Housing market forecasters are adjusting their projections in the wake of President Donald Trump’s fierce trade war, and Fannie Mae expects the economy to take a hit.

The government-sponsored enterprise (GSE) updated its 2025 and 2026 expectations to account for the whirlwind of tariff threats. While it believes economic growth and inflation will trend in a negative direction, its outlook for existing-home sales is slightly higher, as is its forecast for single-family mortgage origination volume.

“Measures of uncertainty and market volatility have risen meaningfully this quarter,” according to Fannie’s newest forecast released on Friday. “That greater uncertainty includes the likely path of fiscal, monetary and other policy developments, but also how firms and consumers respond to them and other financial market developments.

“There are plausible upside and downside risks to both growth and inflation measures over our forecast horizon, as well as to interest rates.”

Fannie’s economic growth outlook for 2025 was revised to 1.7%, down from the previous figure of 2.2%. Inflation expectations rose from 2.8% to 3.2%. The GSE anticipates mortgage rates to end 2025 at 6.3% and 2026 at 6.2% — both slight downward revisions.

It’s more of a mixed bag for the housing market. While Fannie’s home-price appreciation forecast remains at 3.5% for 2025 and 1.7% for 2026, the updated outlook on existing-home sales is marginally higher than its original forecast. The same goes for its prediction on single-family mortgage originations, which ticked up to $1.94 trillion in 2025 and $2.28 trillion in 2026.

Fannie Mae’s update moves in a different direction than the one issued last week by the National Association of Realtors. NAR’s existing-home sales growth forecast for 2025 dropped to 6%, while its estimate for home-price appreciation rose to 3%. It also expects mortgage rates to end this year at 6.4%.

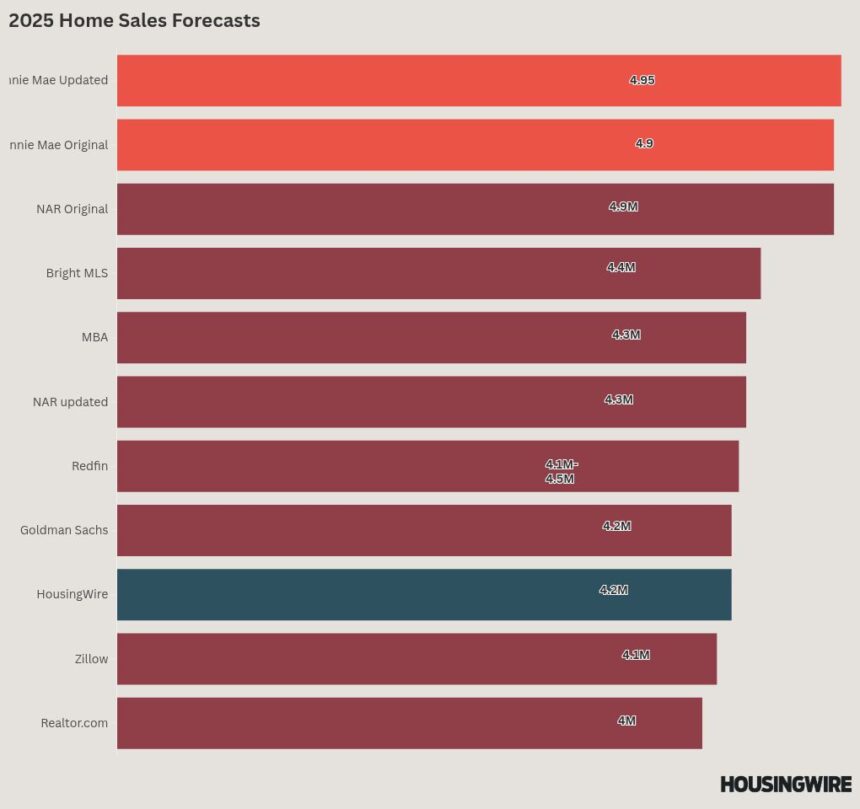

Housing forecasts prior to the start of the year projected a muted outlook for the market. HousingWire‘s forecast, for example, called for existing-home sales to hit 4.2 million and home-price appreciation of 3.5%. Both numbers are generally in the middle of the range of forecasts from other organizations.

NAR’s existing-home sales report for February shows a seasonally adjusted annual rate of 4.26 million, which is a 1.2% year-over-year decline from the dismal 2024 market.

The updated forecasts try to account for the uncertainty that Trump has created through volatile tariff threats, which seemingly change every day. Tariffs that have been implemented already include 20% on China, 25% on all steel and aluminum imports, and 25% on Canada and Mexico for goods not covered by the United States-Mexico-Canada Agreement (USMCA).

More tariffs are scheduled to take effect on April 2. These include 25% on goods covered by the USMCA, 25% on auto imports and global reciprocal tariffs, which would put a tariff on every country in the world that has a tariff on the U.S.

Reciprocal tariffs would be the most disruptive type for the U.S. economy, but the Trump administration has not settled on an exact implementation for this policy. Officials previously scrapped an idea that would put every country into one of three tiers with varying tariff rates. Trump said this week that reciprocal tariffs may be smaller than originally planned.

Economists universally agree that these tariffs will cause consumer prices to rise, which would hinder housing demand. But the president also warned automakers on Friday that they’d face unspecified punishments for raising prices in response to tariffs.

Many industries have lobbied for exemptions to tariffs, including homebuilders. Ever the zero-sum dealmaker, Trump may grant some of these in exchange for something he sees as beneficial to him.

But the volatility alone makes it difficult to gauge the impacts, so other housing industry organizations may revise their outlooks to reflect the potential negative impacts on the economy that tariffs will have.