If you’ve got *amex platinum card*, you’ve tasted the sweet life of a frequent traveler. Wouldn’t it be nice to share your wealth of benefits with someone else?

Like almost any travel card on the market, American Express allows you to add authorized users to your Platinum Card account … and there’s good reason to: These additional users get many of the best Amex Platinum benefits like a fast pass through airport security and customs with a credit to join TSA PreCheck or Global Entry, instant status with Hilton or Marriott, and the same unbeatable access to airport lounges.

At $695 a year (see rates & fees), having the card for just yourself isn’t cheap – and sharing the love of your Amex Platinum comes at a cost, too. That cost is growing: After a change last year, the price of adding an authorized user to your Platinum card is now an extra $195 per user. That’s a substantial increase: Previously, you could add up to three additional users for a total of $175.

Still, it might be worth considering. Here’s how it works and why you should consider it.

What Benefits Do Authorized Users Get?

From unrivaled lounge access to a free membership in Global Entry or TSA PreCheck, the American Express Platinum card has the richest set of travel perks on the market. By adding someone as an authorized user, your travel companion can share many of them – though not all.

Namely, some of the big-dollar annual credits don’t pass over to your guest, so you can’t double dip there. And none of the new benefits added to the card a few years ago – like the new CLEAR® Plus credit or an annual Amex hotel credit – pass on to authorized users.

But there’s still more than enough value here to offset the additional fee for many travelers. Here’s a brief rundown:

| Name of Benefit | Available to Authorized Users? |

|---|---|

| Amex Centurion Lounge access | Yes. |

| Priority Pass lounge access | Yes. |

| Delta Sky Club access (when flying Delta) | Yes. |

| TSA PreCheck/Global Entry credit | Yes. |

| Up to $199 credit for CLEAR Plus | No. |

| Earn 5x points on airfare booked direct with airlines & hotels booked via Amex Travel | Yes. |

| $200 annual airline fee credit | No. |

| $200 annual hotel credit | No. |

| Up to $200 in Uber credits | No. |

| Up to $100 toward Saks Fifth Ave | No. |

| Up to $200 in entertainment credits | No. |

| Instant hotel status with Hilton & Marriott | Yes. |

| Book Amex Fine Hotels & Resorts | Yes. |

| Instant status with rental car agencies Hertz, Avis, & National | Yes. |

In pure dollar value, the credits you don’t get are some of the biggest perks the card offers. They immediately take the sting out of the $695 annual fee … but only for primary users.

But scan the list and you’ll see that additional users do get nearly all the benefits to improve their travels: Lounge access, a credit that covers TSA PreCheck or Global Entry, status with hotels and rental car agencies, and more. On top of earning 5x when booking flights directly with the airline or with Amex Travel (on up to $500,000 spent per year combined), authorized users who book roundtrip flights with their Platinum Card also get some great built-in travel insurance.

Read More: Get TSA PreCheck for the Whole Family with 1 Credit Card

Sharing Lounge Access is Clutch

If sharing lounge access with your favorite travel companion is your goal, adding an Amex Platinum Card authorized user could be a no-brainer.

You can get into the Delta Sky Club by flashing your Delta boarding pass and Amex Platinum card, but a guest costs another $50. But not for an authorized user: That person will have their own card to get into the Sky Club … whether they’re traveling with you or not. Just four trips a year to the Sky Club with your authorized user in tow and you’ve come out ahead by paying the $195 additional fee.

The case for adding an additional user to your Platinum Card gets even stronger in 2025, when harsh new limits for entering Delta Sky Clubs kick in: Come Feb. 1, 2025, Amex Platinum cardholders can only visit Sky Clubs 10 times per year. But authorized users get their own 10 visits, too!

Authorized users can also get into the growing collection of top-notch Amex Centurion Lounges on their own, too. Considering Amex cut free guest access to Centurion Lounges last year by charging $50 apiece (or $30 for minors), adding your spouse or best travel buddy to your card is a nice workaround to let them tag along with you for free to the excellent JFK Centurion Lounge and more than a dozen others around the U.S. (and abroad).

