- Monero surged over 9% after launching its Cuprate node, which slashes sync time to 20 hours, boosting network security and decentralization.

- XMR futures jumped 16.82% as adoption grows, with a Georgia hotel accepting XMR payments and traders positioning for further price gains.

Monero (XMR) climbed over 9% on February 6 following the performance boost delivered by its Rust-based Cuprate node. The privacy-focused cryptocurrency surged to an intraday high of $238.12, marking an impressive 24.90% gain since the start of the year. Its market capitalization briefly crossed the $4.4 billion mark before settling at $4.14 billion on February 7.

Cuprate, the new Monero node, has demonstrated remarkable efficiency. Unlike the default Monero node software, monerod, which takes days to sync the blockchain fully, Cuprate completes a fast sync in just four hours and a full verification sync in 20 hours. This upgrade strengthens network security and encourages more users to operate full nodes, enhancing Monero’s decentralization.

Cuprate, the upcoming Monero node software written in Rust, has achieved fantastic sync results! https://t.co/9YFZuKgNCS

— Monero (XMR) (@monero) February 4, 2025

XMR Futures Surge 16.82% Amid Retail Adoption

Real-world adoption is adding to Monero’s momentum. A hotel in Georgia has started accepting XMR payments, signaling a shift toward greater mainstream use. With Monero’s privacy-focused nature, such adoptions help drive investor confidence, fueling its recent price surge.

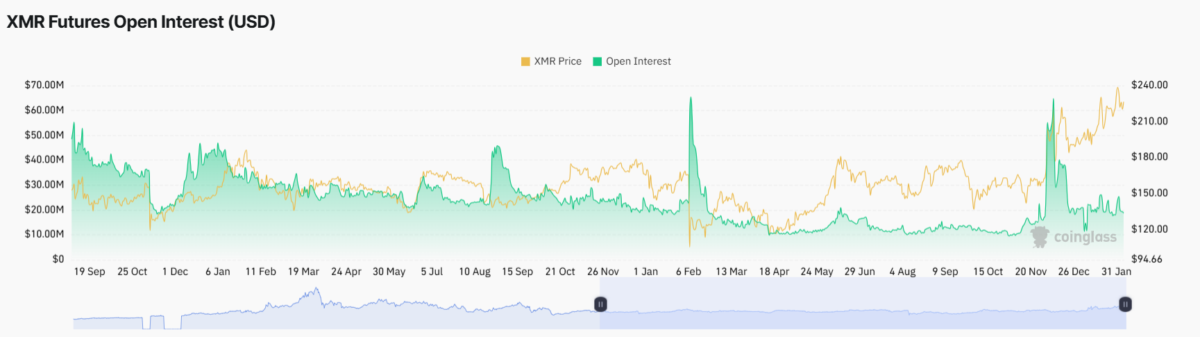

Interest from the derivatives market is also rising. CoinGlass data reveals that open interest in XMR futures spiked 16.82% within 24 hours, reaching $21.60 million. This jump suggests that traders are increasingly positioning themselves for further price appreciation.

Meanwhile, data from Santiment indicates that Monero’s weighted social sentiment has turned positive, reflecting growing optimism within its community. A strong community sentiment often plays a critical role in the price movement of assets like XMR, especially given its history of regulatory scrutiny and exchange delistings.

Key Levels to Watch

At the time of writing, XMR is trading at $222.32, with minimal movement over the past hour. The coin briefly tested a high of $226.49 before pulling back below the 20-day EMA at $226.07. A critical support level sits at $222, while resistance remains at $226.49.

Technical indicators suggest a period of consolidation. The 50 EMA at $225.57 is acting as short-term resistance, while the 100 EMA at $225.00 offers weak support. A bearish crossover between the 20 EMA and 50 EMA signals potential downside risks, with declining trading volume over recent sessions further reinforcing this outlook.

If XMR fails to hold the $222 support, it could drop toward the $215-$220 range, triggering further sell-offs. On the upside, reclaiming $226.49 could push the price toward $235. The RSI, currently at 48.22, indicates neutral momentum, though a dip toward 41.10 would signal decreasing buying pressure.

Market data suggests that large traders are accumulating XMR. Over the past week, investors have withdrawn $8.4 million worth of XMR from centralized exchanges. Such withdrawals often signal that traders are moving assets into private wallets, a bullish sign suggesting long-term holding intentions.