*amex platinum* is one of the most popular cards for frequent travelers. But there’s more to it than a big welcome bonus and earning points when you book flights. Really, it all comes down to the wide array of travel (and also not quite travel-related) benefits.

Between unrivaled lounge access, instant hotel status, and $600 in travel credits each year split between Uber, hotels, and airlines, the Amex Platinum offers more benefits than practically any other travel card on the market. Amex has steadily added even more perks to the fold … but that’s come at a cost: The annual fee now clocks in at a hefty $695 a year (see rates & fees) … and that will likely only go up.

Despite that steep cost, all these perks are one reason why we urge readers to do the math and not to rule out even high-fee credit cards like this one. To be clear, this card definitely won’t make sense for everyone – especially with that high price tag. But if you’ve already got it, you can’t let these perks go to waste if you want to come out ahead. And that requires some work on your end … with some help from us.

Here’s a full breakdown of all the Amex Platinum benefits and how you can use them wisely.

Learn more about *amex platinum*.

Getting Started with Your Amex Platinum Card

First things first, you need to get the Platinum card to get all these benefits.

And now could be a great time to apply, as you may be eligible for an 175,000-point welcome bonus via CardMatch. That’s tough to beat. We’ve also seen 175,000-point bonuses available via referral links. Otherwise, the standard bonus is 80,000 Membership Rewards points after spending $8,000 on purchases on your new card in the first six months.

Read more: How to Make Sure You Get the Biggest Bonus on Amex Cards

But no matter how you slice it, spending $8,000 requires financial responsibility. Credit cards are serious business. No matter the points nor the benefits, it never makes sense to open a new credit card if you can’t afford to immediately pay off every dime you spend.

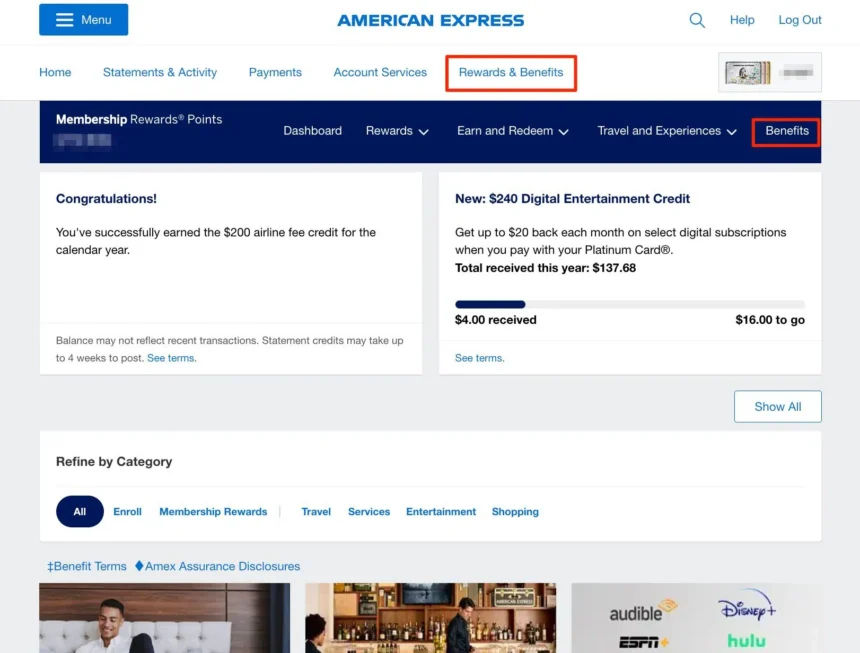

Once you’ve received and activated your card and set up your account online, it’s time to get those perks rolling. Most of what you need will be in the Benefits section, which you can find under the “Rewards & Benefits” tab.

Get Into 1,400+ Airport Lounges

No credit card will get you into more airport lounges than the Platinum Card. American Express calls it the Amex Global Lounge Collection.

For starters, you can get into American Express Centurion Lounges: some of the best lounges you’ll find in the country … though they’ve become popular to a fault. From Seattle (SEA) to Denver (DEN) to Las Vegas (LAS) and New York City (JFK), you’ll find them in more than a dozen U.S. airports and a few abroad, with even more on the way.

So long as you’re flying Delta that day, you can also access the Delta Sky Club – though some major restrictions are coming next month. Come Feb. 1, Platinum cardholders will be limited to just 10 Sky Club visits a year … though you can use this tip to get another four annual visits for 14 total.

Your Platinum card will get you into smaller lounge networks like Plaza Premium, Airspace, and Escape Lounges. And last but not least, you get access to more than 1,200 Priority Pass lounges worldwide. Plus, even with this top-tier Amex Card, you can even visit one Chase Sapphire Lounge a year using Priority Pass!

