- The 30-day MVRV ratio suggests XRP may have bottomed, potentially setting the stage for a significant price rebound based on historical patterns.

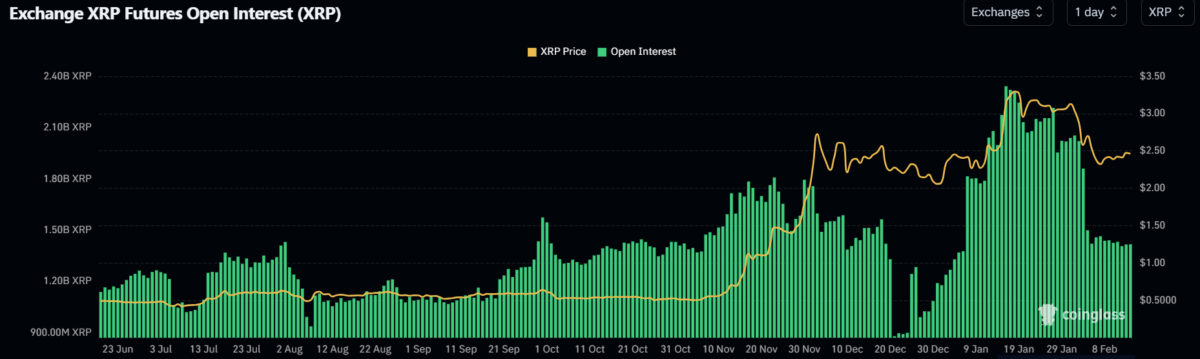

- While spot market activity builds, XRP’s derivatives market shows hesitation, with open interest falling by over 30% and funding rates remaining negative.

XRP price has risen by 2% in the initial Asian trading session on Thursday as investor accumulation trends continue to get stronger, with derivatives activity muted. On-chain metrics indicate that market participants are preparing for a potential price recovery.

XRP Investors Ramp Up Accumulation

Amid the crypto market decline on February 3, holders of XRP have changed their strategy, with a greater predisposition toward accumulation. On-chain statistics reveal a drop in selling pressure, as measured by the Mean Coin Age indicator pointing upwards. The indicator, which shows the average time for XRP tokens to stay in wallets they are in, has been increasing. As mentioned in our previous story, it shows that investors are holding onto their coins instead of transferring them to exchanges for sale.

Also, the 30-day MVRV ratio indicates that XRP could have hit a potential bottom after falling to -17% last week. Historically, similar readings in the metric have led to significant price rebounds, with XRP rallying more than 60% the previous time the MVRV ratio hit such levels. If history repeats itself, the token may witness a significant price surge in the near future.

Derivatives Market Registers Slipping Activity

While posting building activity in the spot market, the derivatives market of XRP shows a more subdued attitude from traders. Open interest—measured by the number of active contracts—has plummeted, slipping more than 30% from 2.05 billion XRP to 1.42 billion XRP. Negative funding rates over the last few days also show that futures traders are hesitant to place aggressive directional bets on the asset.

Meanwhile, regulatory updates may also impact the price action of XRP, with the U.S. Securities and Exchange Commission (SEC) officially acknowledging Grayscale’s filing of XRP ETF on Tuesday. Bloomberg analysts Eric Balchunas and James Seyffart put the chances of approval for the application at 65%.

Key Levels For XRP Price

Statistics by Coinglass show that XRP futures liquidation hit $5.91 million in the last 24 hours. Of this, $2.80 million represented long liquidations, while short liquidations were at $3.11 million.

XRP has been trading in a known range since the downward market correction, with key levels of support at $2.26 and resistance at $2.55. This level has created confusion among traders, especially in the aftermath of recent volatility that washed out a large number of longs.

A firm break above $2.55 would likely prompt renewed buying pressure, and further resistance is expected at $2.72. Should bullish pressure intensify above these levels, it could lure in more players among traders hoping to take advantage of an uptrend.

But if XRP falls below $2.26, it might initiate a serious long squeeze, with more than $80 million worth of positions vulnerable to liquidation. If that is the case, the next significant support level is at $1.96.

Technical indicators including the Relative Strength Index (RSI) and the Stochastic Oscillator are presently above neutral levels, indicating short-term bullish momentum. Whilst, a daily close below $1.96 would test this thesis, though.