- Ethereum (ETH) has been predicted to break into the $3,800 to $4,200 range to target the $4,500 price point based on the “In/Out of Money Around Price (IOMAP)” indicator.

- Whales have been actively accumulating the asset as Lookonchain data shows a $7 million worth of ETH purchase at $3,900.

Ethereum (ETH) has made a 19% surge on its monthly price chart, trading at $3,926 and making an ambitious move toward its all-time high price of $4,891. Amid the backdrop of this bullish run, whales have significantly increased their buying activities according to market data.

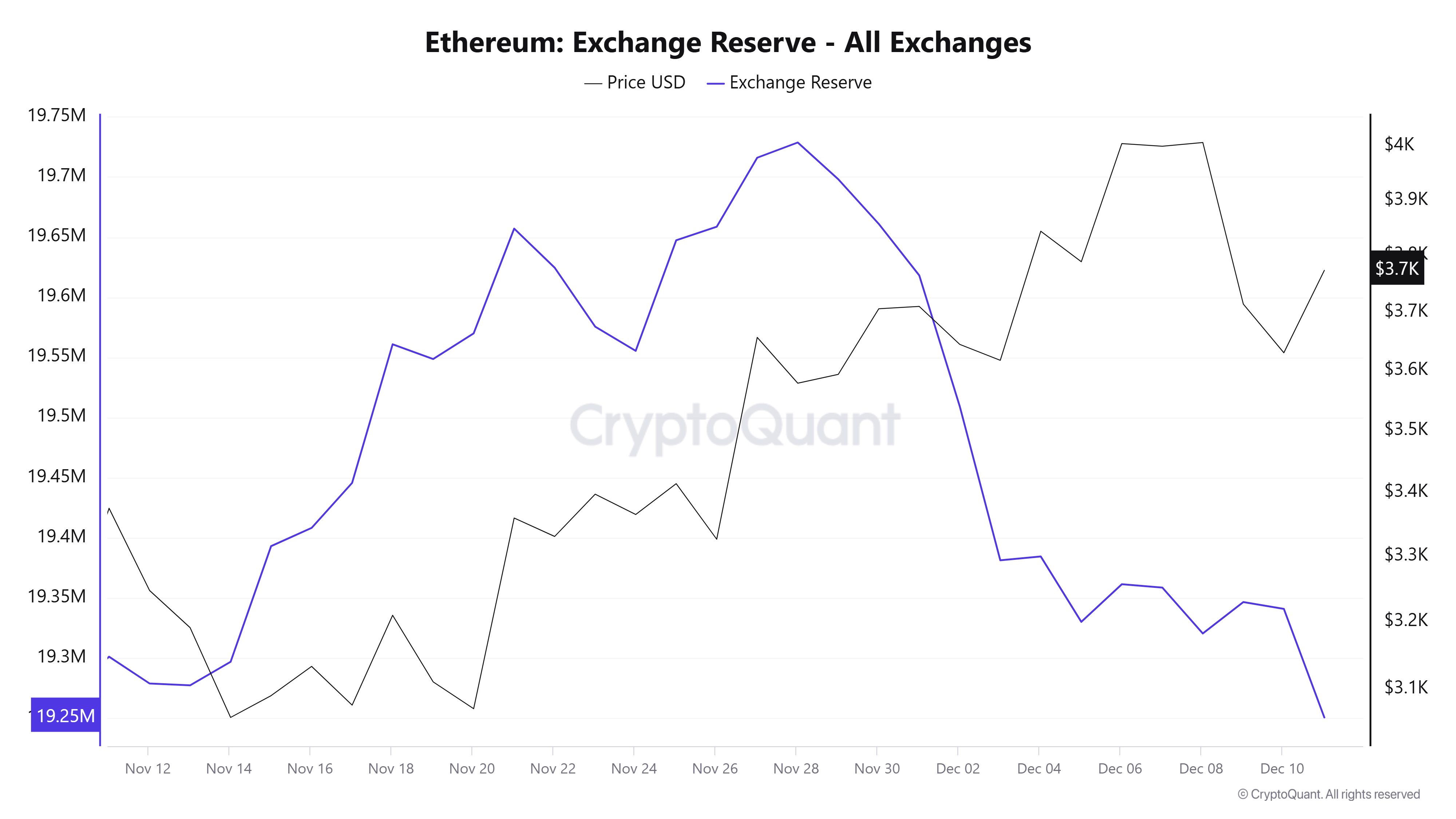

According to CryptoQuant data, whales have withdrawn 130K ETH in the past seven days from centralized exchanges for self-custody. Fascinatingly, this occurred after the asset considerably declined to its monthly low of $3,016.

Similarly, according to Lookonchain data, a whale who has been accumulating millions of dollars of ETH over the past few months recently purchased 1,800 ETH ($7 million). Based on our analysis, this was executed when ETH was trading at $3,900.

Analyzing the performance of spot Ethereum Exchange Traded Fund (ETH), we found out that BlackRock’s iShares ETHA has had inflows for 8 consecutive days with $1.05 billion accumulated within the period.

Meanwhile, Sean Dawson, head of research at crypto options exchange Derive, believes that the significant ETF inflows and whale activities could push the asset above its all-time high price and hit $5,000 a few days after Christmas. However, the probability of this happening has declined from 16% to 8%. His reason is that the trading of “calls and puts” is currently distributed evenly. This suggests that the sentiment around the coin is neutral.

Analysts Speak on Ethereum (ETH)

According to analyst Michael van de Poppe, ETH is currently trading in a position that enables accumulation at a discount. According to him, ETH has been forming a bullish pattern, which could be validated once the asset breaks out of the $3,800 and $4,000 resistance range. Per his observation, this could mark the beginning of the ETH’s bull run which could run into 2025.

ETH provides an excellent opportunity to accumulate. Standard correction after testing a new resistance area. I expect we’ll continue to run from later this month into the new year.

Delving into on-chain data, Van de Poppe observed that the ETH sentiment aligns with the In/Out of Money Around Price (IOMAP). Per our analyst’s interpretation, IOMAP subjects crypto addresses to classifications based on their accumulation periods. The higher the accumulation volume of a coin, the stronger the resistance level, and vice versa. Specifically, the volume of ETH at $3,715 was much higher than that of $3,830 and $4,274. This implies that the asset could soon target the $4,500 mark.

The above bullish prediction is also supported by the ETH Daily Active Addresses (DAA), which has surged by almost 7% in the last 24 hours to cross the 600,000 line. Similarly, the net network growth has surged by 0.30%, entering bullish territory.

Another analyst, identified as Crypto Patel, estimates that ETH could skyrocket to $10,000. However, failure to hold above a crucial support level could see the asset crashing to $2,500-$2,800, which could also be a perfect accumulation zone.