- The Ethereum Pectra upgrade includes 11 new features, including scalability enhancements, sparking discussions on whether the “buy the rumor, sell the news” trend will repeat.

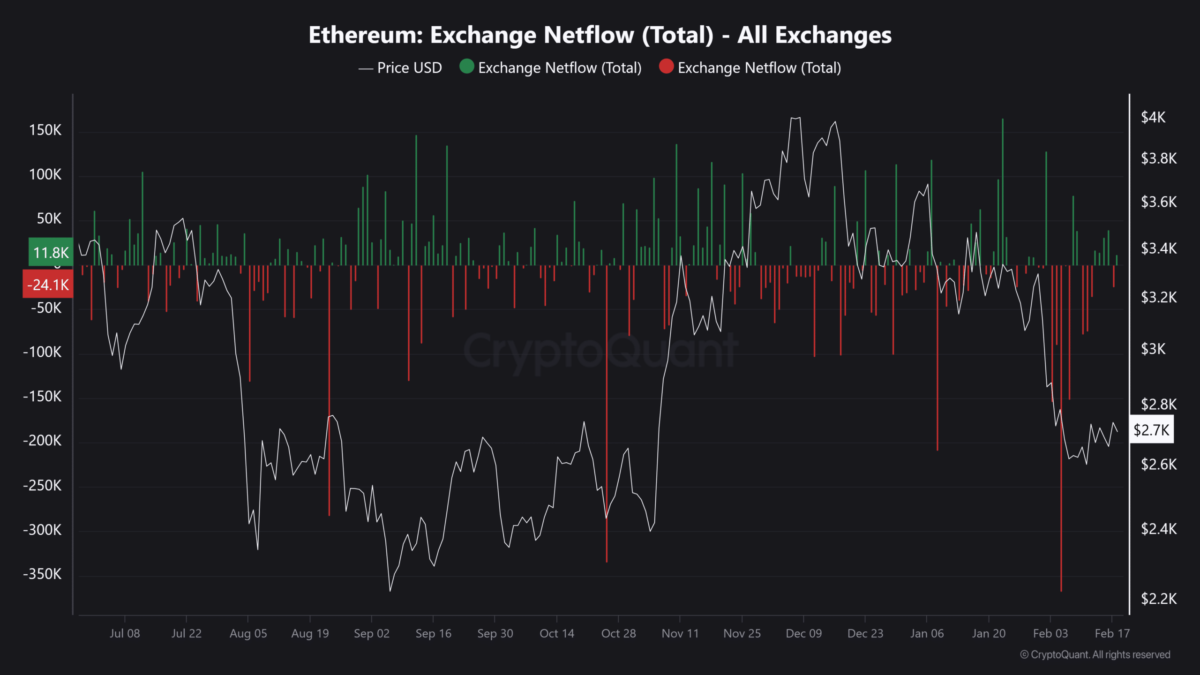

- On February 5, 367,000 ETH were withdrawn from exchanges, reflecting robust accumulation as Ethereum’s price fell below $3,000.

Crypto market traders and investors are gearing up for Ethereum’s much-awaited Pectra upgrade while stirring up discussions on whether the classic “buy the rumor, sell the news” trend will repeat itself. The Ethereum Pectra upgrade will happen sometime in April, subject to successful testnet deployments on February 24 and March 5, as reported in our earlier coverage.

Crypto options trading desk QCP Capital has noted a predominantly bullish stance among traders positioning ahead of the upgrade. This reflects strong optimism, providing a ray of hope to investors as Ethereum has been struggling for a while, flirting around $2,700 levels. In its analysis, QCP Capital noted:

Traders are positioning for another volatility event, with volatility skewed in favor of calls from March 28 onward. This could set the stage for the next major positioning theme.

Can Pectra Upgrade Be the Catalyst for ETH Price Pump?

In their analysis, QCP Capital noted that the previous Ethereum upgrades have seen a surge in activity ahead of the event. The sole exception to this pattern was the Shanghai upgrade in April 2024. In their analysis, QCP noted:

The Merge (Sep 2022) → Classic “buy the rumor, sell the news”. ETH rallied 100%+ from June lows before selling off post-event. Shanghai (Apr 2023) → Markets feared excess supply, but when selling pressure failed to materialize, ETH climbed 30% in the following months.

The upcoming Pectra upgrade for Ethereum will bring a total of 11 features including important ones like blob expansion and smart wallet capabilities. Furthermore, the network’s scalability efforts have already started paying off such as the average Ethereum transaction cost dropping significantly to $0.41 recently.

Despite these initiatives, demand for Layer 1 has yet to significantly increase. Whether the Pectra upgrade will drive a notable boost in L1 adoption remains uncertain.

Road Ahead for ETH Price Recovery Above $4,000

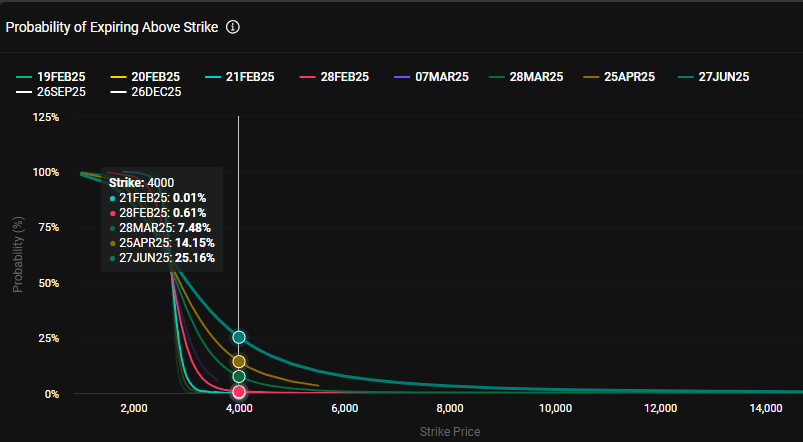

The Ethereum options market is showing a healthy uptick, with the calls for $3K and $3.2K being the most bought in the last 24 hours. To hedge against risk, traders heavily positioned bearish put options at the $2,000 target. This indicates that, in the short term, options traders anticipate a potential surge to $3,200, with $2,000 serving as a critical support level during periods of heightened bearish activity.

However, the options market is not enough optimistic for the ETH price to rally past $4,000 by the end of April after the Pectra upgrade. As of now, traders believe that there’s only a 14% chance wherein the king altcoin could reclaim $4K levels. However, the odds of hitting $4K by June have surged to 25%. As mentioned in our previous story, some market analysts also expect ETH to rally to $15,000 by June.

One major catalyst ahead for Ethereum is the significant drop in the ETH exchange supply. On February 5, a notable 367,000 ETH were withdrawn from exchanges, signaling a robust accumulation trend as the altcoin’s price dipped below $3,000 on the charts.