Nearly 90% of U.S. metropolitan areas analyzed experienced annualized home-price gains in the fourth quarter of 2024, according to data published Thursday by the National Association of Realtors (NAR).

NAR found that 201 of 226 metro areas (89%) saw sale prices for single-family homes rise on a yearly basis in Q4 2024, up from 87% in the prior quarter. Of the 201 markets that reported price gains, 32 of them (or 14%) recorded double-digit appreciation, double the 7% share in the third quarter.

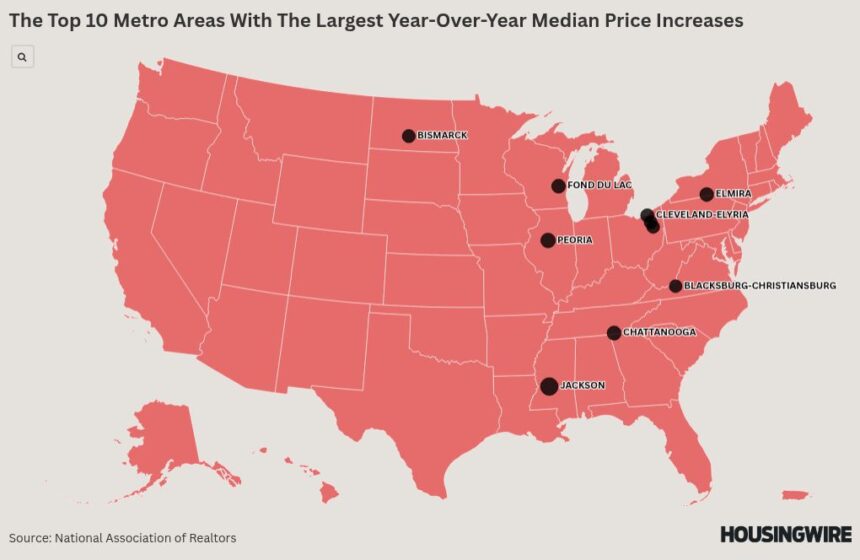

he top-five metro areas for annual median price gains in Q4 2024 were Jackson, Mississippi (+28.7%); Peoria, Illinois (+19.6%); Chattanooga, Tennessee (+18.2%); Elmira, New York (+17.6%); and Fond du Lac, Wisconsin (+17.6%). Each of the top-10 metros for annual price gains recorded increases of at least 14.9%.

With so many metro areas recording price gains, it should come as no surprise that at the national level, the median single-family existing-home sale price rose 4.8% year over year to $410,000. In the third quarter, the annual price gain was 3.2%. Over the past five years, from 2019 to 2024, the median home price has risen 49.9%, NAR reported.

When it comes to the markets with the highest median price, eight of the top 10 in Q4 2024 were in California. The top-three markets included San Jose ($1.92 million, up 9.7% annually); Anaheim ($1,36 million, up 4.7%); and the Bay Area neighbors of San Francisco and Oakland ($1.32 million, up 5.2%). The two non-California markets in the top 10 were Honolulu ($1.1 million) and Boulder, Colorado ($840,700).

“Record-high home prices and the accompanying housing wealth gains are definitely good news for property owners,” NAR chief economist Lawrence Yun, said in a statement. “However, renters who are looking to transition into homeownership face significant hurdles.”

Despite rising prices, the monthly mortgage payment on a typical, existing single-family home (assuming a 20% down payment) was $2,124, down 1.7% from one year ago and 0.8% lower than the prior quarter.

The 30-year fixed mortgage rate ranged from 6.12% to 6.85% during the final three months of 2024. And the study shows that households typically spent 24.8% of their income on mortgage payments, a decrease from 25.2% in Q3 2024 and 26.5% in Q4 2023.

First-time homebuyers also experienced improved affordability, with the monthly mortgage payment on a typical starter home dropping to $2,083. This was down 0.9% from the prior quarter and down 1.7% from one year earlier. The typical starter home, according to NAR, was valued at $348,600. The monthly payment amount assumed the buyer put 10% down.

Additionally, first-time buyers are using less of their income on mortgage payments compared to the prior quarter — 37.4% in Q4 compared to 38.1% in Q3.

While affordability has improved, a family needed a qualifying income of at least $100,000 to afford a 10% down payment mortgage in 43.8% of the markets analyzed — up from 42.5% in Q3 2024. Conversely, families need a qualifying income of less than $50,000 to afford a home in 2.2% of markets, the same as in Q3.

“While recognizing many workers may not have the option to relocate, those who can or are willing to move may find more affordable conditions, especially given the wide variance in home prices nationwide,” Yun said.