Institutional home-buying activity remained subdued last year as transactional players — including iBuyers, flippers, and sales leaseback firms — dominated the market. While major single-family rental (SFR) funds continued to make acquisitions, their volume was significantly lower than during the post-pandemic surge of 2021.

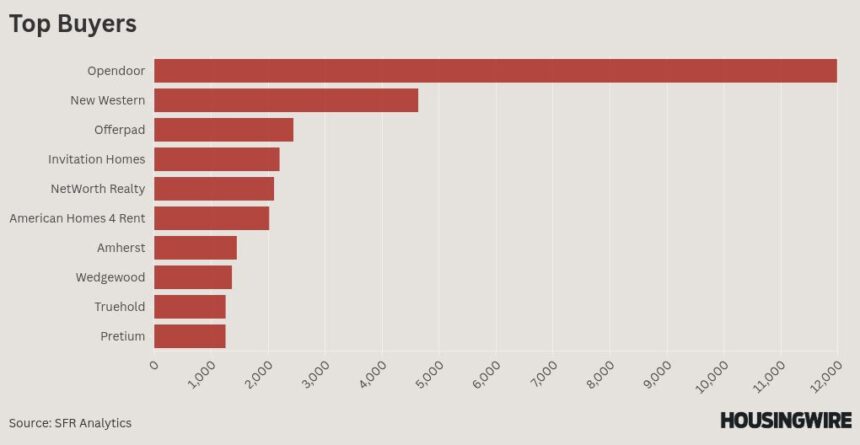

An analysis by SFR Analytics, which tracks nationwide real estate transactions, found that the threshold to rank among the top 10 buyers in 2024 was nearly 80% lower than it was in 2021, when institutional firms routinely acquired 5000-plus homes annually.

A shift toward short-term holders

The largest institutional buyers of 2024 were predominantly firms that only held properties temporarily. iBuying companies like Opendoor and Offerpad typically resold homes within 90 days, while wholesale operators like New Western and NetWorth structured transactions to avoid direct ownership.

Opendoor’s 11,985 purchases last year more than doubled New Western’s second-place total.

Traditional SFR funds — including Invitation Homes, American Homes 4 Rent, Amherst, and Pretium — remained active but at a more measured pace. These four were among the six largest SFR funds still making acquisitions, with Tricon and FirstKey also maintaining some activity.

Truehold, a sales leaseback company focused on Midwest markets, saw significant growth, while Wedgewood, a Southern California-based home flipper, continued its operations across dozens of states, earning a spot on the top 10 list for the second consecutive year.

The scale of institutional acquisitions remains a fraction of what it was during the pandemic-fueled buying boom. Even among active buyers, net acquisitions were low. Invitation Homes, for example, sold 1,575 homes in 2024, further reducing its overall holdings.

Despite the slowdown, some private SFR funds, such as Amherst and Pretium, continued acquiring homes in the range of dozens to a few hundred properties per month. Public SFR fund Invitation Homes also maintained a steady, albeit reduced, presence in the market.

Regional hotspots

Atlanta led the nation in purchase volume, with every major buyer except Truehold active in the metro. Texas and Florida also saw high investor activity, with Dallas standing out as a particularly competitive market where all top 10 buyers had a presence.

The strategies of these buyers varied widely. Wedgewood focused on California’s Inland Empire and Los Angeles, while Truehold prioritized St. Louis and Oklahoma City — markets where Wedgewood had no presence. Meanwhile, SFR funds concentrated on similar property types but competed across multiple regions.

Real estate investors bought fewer homes in the fourth quarter of 2024, with purchases falling to the lowest level for any fourth quarter since 2016, according to a new report from Redfin.

Investors purchased 47,004 homes during the quarter, marking a 3.9% decline from Q4 2023, the steepest drop in a year. The decline comes amid high mortgage rates, slowing homebuyer demand and an uncertain economic outlook.