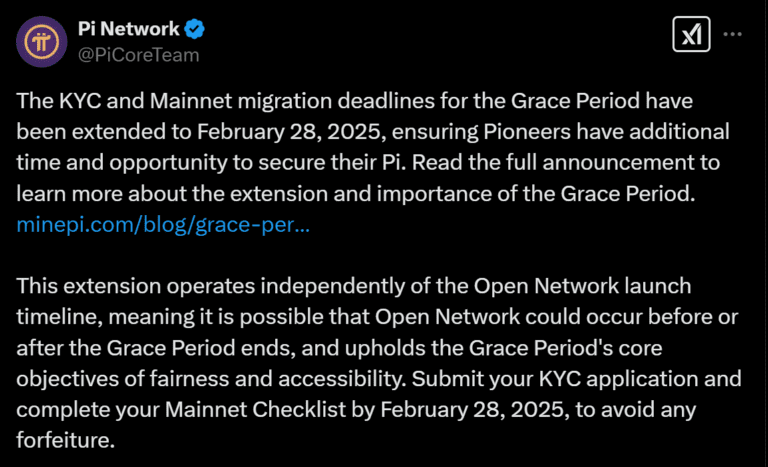

- Pi Network (IOU) has rescheduled its mainnet migration to February 28, 2025, citing Know-Your-Customer (KYC) verification setbacks.

- The IOU price has plunged below a crucial support level to trade at $39 after the broad market liquidation caused a daily decline of 3%.

The latest report coming from Pi Network (IOU) establishes that the much anticipated mainnet launch has once again been postponed. According to the report, the full migration has now been rescheduled to February 28, 2025. Fascinatingly, this has created concerns among stakeholders who appear dissatisfied with the uncertainties surrounding the launch date.

Per reports, the mainnet launch was initially expected to be done in 2022. However, this was later postponed to 2023, and then to 2024. After citing some reasons, the transition was once again pushed to 2025 with no assurance that the rescheduled date would be the final delay.

Shedding more light on this development, the team has assured that the current postponement would have no effect on the much-expected launch of the Open Network. This, however, failed to calm some users who believe that the consistent delays may raise issues on the legitimacy and the sustainability of the network.

However, the team believes that there are genuine reasons for the delays as the current one has to do with some setbacks in its compliance. This specifically has to do with the Know-Your-Customer (KYC) Verification issues. Meanwhile, little information has been provided to that effect. Amidst these concerns, the team has cautioned users to rely only on the official Safety Center, as we outlined in our recent post.

More About PI Network’s KYC Issue and Price Analysis

Further researching into its KYC development, CNF discovered information from the Pi Network’s team which highlights that more than 10 million users had completed their KYC verification as of January 10. However, more than 40 million users remained unverified.

As earlier reviewed in our recent publication, users have been asked to complete verification before the mainnet launch. Meanwhile, there are concerns that the company has not been able to provide independent verification to the claims that many users have transitioned to the mainnet. Verification is also impossible since there is no functional blockchain explorer.

In a recent update, we examined the latest announcement urging all users to migrate their referral teams before January 31. According to that report, this was part of the strategies to encourage user engagement with their team members in the migration process.

Amid the backdrop of this, IOU has failed to make any appreciable surge as the price breaks below a crucial support level to trade at $39. According to market data, the asset has declined by 3% in the last 24 hours and 10% in the last seven days. Currently, IOU has a self-reported market cap of $2.7 billion. However, its 24-hour trading volume remains around $376,000.

Looking at the market indicators, we found that the asset’s price currently remains below the 200-day EMA and the 20-day EMA. Failure to sustain above the $39 level could see the asset breaking down to $35. According to analysts, the decline in trading volume shows that IOU has a weakened interest.