The housing market is starved for relief on mortgage rates, but hope for the Federal Reserve cutting interest rates just took a huge blow.

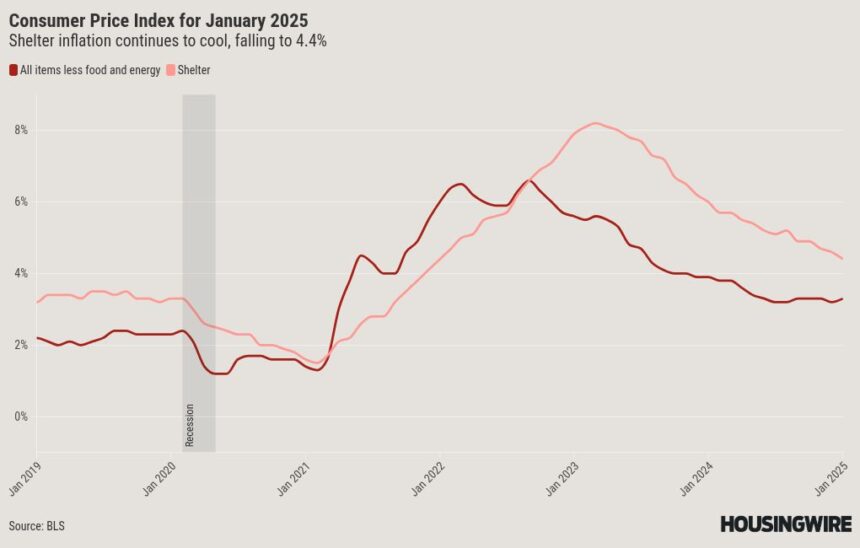

The reading of the consumer price index (CPI) from the Bureau of Labor Statistics came in unexpectedly high, showing a 3% rise for the 12-month period ending in January and 0.5% compared to December.

The Fed’s stated target inflation rate of 2% is getting further and further away, as it’s the fourth month in a row that the inflation rate has increased. This makes it less like it will cut interest rates in the near term.

“Expectations were for some further deceleration [of inflation],” said National Association of Realtors (NAR) Chief Economist Lawrence Yun. “However, inflation has continued to rise in recent months, and in January, consumer price inflation increased to 3%. This will delay any rate cuts by the Fed this year until there are clear signs that either inflation is trending toward 2% or the economy begins to face net job losses.”

Shelter costs continue to drive inflation. Those accounted for 30% of overall inflation for the month of January, though there are signs that both rent and home prices are accelerating at a lower pace.

Inflation for housing registered at 4.4%, the sixth month in a row that the number has fallen. It peaked in April 2023 at 8.2%. Still, housing costs remain the primary reason the housing market will continue to suffer from high rates.

“It will be very hard for the headline inflation number to reach the Fed’s 2% goal without a slowdown in housing costs,” said Bright MLS Chief Economist Lisa Sturtevant in a statement. “More housing supply—both rental and for-sale housing—is the key to easing housing costs and bringing the overall rate of inflation down.”

President Donald Trump remains a major wild card. He has made it clear that he wants the Fed to cut interest rates. During a virtual appearance at the World Economic Forum, he said he would “demand that interest rates drop immediately.” It’s unclear how much direct pressure he will apply to Fed Chairman Jerome Powell or whether Powell would cave to Trump’s demands.

Trump has yet to do much that economists say could put downward pressure on home prices and rent. Despite issuing an executive order calling for “emergency home-price relief” related to various regulations around home construction, builders say that Trump’s on again, off tariffs will likely increase the cost of building a home.

Trump’s 25% tariffs on Mexico and Canada were paused shortly after they were implemented, but the pause is scheduled to expire on March 1. Homebuilders heavily rely on Canada for lumber and Mexico for hardware. The additional tariffs on China could raise prices on home appliances. The president has also implemented a tariff on steel and aluminum products.

However, builders say that Trump’s broader interest in deregulation would help reduce some building costs.