- Litecoin’s price dropped 3.40% to $114, forming a bearish double-top pattern that signals a potential decline to $90.

- Speculation about a possible Litecoin ETF fuels optimism, but Bitcoin’s dominance limits Litecoin’s growth potential in 2025.

Litecoin, often seen as Bitcoin’s “silver,” is struggling to keep pace with its more popular counterpart in 2025. Despite a notable 45% surge in 2024, the cryptocurrency has entered the new year under pressure. Recent analysis suggests that its current price trajectory could lead to a steep decline, potentially revisiting lows last seen in August 2024.

As of January 23, 2025, Litecoin is priced at approximately $114, marking a 3.40% drop from the previous day. This figure represents a significant decline from the $140 level it tested late last week, echoing December’s local highs. Together, these movements form a “double-top” pattern, often regarded as a bearish signal that hints at potential price reversals.

Bearish Double-Top Signals Potential Drop to $90

Litecoin’s daily chart reinforces the bearish undertones, exhibiting a classic double-top formation. The first and second tops align near the $140-$150 range, suggesting strong resistance. The price decline below the EMA 20 at $113.62 confirms bearish sentiment. A further dip toward $90.18 support appears likely.

The RSI indicator at 53.16 signals a neutral momentum, yet the trend is downward from overbought levels. This divergence aligns with the observed price fall. If RSI breaks below 50, further bearish momentum could push LTC towards the $80-$90 range, aligning with the lower EMA 200 level.

Volume analysis reveals declining trading activity during the second peak, emphasizing reduced bullish strength. Combined with the double-top pattern, this suggests a reversal. Investors should monitor $113.62 as a critical level; losing this could accelerate bearish moves, potentially triggering a $90 support test.

LTC shows bearish tendencies with a projected decline toward $90 if current support fails. The double-top formation, RSI decline, and EMA breakdown validate this outlook. A recovery above $120 would counter this narrative, requiring renewed bullish momentum to sustain higher levels.

72% Litecoin Addresses Profitable

Litecoin’s recent market behavior has been partly driven by speculation surrounding a possible Litecoin exchange-traded fund (ETF). Reports of Nasdaq’s application to list such an ETF have stirred optimism among investors. If approved, the ETF could pave the way for increased institutional participation, boosting adoption and price growth.

On-chain data also paints a mixed picture. Last month, 72% of Litecoin addresses remained profitable, reflecting positive sentiment among holders. This profitability often supports a bullish outlook, as investors are less inclined to sell when their holdings are in the green. However, broader market trends and Bitcoin’s dominance continue to overshadow Litecoin.

The latest Bitcoin all-time high, fueled by Donald Trump’s cryptocurrency launch and political developments, failed to generate a similar rally for Litecoin. Commenting on this, Paul Howard, Senior Director at Wincent, stated:

The realization for many is the awareness they find themselves living in a crypto echo chamber… Our OTC desk was very active in the former since launch.

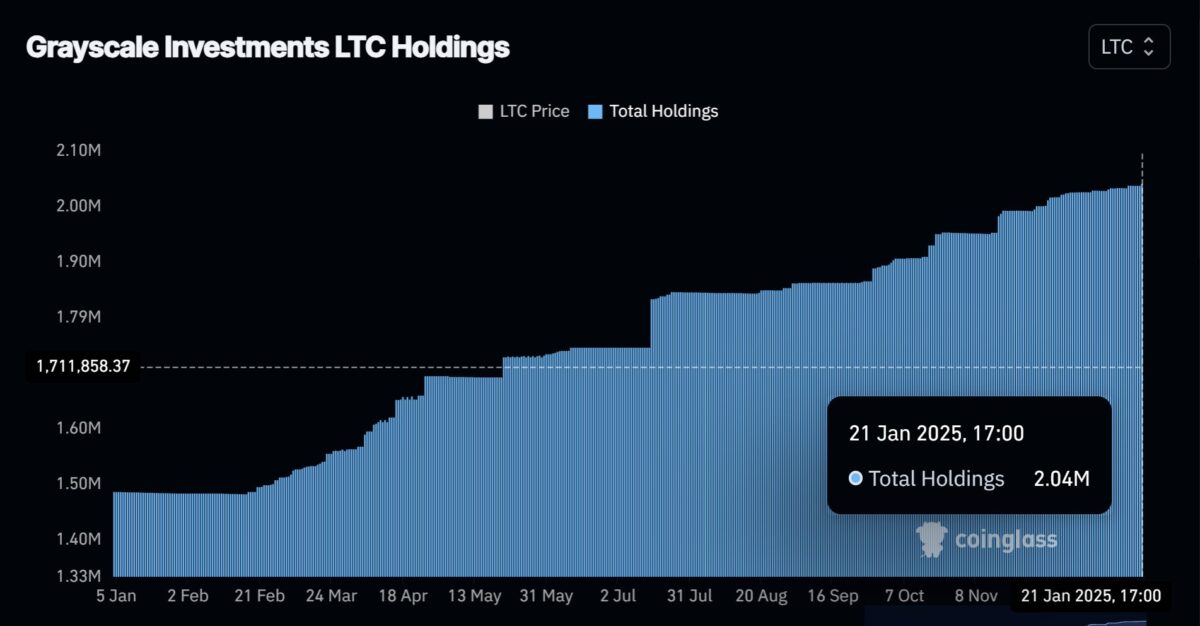

Grayscale Trust holds over 2 million LTC

Investors are showing a strong appetite for Litecoin through Grayscale’s Litecoin Trust, with holdings surpassing 2.04 million LTC as of January 21, 2025. The consistent rise reflects Litecoin’s growing recognition as a liquid asset and reliable store of value, further cementing its position in the cryptocurrency market.

Grayscale’s investment in Litecoin highlights steady market demand, underscoring the asset’s stability and appeal to institutional investors. As Litecoin continues to gain traction, its potential for broader adoption as a versatile digital currency and investment option is becoming increasingly evident to stakeholders.

Price predictions for Litecoin in 2025 remain varied. Some analysts believe the coin could recover and surpass the $150 mark, with more optimistic forecasts suggesting a peak of $200. Looking further ahead, projections for 2030 are even more ambitious, with estimates ranging between $700 and $1,200.