But while you only need to flash your Platinum card to get into many of these lounges, you’ll actually need to activate your complimentary Priority Pass Select Membership to get into Priority Pass lounges. You can do so underneath your Benefits tab in your Amex account – click the “American Express Global Lounge Collection” to enroll your Priority Pass account.

You should get your card in the mail within a week or so, but be sure to save the materials to register your account online. Once you’re logged into the Priority Pass app, you can simply pull up your digital card on the app at lounge entrances rather than carry it in your wallet.

For all but Delta Sky Clubs and Amex Centurion Lounges, two guests can accompany you into any lounge for free. Nowadays, bringing a guest into Delta Sky Clubs or Amex Centurion Lounges will cost you an extra $50 apiece (or just $30 for children at Centurion Lounges.)

Thrifty Tip: Add your Platinum card to your Delta wallet, and you can get into Sky Clubs just by scanning your mobile boarding pass!

Sadly, the Priority Pass membership from the Platinum Card took a hit a while back. As of August 2019, Priority Pass members with American Express cards can no longer receive credits to eat at select airport restaurants.

Get Uber Rides (or Uber Eats) for Free

The American Express Platinum card gives you up to $200 in Uber Cash split up across all 12 months of the year. Like almost every benefit on this card, enrolling in advance is required in order to actually put them to use.

You get up to $15 every month except for December, when you get $35 to round out the year. But getting these credits isn’t automatic, either. You’ll have to punch in your card details into your Uber account as a form of payment through the app. Once your card is in the system, the app will track how many credits you have available.

These credits reset every month, and any unused portion will not roll over to the next month. It’s a use-it-or-lose-it benefit, so make sure to use them up each month. American Express now requires that you charge any additional balance to your Platinum Card in order to use these credits.

Need a way to use up your remaining credits? They work for UberEats, Uber’s food delivery service, too! I set myself a reminder late each month to make sure I’ve used these credits up. If not, I’ll order some takeout via Uber Eats to ensure it doesn’t go to waste.

Cover the Cost of Getting Global Entry or TSA PreCheck

For any frequent traveler, Global Entry and TSA PreCheck are a must. PreCheck is your ticket to skip the long lines and speed through airport security, while Global Entry can get you through immigration faster. And the American Express Platinum Card can get you both.

The card offers up to a $120 credit to sign-up for either one of these five-year memberships. You’ll receive the benefit every 4 1/2 years for the application fee for TSA PreCheck® and every four years for Global Entry. Either way, you’re set to keep your membership active just with your Platinum Card.

Weighing TSA PreCheck vs Global Entry? Our recommendation is to opt for Global Entry, as your membership actually comes with PreCheck, too.

Read our in-depth guide on how to get signed up for Global Entry!

All you have to do to get this benefit is pay your application fee with your new American Express Platinum card. The expense should get reimbursed within a few days.

Already signed up for one of these great trusted traveler programs? Use your card to pay for a friend or family member’s application!

Sign up for CLEAR Plus, Too

The Platinum Card from American Express now offers a $199 credit annually to sign up for CLEAR® Plus, the privately run airport security program. That covers the entire cost of the $199 CLEAR® Plus membership.

But you can do even better. While CLEAR starts at $199 a year, you can drop the cost to just $189 with a free Delta SkyMiles or United MileagePlus account number – or down to $159 if you’ve got status or a co-branded credit card with either airline.

After a recent hike, adding adults to your CLEAR® Plus Family Plan additions cost another $99 a year, though minors can come with you for free.

While they may seem duplicative, CLEAR and TSA PreCheck (or better yet, Global Entry) can form a powerful duo. You use CLEAR to cut to the front of the PreCheck, then PreCheck itself gets you through faster by saving you the trouble of removing shoes, a belt, a light jacket, liquids, or electronics.

Read more: Is CLEAR Plus Worth It? A Review of the Security Fastpass Program

Just charge your CLEAR Plus enrollment to your Platinum Card and voila – you’re set. A statement credit for the full amount should kick in automatically within a few days.

Maximize Your $200 Airline Credits

The American Express Platinum card also offers up to $200 in credits every year toward incidental airline fees (enrollment is required).

Unfortunately, this credit isn’t as expansive as the $300 annually offered by the Chase Sapphire Reserve … nor are they as simple to use. But it’s still an easy way to offset the card’s annual fee: It can cover the cost of checked luggage, seat assignments, change fees, in-flight meals, and more on U.S. airlines. There are even a few crafty ways to put these credits toward airfare.

