As the 2025 spring homebuying season approaches — and the tone is set for what the rest of the year could look like — the long-term costs of a home loan are inching lower even as fears of inflation, unemployment and tariffs loom large.

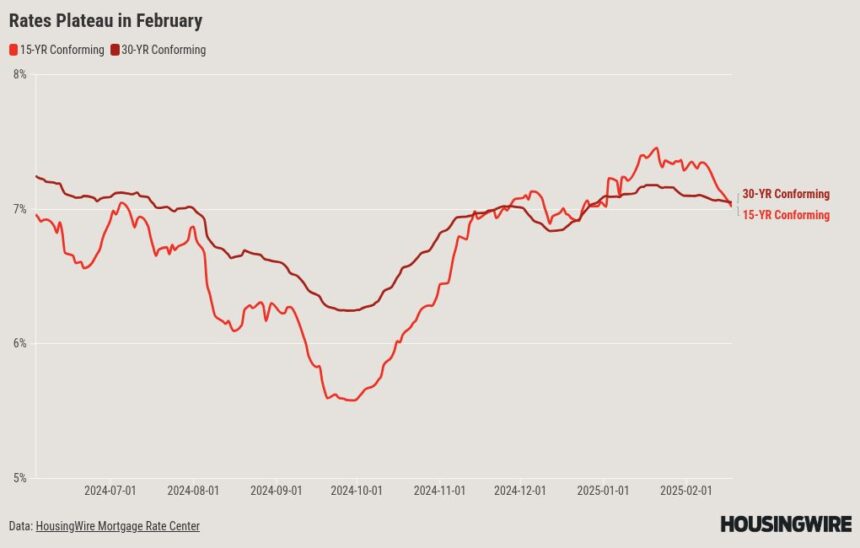

HousingWire’s Mortgage Rates Center showed that 30-year fixed rates for conventional loans stood at 7.05% on Tuesday. That was down 2 basis points (bps) from a week ago and 5 bps lower than two weeks ago.

Rates for 15-year conventional loans have been a roller coaster ride in recent months and have dropped back below the 30-year average for the first time since early January. The 15-year rate shed 30 bps in the past two weeks to reach 7.02% on Tuesday.

Dan Bauer, head of residential lending for Chicago-based Alliant Credit Union, told HousingWire via email that affordability is “one of the biggest deterrents to homeownership” as borrowers struggle to handle the one-two punch of higher mortgage rates and higher home prices.

“That said, we are seeing more acceptance of 7% mortgage rates compared to a year ago,” Bauer said. “Buyers have adjusted their expectations and recognize that waiting for significantly lower rates may not be realistic. The key is preparation — buyers who take steps to improve their credit, get preapproved and budget effectively are still finding paths to homeownership despite market challenges.”

Key datasets are making it highly likely that the Federal Reserve will choose to keep benchmark rates at their current level in the near term.

The CME Group’s FedWatch tool on Tuesday showed that 97.5% of interest rate traders expect the federal funds rate to remain at a range of 4.25% to 4.5% after the March 19 meeting of the Federal Open Market Committee. The odds of a decrease later in the spring aren’t much better, with 87.4% predicting no changes after the Fed’s May 7 meeting.

The Consumer Price Index (CPI) for January, released last week, showed that inflation rose 3% on a yearly basis and 0.5% on a monthly basis. It was the fourth straight month of inflationary growth — another warning sign for the Fed as it tries to achieve annualized growth of 2%.

The good news for the CPI arrived in the form of shelter costs, which declined for a sixth straight month. At 4.4% growth in January, this figure is nearly half of what it was when it peaked at 8.2% in April 2023.

“People are concerned about inflation being reignited, and the possibility of mortgage rates going higher versus lower,” said Melissa Cohn, regional vice president for William Raveis Mortgage. “Once again, we’ve hit a roadblock, and that roadblock is not just tariffs but also tax cuts and immigration policies.”

Although President Donald Trump’s planned tariffs on Canadian and Mexican goods have been paused until March 4, the specter of higher prices on imported goods have sparked concerns across various business sectors. This is reflected in the newest survey data from the National Association of Home Builders (NAHB) as builder sentiment sank by 5 points from January to February, with the current index reading of 42 reflecting increased pessimism from the construction industry.

For Americans who are willing and able to relocate, Midwest markets like Chicago provide lower barriers to achieve homeownership.

“Chicago and many of Illinois’ smaller cities offer more affordable housing options than coastal markets, but affordability is still relative. In Chicago, demand remains strong, especially in desirable neighborhoods with limited inventory,” Bauer said.

“In smaller cities, we’re seeing more opportunities for homebuyers, but economic factors like job growth and property taxes play a big role in long-term affordability. The state’s economy has strengths in industries like health care, logistics and technology, but ongoing concerns about tax burdens and outmigration could impact housing demand over time.”

Bauer’s remarks about property tax burdens are reinforced by a new WalletHub analysis of U.S. Census Bureau data. Illinois has the second-highest effective tax rate among all states and the District of Columbia based on the median U.S. home value. And the typical homeowner in Illinois pays $5,189 per year in property taxes, the sixth-highest amount in the nation.

At a time when banks continue to pull back on mortgage offerings or exit the business entirely, credit unions could be an option for home shoppers seeking personalized attention or local market expertise. Bauer said that Alliant — the largest credit union in Illinois — has loan programs targeted toward first-time homebuyers, medical professionals and other groups.

“We focus on member-first lending, which allows us to offer competitive mortgage options tailored to a borrower’s financial situation, not just a one-size-fits-all approach, he said. “Credit unions can expand their market share by focusing on personalized service, flexible lending solutions and maintaining strong member relationships.”