- Ethereum Foundation has deployed 45,000 ETH into 4 DeFi lending protocols.

- The foundation is also likely to stake up to $1 billion worth of ETH.

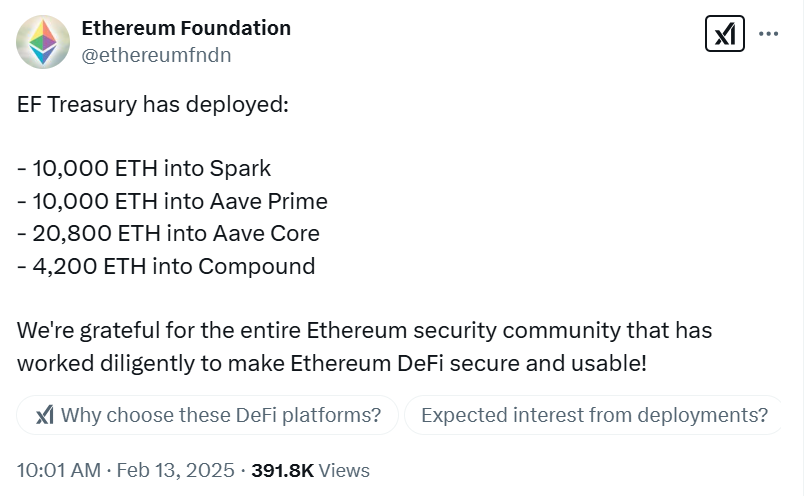

The Ethereum Foundation (EF) recently made a bold move to drive innovation in the Decentralized Finance (DeFi) ecosystem. The Foundation said it transferred $120 million worth of Ethereum (ETH) from its holdings to decentralized finance protocols Spark, Aave, and Compound.

EF Treasury has deployed:

– 10,000 ETH into Spark

– 10,000 ETH into Aave Prime

– 20,800 ETH into Aave Core

– 4,200 ETH into CompoundWe're grateful for the entire Ethereum security community that has worked diligently to make Ethereum DeFi secure and usable!

— Ethereum Foundation (@ethereumfndn) February 13, 2025

Details of the ETH Transfers

According to the transaction details, the EF transferred 30,800 ETH, worth $81.6 million, from its multi-sig wallet to Aave. In two transactions, the EF split the transfers into two on Aave, the biggest DeFi lending platform. Aave’s core market received the biggest chunk, 20,800 ETH valued at $55 million, while Aave Prime got 10,000 ETH ($26 million).

Additionally, the Foundation moved 10,000 ETH (worth $26 million) into Spark, a lending service platform similar to Aave. In another transaction, the EF deployed 4,200 ETH, valued at $11.2 million, to Compound’s lending platform.

These transfers represent a bold move for the Foundation to increase the value of its treasury without selling assets. With the 45,000 ETH it deployed into these protocols, the Foundation would start earning yields on DeFi deposits. The EF could earn an annualized yield of $1.5 million based on the 1.5% supply rate.

Notably, the recent transfers reinforce the Ethereum Foundation’s support of DeFi innovation. In January, the Foundation transferred 50,000 ETH to a multi-sig wallet following public scrutiny of its treasury management.

In addition, Ethereum co-founder Vitalik Buterin revealed EF is considering staking $1 billion worth of its ETH holdings. As indicated in our earlier discussion, Buterin’s comments were in response to scrutiny over the Foundation’s seeming lack of Ethereum ecosystem participation.

Also, EF liquidated 100 ETH for 307,893 DAI in January at an average price of $3,078.93, as featured in our recent coverage. So far in 2025, the Foundation has conducted total sales amounting to 300 ETH.

Historically, the foundation sells its ETH holdings to cover operational expenses. This move has often raised criticism among community members. Some have recently suggested leadership changes, including replacing the executive director, Aya Miyaguchi.

Ethereum Set for Pectra Upgrade

The Ethereum network is set to experience improvements with the launch of new updates this year. Ethereum developers have confirmed test dates for Pectra, the first major update to the network in almost a year.

As CNF discussed earlier, testing for Pectra will begin on February 26 on the Holesky test network. A second phase will commence on the Sepolia test network on March 5. Developers will meet on March 6 to finalize the launch schedule if both phases are successful.

For clarity, the Pectra update merges two separate updates, Prague and Electra, into a single release under the name “Pectra.” The update will introduce eight key enhancements to the Ethereum network. Of these improvements, EIP-7702 stands out for its impact on cryptocurrency wallets.