Read our full guide on the best ways to maximize Amex airline credits !

You’ll need to log in and manually select an airline each year, choosing from: Alaska, American, Delta, Hawaiian, JetBlue, Southwest, Spirit, and United. And while you’re generally locked into that airline for the year, you may be able to switch it up by calling (or chatting online with) American Express.

You can easily track how much of your credit you have used throughout the year in your Benefits portal.

These credits reset every calendar year, expiring on Dec. 31 and resetting right away on Jan. 1. So even if you just used your credit at the end of last year, you’ve already got another $200 to spend. This also means you can get up to $400 in airline credits in your first full year with the card, allowing you to double-dip on this benefit while paying a single annual fee.

Up to $20 a Month in Entertainment Credits

Another perk added to the Platinum Card a few years back is up to $20 in monthly entertainment credits. Unfortunately, you don’t have too many options to put it to use.

This $20 monthly credit can currently be used in just a few places: The Wall Street Journal, The New York Times, Peacock, Hulu, Disney Plus, and the Disney Bundle.

That’s far more restrictive than we’d like. But if you’re already using one of these platforms or plan to, it adds up to another $240 over the course of the year.

Just charge your subscription for these services to the Platinum Card and it will kick in to cover up to $20 a month.

Instant Marriott & Hilton Gold Status

The American Express Platinum Card is a quick ticket to hotel status. You can instantly enroll for Gold-level status with Hilton and Marriott Bonvoy. Here’s a quick breakdown of what each is worth.

Hilton Honors Gold Status gets you 25% bonus points on paid stays, free upgrades when space is available, a fifth night free when staying with points and free breakfast for you and a guest – but only when staying abroad. Unfortunately, Hilton has replaced this perk with a less-valuable (but more flexible) daily food and beverage credit at U.S. Hilton properties.

Meanwhile, your Marriott Bonvoy Gold Elite status allows you to earn a 25% points bonus on paid stays, upgraded internet access, space-available room upgrades and priority late checkout.

You have to individually enroll for each status upgrade with your loyalty account number for the hotel brands. The registration generally takes a day or two to process. Just head to your benefits tab in your Amex account to start the process with each hotel chain or fire up the online chat function and ask an Amex representative to do it for you.

A $200 Credit for Fine Hotels & Resorts, Hotel Collection

The value of the Platinum Card at hotels goes beyond status.

It also opens the door to Amex’s Fine Hotels and Resorts (FHR) Program, a collection of luxury properties across the world that also comes with a handful of special perks. Think of FHR as hotel status on steroids. And your Platinum Card gets you up to $200 in credit to use at Fine Hotels and Resorts.

Those FHR perks include free room upgrades when available, free daily breakfast for two, an experience credit of $100 or more for dining or spa services, noon check-in when available, and guaranteed 4 p.m. checkout.

For instance, I previously used my $200 credit to book Hotel Las Islas Baru, a stunning property on the coast of Colombia. That credit covered all but a fraction of the nightly charge for this spacious pool villa. And in lieu of a dining credit, the property gave us free roundtrip transfers from Cartagena.

The $200 credit also works with the slightly-less-luxurious-but-still-excellent The Hotel Collection. Though, The Hotel Collection properties require a two-night minimum stay to trigger the credit.

Either way, it’s available to Platinum Cardholders who book through Amextravel.com, Amex’s travel portal. Just log in with your Platinum Card and start searching to see what FHR or Hotel Collection properties you can find.

Car Rental Insurance: Rental Car Benefits with Hertz, Avis & National

Renting a car is easier and more comfortable when you carry the American Express Platinum card. Just as with hotel chains, the Amex Platinum gets you rental car benefits with instant status at several car rental companies.

Our favorite among the bunch is Emerald Club Executive status with National. That’s because you get access to the special Executive Section, where you can choose any full-size car or higher when paying a midsize car rate. That means that you can make a reservation of any-full size car and skip the National check-in desk entirely. Instead, head straight for the Emerald Aisle and take your pick.

It also gets you free upgrades and extra points when you book.

Read more about why we love National Car status and the Emerald Aisle!

Hertz President’s Club is great, too. You can skip the line and grab any car on the lot at one of the 50-plus airport locations across the country that offers Hertz Ultimate Choice. There are other perks like complimentary upgrades, earning bonus points, free additional drivers on each rental, and more.

With Avis Preferred Status, you get to skip the line altogether and pick a car, or get 25% off your rental and a one-class car upgrade. Hertz Gold Plus Status means you can head straight for the Gold counter at check-in, where it’s available. And it gets you some lower rates and a one-class car upgrade as well.

