The word “uncertainty” is ruling the day in markets across the world, but the U.S. housing market got a reprieve from it — at least temporarily.

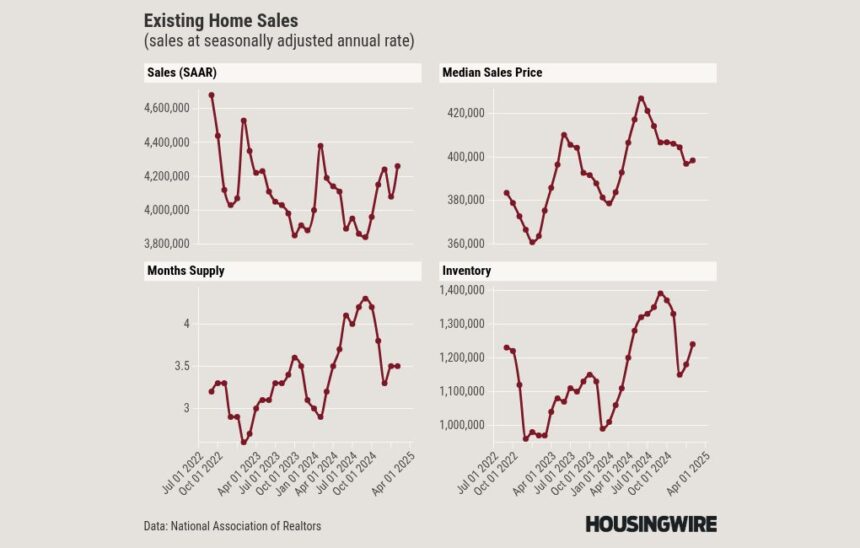

According to data released Thursday by the National Association of Realtors (NAR), existing-home sales in February clocked in at a seasonally adjusted annual rate of 4.26 million, a 4.2% increase relative to January. But this number also represents a 1.2% decline from a year ago.

The annualized pace is relatively high compared to 2025 housing market forecasts, some of which had existing-home sales for the year as low as 4 million. But it also snaps a four-month streak of year-over-year gains.

hose hoping to see sales move higher face a familiar obstacle — high mortgage rates and home prices. NAR reported that the median home price in February landed at $398,400, a 3.8% year-over-year gain. It’s the 20th consecutive month of year-over-year increases.

“Mortgage rates continue to matter for home shoppers,” Realtor.com chief economist Danielle Hale said in a statement. “Despite the context of an expensive borrowing environment and stretched affordability for many shoppers, today’s pick-up shows that a fair number of buyers and sellers are still able to find the middle ground that a transaction requires.”

The good news for buyers is that they’re continuing to have more options. Unsold inventory reached 1.24 million units in February, which is a hefty 17% increase compared to one year ago. There was 3.5 months of supply, a 3% increase from February 2024.

Regionally, sales increased during the year in the Northeast (+4.2%) and Midwest (+1%), decreased in the South (-4%) and remained flat in the West.

The report comes on the heels of Wednesday’s decision by the Federal Open Market Committee (FOMC) to keep the federal funds rate unchanged. The majority of Federal Reserve officials still expect to make rate cuts later this year.

But the wild card is President Donald Trump. His trade war has roiled markets across the globe and stands to directly impact housing construction by pushing up the price of building material imports.

Trump also went on a trademark social media rant about the FOMC’s decision to stand pat while demanding that it cut rates. While the Fed is a body independent of presidential administrations, Trump is consolidating power within the federal government and may set his sights on revamping it.

Earlier this week, he fired two Democratic committee members at the Federal Trade Commission, another independent group. The ousted members plan to challenge their removals in court.