The lounge access goes even farther. Your authorized user can also enroll in their own Priority Pass membership, the massive network of 1,300-plus lounges across the world. That means they can head into these lounges on their own and also bring up to two guests apiece with them. Plus, Amex Platinum cardholders (and their authorized users) get access to other great lounges that are part of the so-called Amex Global Lounge Collection: Plaza Premium Lounges, Escape Lounges – The Centurion Studio Partner, Airspace Lounges, and more.

Other Benefits Add Up

The benefits go far beyond lounge access. A few other worth considering include:

- Unlike other premium travel cards that offer credits to cover TSA PreCheck or Global Entry, authorized users on Amex Platinum cards can get their own credit of up to $120 to join either program. In fact, this is true even if you add friends or family as free Companion Platinum Cards!

- Each authorized user can also enroll in their own Hilton Honors Gold status and Marriott Gold Elite status, just like the primary cardholder. That unlocks benefits for hotel stays like space-available upgrades, late checkout, extra points earning.

- They’re also eligible for elite status with several rental car companies – though our clear favorite is National Executive status.

Transfer Points to Your Pal

This could just be the most important perk of the whole bunch.

Airlines often make it difficult – and pricey – to send miles from your frequent flyer account to a spouse or family member. And while some banks allow you to share or pool points with a spouse or family member, American Express isn’t one of them.

Instead, you can transfer Amex points directly to your authorized users’ frequent flyer accounts. That’s an extra layer of flexibility that can come in handy in a pinch.

We recently found a real unicorn of a deal to fly ANA’s The Room from from Chicago-O’Hare (ORD) to Tokyo-Haneda (HND). The best way for us to book this was using some orphaned Virgin Atlantic Flying Club points. At 60,000 points one-way from Chicago to Tokyo, it was a steal – even after a devaluation earlier this year.

The problem is that the orphaned Virgin points were in my wife’s account and she didn’t have any way to top off her balance in time to book this award. Luckily, since she was already added as an authorized user on my Platinum Card, moving my Amex Membership Rewards over to her account was no problem at all.

It works just like any other time you send points to Amex transfer partners, the array of more than 20 airlines and hotel chains to which you can send your points. There’s just one catch: You can only transfer points to additional cardmembers added at least 90 days ago.

Be sure to select your authorized user’s account rather than your own. And keep in mind that some American Express transfers aren’t instantaneous.

| Program | Type | Transfer Ratio | Transfer Time |

|---|---|---|---|

| Aer Lingus | Airline | 1:1 | Instant |

| AeroMexico | Airline | 1:1.6 | 3-5 days |

| Air Canada Aeroplan | Airline | 1:1 | Instant |

| Air France/KLM | Airline | 1:1 | Instant |

| ANA | Airline | 1:1 | 1-2 days |

| Avianca | Airline | 1:1 | Instant |

| British Airways | Airline | 1:1 | Instant |

| Cathay Pacific | Airline | 1:1 | Instant |

| Delta | Airline | 1:1 | Instant |

| Emirates | Airline | 1:1 | Instant |

| Etihad | Airline | 1:1 | Instant |

| Hawaiian | Airline | 1:1 | Instant |

| Iberia | Airline | 1:1 | Up to 24 hours |

| JetBlue | Airline | 1.25:1 | Instant |

| Qantas | Airline | 1:1 | Instant |

| Qatar Airways | Airline | 1:1 | Instant |

| Singapore | Airline | 1:1 | Instant |

| Virgin Atlantic | Airline | 1:1 | Instant |

Read more on Amex transfer partners!

Help Hit Spending Requirements to Earn a Bonus

It might seem straightforward, but it can pay off big time.

Because your Amex Platinum authorized users get their own cards, they can help you quickly spend the money necessary to unlock that big points bonus. American Express Platinum cardholders have to spend $8,000 within six months to get the 80,000-point welcome bonus – and that bonus could be 175,000 points if you qualify for an even better welcome offer via CardMatch. Otherwise, check for personal referral links or simply search for the Platinum Card in an incognito browser to see if you can get a bigger bonus.

Of course, you’d need that person to pay off the charges they’re making, too. Otherwise, they’re simply saddling you with a bigger monthly payment.

Learn more about *amex platinum*.

Extra Considerations for Adding Authorized Users

Adding authorized users can be a confusing topic in the world of credit cards. Let’s set a few things straight.