No matter which company you choose, you have to enroll through your benefits page to get status with all three rental car companies. Those upgrades generally take a few days to process, so you may want to plan ahead.

Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

Get up to $100 in Annual Credits at Saks Fifth Ave

You can buy some fancy goods with your Platinum Card … just don’t expect much.

A few years back, the American Express Platinum card rolled out $100 in credits on Saks Fifth Avenue purchases each calendar year. It’s divvied up into two, $50 credits.

The first credit is available through June, while the second becomes available July through the end of the year. After activating the credit through your account, the credit should automatically apply when you make a purchase at Saks. Unused credits don’t roll over, so remember to use them or lose them.

Sadly, Saks nuked this benefit last year by eliminating free shipping unless you spend $300 or more. While $50 won’t go very far, it’s still worth trying to put this one to use.

Check out some of the best ways to use your $50 Saks Fifth Ave credits!

Free Walmart+ (Yes, Really)

It sounds like a joke, doesn’t it? A free Walmart subscription … from a nearly $700 travel credit card?

But it’s true. Using your Platinum Card to sign up, it’ll cover the full monthly cost of Walmart+. It normally costs $12.95 per month (or $98 per year).

Think of Walmart+ as the big box store’s answer to Amazon Prime. You get free next-day and two-day shipping with no order minimum, including items sold by third-party retailers through walmart.com. You’ll also get free same-day delivery for groceries and other in-store items with a $35 minimum order.

Plus, you can get a 10 cent per gallon discount on gas at over 13,000 stations nationwide

But your Walmart+ account also opens the door to a few other worthwhile (and even more questionable) perks, including:

- A free Paramount+ Essential subscription, which normally costs $4.99

- A 25% discount (and four free Whoppers a year) at Burger King

- 24/7 complimentary telehealth for your pets via Pawp

An Equinox Gym Membership … Kind Of

We’ve reached the bottom of the barrel.

Back when it got its latest facelift in 2021, Amex added a credit of up to $300 for Equinox, the incredibly pricey luxury fitness clubs found primarily in New York and California. Most Equinox locations cost at least $200 a month – if not twice that or more – so this credit won’t get you very far.

But there’s one other option: You can sign up for Equinox+, the gym’s app with on-demand fitness courses and tracking. The credit will kick in to cover the entire $300 annual fee.

Authorized Users Get (Some) Benefits Too

You’re not the only one who can benefit.

American Express allows you to add authorized users to your account, and they’ll share many of these perks. At $195 per year apiece after a recent hike, it’s not exactly cheap.

So what do these users get?

- American Express Centurion Lounge Access: Yes.

- Priority Pass Select Lounge Membership: Yes.

- Delta SkyClub Access (When Flying Delta): Yes.

- Up to $120 Credit for TSA PreCheck or Global Entry: Yes.

- Earn 5x Points on Airfare Booked Directly with Airlines and Hotels Booked Through Amextravel.com on up to $500,000 spent in this category each year: Yes.

- $200 in Annual Airline Fee Credits: No.

- $199 in Annual CLEAR Credits: No.

- $240 in Annual Entertainment Credits: No.

- $200 in Annual Uber Ride Credits: No.

- Instant Hotel Status with Marriott and Hilton: Yes.

- Access to Fine Hotels & Resorts: Yes.

- $200 Annual Hotel credit: No.

- Instant Rental Car Agency Status with Hertz, Avis, and National: Yes.

- $100 in Annual Saks Fifth Avenue Credits: No.

- Walmart+: No.

- Equinox: No.

That’s a lot of perks that you can pass on to your friends and family members. Only the monetary credits – for hotels, airlines, Uber, Saks Fifth Avenue, gym, and entertainment credits – don’t pass down.

The Amex Platinum’s lounge access alone can be worth a ton. For example, if you try to get a spouse into the Delta Sky Club or Amex Centurion Lounge, you’d have to pay $50 for each visit. Add them as an authorized user to your account, and they can get in for free.

Another bonus: American Express allows you to transfer Membership Rewards points directly to an authorized user’s frequent flyer account. Unfortunately, Amex has recently added some restrictions to these transfers. But it can still make it much easier to book that trip together.

Bottom Line

There’s a lot to keep track of but there’s no doubt about it: The Amex Platinum’s long list of perks and benefits can add up. In fact, for the right traveler, they can outweigh the card’s annual fee … and then some.

From your trip to the airport to renting a car to clearing immigration on your way back, there’s a lot at your fingertips. Make sure you do all of the above to make your travels more comfortable.

Learn more about *amex platinum*.