This week, the leading indicator of price reductions is more bearish for home prices. The share of homes on the market with price reductions ticked up this week, which is unusual this early in the season.

Potential home sellers notice weak demand, fewer offers and price reductions, prompting them to back away from the market. As such, housing inventory isn’t shrinking. If potential sellers avoid the market, this will keep a lid on supply growth. This trend stretches across every ZIP code in the country. Some markets are underperforming, while others are much tighter with supply and demand.

This will be one of several topics in our HousingWire/Altos Research February webinar, where we spend an hour covering all the details of the data. There are only 1,000 spots open and they are filling up fast, so act now. With that out of the way, let’s dive into this week’s data insights.

New listings are hitting the market

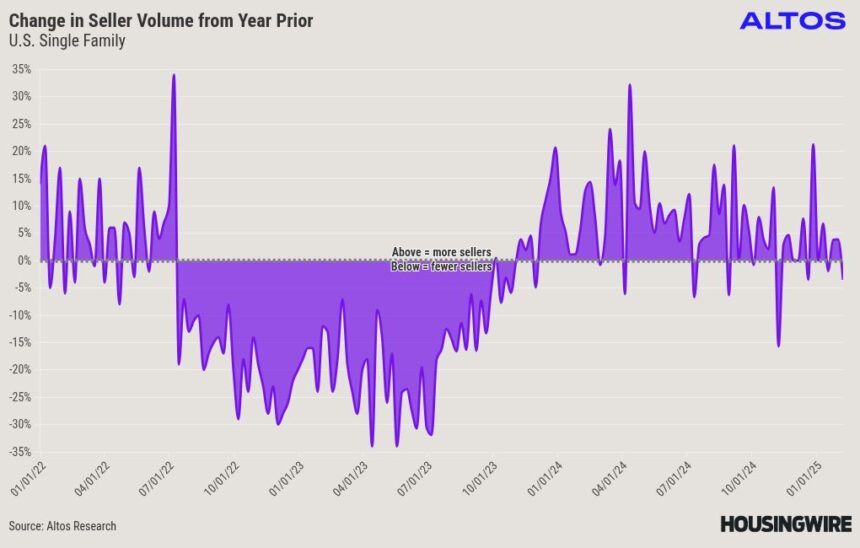

Last year was an environment with 5% to 10% more sellers each week than a year prior. This week, the new listings stat has grown with slightly more sellers. This indicates slow market stabilization and continued inventory growth throughout 2025.

In recent weeks, we’re only averaging about 1% to 2% more sellers. This week had fewer sellers in total than one year prior. The trend is usually 10% more sellers, but now the trend is indicates almost no growth.

The post-pandemic era is one with very few sellers. Three years later, signs point to market stabilization. Every year, we have fewer people “locked in” with ultra-cheap mortgage rates, meaning that sellers are slowly returning to the market. In the fourth quarter of 2024, we also noticed home sales growing, and that seems to be the theme this time around too.

But weekly new listings volume is low compared to January 2024, which is a sign of market stagnation. Now, that momentum with new listings each week seems to be evaporating too. Fewer weekly sellers implies that we’ll have a cap on inventory growth this year, even though demand is weak. In other words, fewer sellers means less inventory and fewer sales. That’s not a good combination for the market.

Take a look at the chart above. Sellers reemerged slightly and the line went positive in November 2023. For most of 2024, there were more sellers than the year prior — and we talked about that growth all year. This week’s trend deviates from that, although it’s not nearly as abrupt as in July 2022.

This implies that prospective home sellers are frustrated. There are just barely more sellers now than last year. Some weeks have seen fewer sellers than last year. Any inventory growth now is because demand is really weak. It’s not coming from the supply side.

If you are assuming that inventory will surge in 2025, this trend may prompt you to think twice. We still expect inventory to grow over 2024, but watch this new listings trend to see what happens next.

Unsold new listings ramped up

There were 54,000 new listings unsold in the first week of February, including another 10,000 immediate sales that are already in contract.

