Loan locks for refinances rose more than 20% year over year while purchase lock counts saw a 6% decrease, according to Optimal Blue‘s January 2025 Market Advantage mortgage data report released Thursday.

Purchase lock volume climbed 16% from December, but year-over-year counts – which control for home-price appreciation – were down 6%. That marked the lowest January figure in six years. This followed a strong end to 2024 and will be an important trend to watch moving forward, Optimal Blue explained.

Meanwhile, refinance lock volume surged even as 30-year conforming rates through the Optimal Blue Mortgage Market Indices (OBMMI) ticked above 7% for the first time since May. Refi lock volume grew for both rate-and-term and cash-out products, indicating that a growing share of borrowers — particularly those who purchased homes between August and November 2023 — are finding opportunities to refinance.

Total rate lock volume rose nearly 11% in January, driven by a 16% monthly increase in purchase volume and a 9% increase in cash-out refi volume. Rate-and-term refis dipped 20% from December due to a less friendly mortgage rate environment.

“January lock data shows two important ways constrained affordability is impacting the housing finance market,” Brennan O’Connell, director of data solutions at Optimal Blue, said in a statement.

“On one hand, refinance activity saw impressive YoY growth despite elevated rates, signaling a growing pool of homeowners with mortgage rates high enough to justify a refinance. On the other hand, purchase lock counts declined YoY, marking the lowest January figures since we began tracking this data in 2019. A combination of high home prices and rates are curbing purchase activity, while at the same time fueling refinance demand among homeowners who purchased when rates were even higher.”

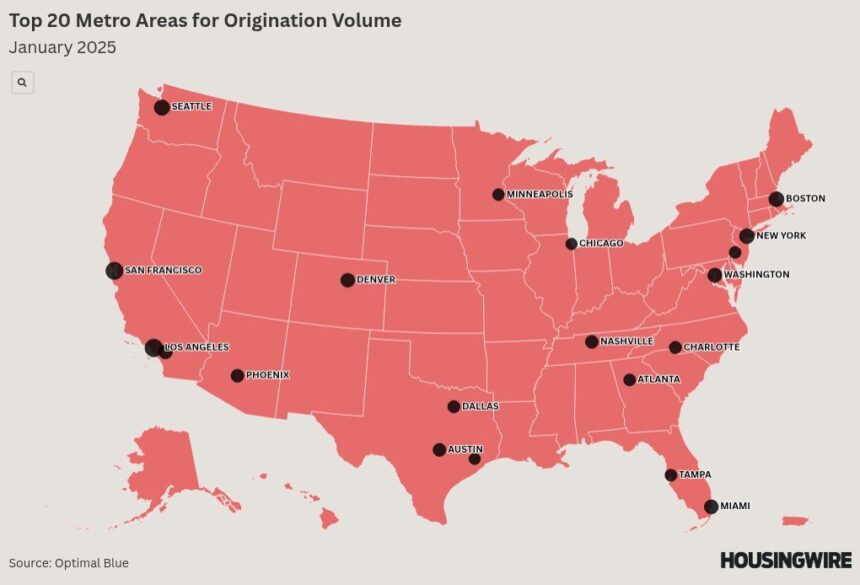

Based on the percentage of lock volume across the 20 largest U.S. metro areas, New York City led the way with 5.2% of all locked loans in January. The average loan amount there was $576,385. It was followed by Dallas (3.4% of lock volume) and Washington, D.C. (3.3%).

The report noted that the OBMMI 30-year conforming rate moved above 7% in early January but rallied late in the month, ending at 6.84% (up only 1 basis point). Jumbo mortgage rates were up 2 bps, VA loan rates were up 4 bps and FHA loan rates remained unchanged.

Optimal Blue reported that after hitting a multiyear low in December, the conforming loan share edged up slightly to 51% of total production but remained near record lows. This was offset by small declines in nonconforming and FHA loan shares, while the VA loan share held steady.

Credit scores showed mixed trends in the report, with the average credit score for purchase loans and rate-and-term refinances rising by 1 point to 738 and 728, respectively. Meanwhile, the average credit score for cash-out refis declined by 4 points to 693.

The report’s final takeaway was that home prices increased while loan amounts remained stable. The average home purchase price rose from $473,000 in December to $476,200 in January, while the average loan amount dipped slightly from $376,900 to $376,400.