Mortgage rates have been moving lower in recent weeks, even after the Federal Reserve’s decision to pause its rate-cutting cycle. But mortgage executives and housing economists don’t believe this trend will continue long enough to meaningful impact mortgage demand or home sales.

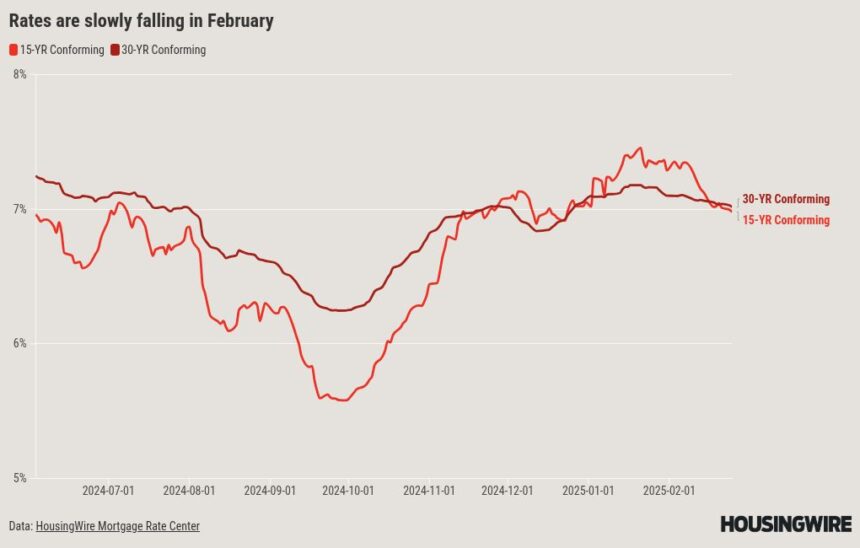

According to data at HousingWire’s Mortgage Rates Center, the average 30-year conforming rate was 7.01% on Tuesday. That’s 4 basis points (bps) lower than a week ago and 11 bps lower than three weeks ago. The 15-year conforming rate has tumbled even further, going from 7.35% at the start of February to 6.97% on Tuesday.

Emanuel Santa-Donato, senior vice president and chief market analyst at Connecticut-based Tomo Mortgage, said that 30-year mortgage rates and 5-year Treasury yields have recently had similar patterns of volatility. That’s because the “fixed-income market is constantly repricing as new information comes in, and the Trump administration whipsaws on policies that have major implications for growth and inflation,” he told HousingWire via email.

In contrast to long-term trends, the 15-year conforming rate had been trending higher than its 30-year counterpart for much of the past three months, a pattern that recently reversed.

Santa-Donato said that higher benchmark rates maintained by the Federal Open Market Committee (FOMC) contributed to an inverted Treasury yield curve. And because market observers were betting on a slowdown in the U.S. economy, shorter-duration products like adjustable-rate mortgages and 15-year loans became more expensive than 30-year loans.

“The market believes the Trump administration would bring in pro-growth and pro-inflation policies, which pushes the long end of the yield curve up. Should the FOMC have to resume rate increases to combat resurgent inflation, we may see an inversion again,” Santa-Donato said.

Tomo’s newest forecast calls for rates to remain relatively flat throughout 2025, ending the year close to their current levels. Based on Freddie Mac’s survey at the start of the year, which showed 30-year fixed rates at 6.91%, the odds that rates will drop to 6% by the end of the year are about 25%. A decline of at least 91 bps in a single year has happened only 13 times in the 53-year history of the survey, Santa-Donato noted.

Stubbornly high rates will continue to hamper sales activity as sellers will be hesitant to list and buyers will grapple with affordability concerns among the fewer available listings.

New data from Altos Research shows that the number of newly listed homes across the country is up 4.8% from one year ago. While this is relatively slow growth, Altos President Mike Simonsen said that it’s worth keeping an eye on things like cutbacks in the federal workforce, which could cause the unemployment rate to rise in the coming months and lead to more inventory if people are forced to sell their homes.

“The economy-employment-home sales cycle this time around has an added wrinkle which is homeowners all having ultra-low mortgage rates. So, selling their home would put them in worse cash flow position,” Simonsen wrote this week.

A Bright MLS report released this week noted that the Washington, D.C., metro area is home to about 400,000 federal employees. The report found it “likely that the federal workforce changes will have an impact on the region’s housing market.”

For the week ending Feb. 23, Bright MLS reported that new listings in the D.C. area jumped by 20% from the prior week and were up 13% from year ago. These growth rates were about three times higher than those for the Mid-Atlantic region as a whole.

“Keep in mind that housing market data can fluctuate significantly week-to-week,” Bright MLS chief economist Lisa Sturtevant wrote. “We urge caution about drawing conclusions from just one week of data and rather should watch trends over time.”

Other market observers noted that even as the share of listings with price cuts remains high, a surge of buyer demand has yet to materialize.

“The economy is in a negative ‘beat’ right now with inventories only slightly up year over year, with home sellers beginning to take their listings off the market in growing numbers,” Lloyd San, senior vice president of enterprise business development at real estate technology firm Voxtur, said in a statement.

“Price reductions are prevalent, but only to a certain point, as sellers are not seeing the traffic or attention in their homes like a year ago. The only positive is the employment numbers even though mortgage interest rates are volatile with shifting monetary and fiscal policies.”

Mortgage programs tailored to low-income and first-time homebuyers, such as those through the Federal Housing Administration (FHA), have added significance in today’s market. The FHA share of new-home mortgage applications recently reached an all-time high.

Santa-Donato also pointed to Special Purpose Credit Programs (SPCPs) offered by some depository institutions and independent mortgage banks as options that could help buyers in certain regions.

“These programs got significant support from the FHFA and regulators in the (Biden) administration to promote the goal of racial equity in housing,” Santa-Donato said. “We have not gotten any guidance yet if these SPCPs will be wound down as the (Trump) administration rolls back anything DEI and DEI-adjacent, but we are not hopeful these will continue, especially as focus shifts to getting the GSEs out of conservatorship.

“If you are a potential homebuyer working with a lender who offers these programs, you should be certain that you could afford the home without the program in case they are terminated while you are in the home search process.”