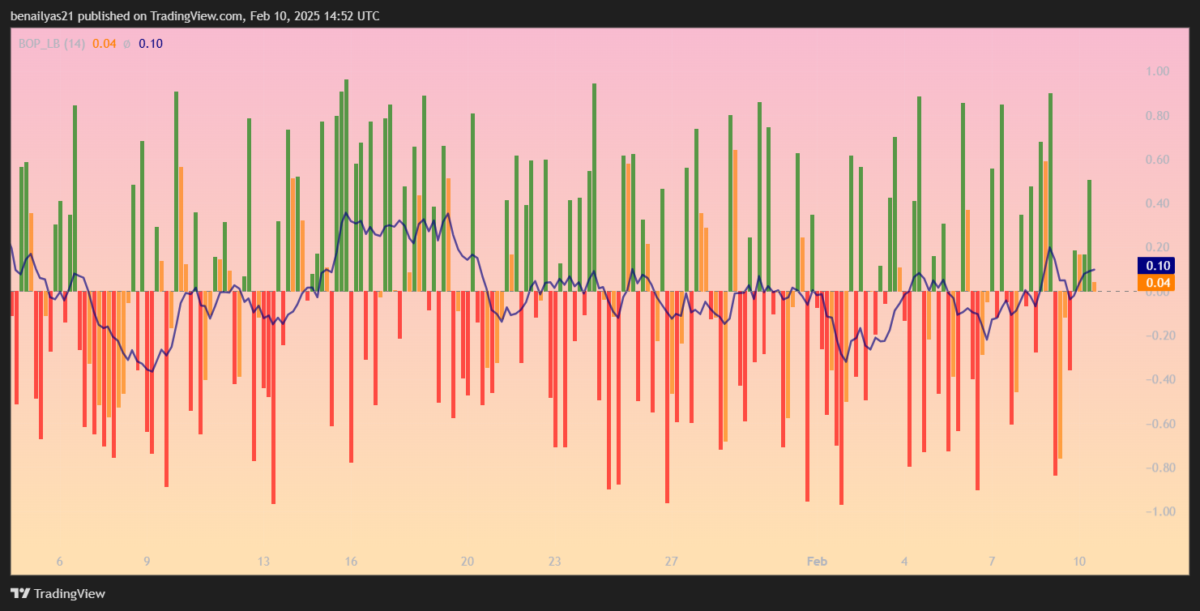

Beyond the inflows, technical indicators also flash encouraging signs. The market’s balance of power (BoP) indicator shows volatile shifts, with buyers gaining strength after a prolonged bearish trend. Recent positive momentum suggests renewed confidence. A positive BoP reading often points to stronger accumulation, potentially laying the foundation for further gains.

Solana has already shown some resilience, climbing 2.80% in the last 24 hours to trade at $207.35. A symmetrical triangle breakout suggests that bullish momentum is building, with resistance levels at $212.67 and $216.15 now in focus. The 50-day Exponential Moving Average (EMA) at $205.04 offers short-term support.

The Relative Strength Index (RSI) is adding to the optimism. Currently, at 59.74, it indicates increasing buying pressure, with the 14-day RSI moving average at 51.42 pointing to a gradual bullish trend. If Solana can maintain strength above $205, a move toward $220 appears within reach. However, failing to hold above this support level could lead to a retest of $200.97.

Key Levels to Watch for a Sustained Breakout

Trading volume has been increasing, signaling growing participation in the market. If the bullish momentum continues, a close above $212.67 could invite further demand, pushing Solana toward its next resistance at $216.15.

That said, the 200-day EMA at $216.15 remains a significant long-term barrier. A clear breakout above this zone could set the stage for a retest of January highs near $230. However, if buyers fail to maintain momentum, profit-taking around these levels could lead to a short-term correction back toward $200.

A broader factor influencing Solana’s direction is the performance of Bitcoin and the overall crypto market. If Bitcoin remains stable or trends upward, Solana’s bullish outlook could strengthen. But if Bitcoin faces downward pressure, it may drag Solana along with it.