There were slightly more new listings unsold than a year ago. And there are 30% fewer immediate sales now than a year ago. Of the 64,000 total sellers this week, almost 10,000 are already under contract. That leaves 54,000 left to bolster active inventory. While there were 3.8% more unsold new listings compared to one year ago, the total count of sellers is down from 66,000.

When we track the supply side of the equation, we want to watch the weekly level of new listings and the total inventory of unsold homes. Even though new listings volume is climbing for the spring, there were 10% more sellers this week than last. It’s starting to look like inventory growth will be capped.

National inventory drops to 632K

As a result, the available inventory of unsold single-family homes fell by 40 basis points (bps) this week. There are now 632,000 single-family homes on the market nationwide, down from 635,000 a week ago.

This represents the latest development in a two-week trend of low inventory. It’s not unusual for this time of year to have a decrease in the total inventory count. But it is a slight deviation from January’s trend of rising inventory levels. In February, inventory shrank based on the trend of discouraged potential sellers that we just covered.

The second week of January was the lowest week of the year for inventory. Our forecast model expects inventory to tick up in the next couple weeks and then grow consistently starting in March. There are also 27.8% more homes on the market than last year at this time. That percentage gap hasn’t grown in several months.

Historically, the question is, when does inventory reach the historically normal levels posted before the pandemic? We still have 17% fewer homes on the market compared to February 2018. It’ll be healthy for the housing market to return to the old norms for inventory. But I’m growing less optimistic that we’ll get there in 2025.

Price reductions reach highest level in a decade

Home sellers sense pricing weakness in the market. The share of homes on the market with price reductions in February is at the highest level for any February in more than a decade. Price reductions ticked up by 10 bps this week to 33.2% of the homes on the market.

In early 2023, we talked about this — and it was a very contrarian observation at the time. Everyone thought home prices were tanking. We could this see in this price reductions indicator. Each week, sales were happening and fewer price cuts were needed.

This year, that trend is reversed. Price cuts are ticking up each week, which is very odd this early in the season. Last year, more than 30% of the listings had price cuts, alongside a weekly drop rate of 40 bps. As such, the leading indicator for future home sales prices is weaker than last year.

This does not bode well for home prices in 2025. If you’re a home seller this spring, you want to be ahead of this trend. You want to price your house properly from the start. Don’t wait until pricing conditions worsen from here. Local markets vary, of course, and you can look up the price reductions in any ZIP code using the Altos data. We’ll discuss many of the local markets during next week’s webinar.

Home prices are somewhat stable

The median price for all single-family homes this week is $425,000. That’s essentially unchanged from a week ago and one year ago. The price of the homes going into contract — or home sales that will close in March — was $389,000. That was a small step down from a week prior, and it’s only 2.4% more than last year at this time.

Here are a few things to remember about home-price trends:

- Although homebuyer demand is weak — and we have data that shows the impact on prices — there’s no sign of a big decline. There are plenty of markets where inventory is sufficiently tight, causing home prices to continually push up. There are, however, some markets where home prices are sliding lower.

- Home prices staying flat for an extended period is unusual in the history of the housing market. But it’s probably what we’re in for. And it slowly eases the affordability crisis. Incomes have been rising faster than home prices — and that’s a good thing.

Home sales growth slows slightly

Nationwide, there were slightly more than 57,000 new contracts started for single-family homes this week. That’s up a couple percentage points from last week. But this number also came in 5% lower compared to the same week in 2024.

The slow purchase market has continued into February. In Q4 2024, we were optimistic that home sales growth would continue into Q1 2025. But that clearly isn’t the case right now. In the fourth quarter, home sales were about 5% to 10% higher on annualized basis, but these gains are essentially gone now. Homes take about 40 days to close, so these sales are likely to be finalized in March.

The headlines for home sales are going to be bearish for the next few months.

We see fewer sales, weakness in demand impacting prices and potential sellers who are more vigilant than we realize. They’re waiting until conditions improve, but that may take a while.

Mike Simonsen is the founder of Altos Research and will be a featured speaker at the Housing Economic Summit in Dallas on Feb. 26. Learn more here.