First, and most importantly: You’re responsible for paying off any charges your authorized user makes to your account. That means you should only add someone you trust – and preferably someone with a big expense coming up that they can immediately pay off (or make a charge on your behalf).

Read more: Everything You Need to Know About Credit Card Authorized Users

Beyond that, it’s a good news, bad news situation:

- The good news: Being an authorized user does not make you ineligible to open that card outright to earn a bonus later on. That means you could add a friend or spouse as an additional Platinum Card, and they could still open their own Platinum Card and earn a 80,000-point bonus after spending $8,000 within six months.

- The bad news: This could make it harder for your buddy to open a Chase card. That’s because being an authorized user does count toward your Chase 5/24 rule status, which means you won’t get approved for any Chase card if you’ve opened five or more credit cards (from any bank, not just Chase) in the last 24 months. You may be able to get Chase to overlook that if being authorized user is what’s pushing you over the edge, but that’s no sure thing.

How to Add Someone to Your Platinum Card

If you’ve decided to add an authorized user to your Amex Platinum card, let’s go over the nuts and bolts of how it’s done.

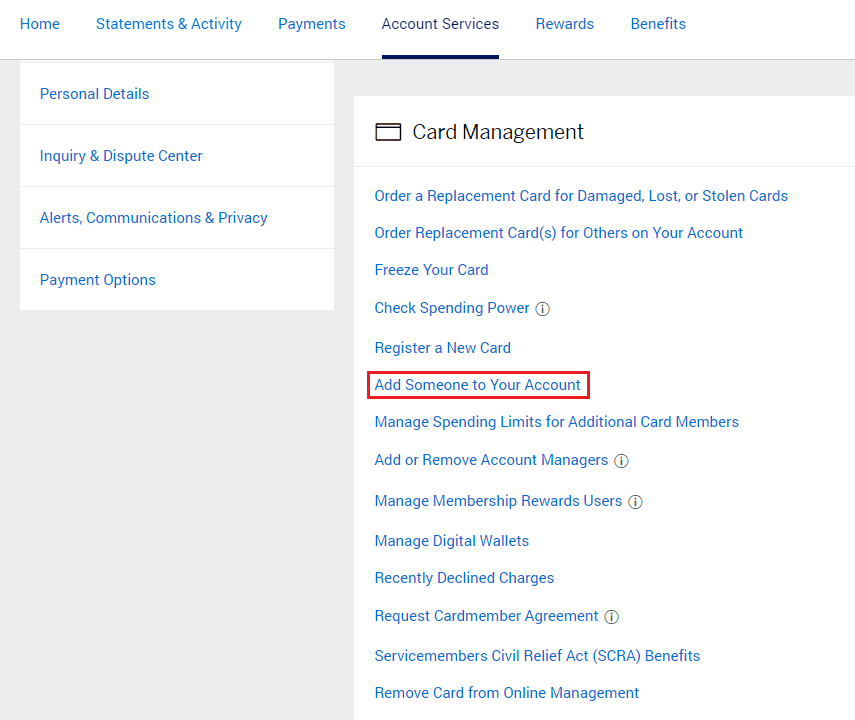

Simply log into your account and head to the “Account Services” tab. That’s where you’ll find the link to “Add Someone to Your Account.”

Otherwise, look for the chance to earn a 20,000-point bonus (or more!) by adding an authorized user under your Amex offers.

You’ll need to enter some information for your new user, including their social security number – either when you add the user or within 60 days. Yet all signs suggest that your authorized user will not be subjected to a hard credit inquiry – which could temporarily ding their credit score. It’s simply a bookkeeping measure for American Express.

Once you’ve added the user, they will get their own, heavy metal Amex Platinum card in the mail within the next week or so. They’ll have their own, distinct account number and online account.

But it’s important to note that everything is tied back to your primary account. Any charges an authorized user puts on their card will be on your balance. So it should go without saying that you should only add an authorized user that you trust. You can also decide whether to let your new user use American Express Membership Rewards points.

Bottom Line

Depending on your situation and how much you’ll get out of the perks, the benefits of adding an authorized user to your Platinum card can easily outweigh the additional $195 fee. Just be sure to run the numbers for yourself before committing to that extra cost.