New data released Thursday by the Mortgage Bankers Association (MBA) revealed that the delinquency rate for mortgages on one- to four-unit residential properties increased to a seasonally adjusted rate of 3.98% of all loans outstanding at the end of 2024.

The national delinquency rate was up 6 basis points (bps) from Q3 2024 and up 10 bps from one year ago. And the percentage of loans on which foreclosure actions were started rose by 1 bps to 0.15% in the fourth quarter.

“Although mortgage delinquencies rose only ten basis points in the fourth quarter of 2024 compared to one year ago, the composition of the delinquencies changed,” Marina Walsh, the MBA’s vice president of industry analysis, said a statement.

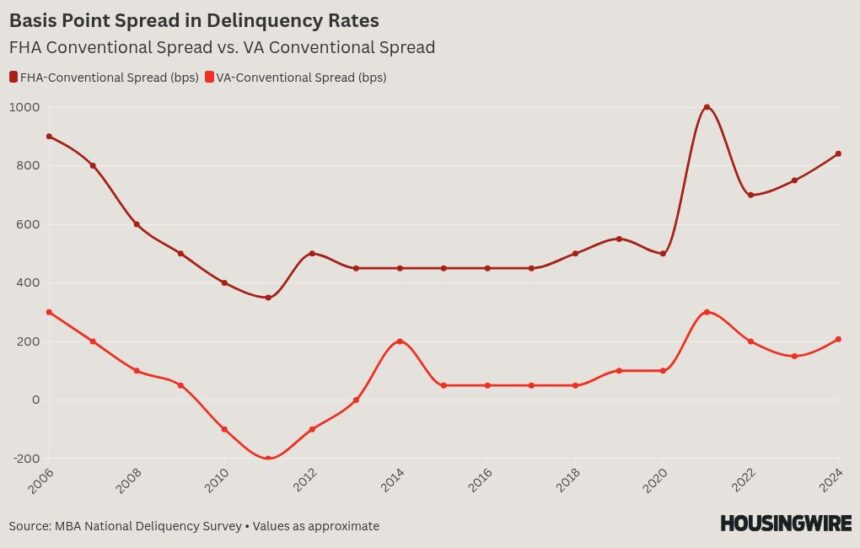

“Conventional delinquencies remain near historical lows, but FHA and VA delinquencies are increasing at a faster pace. By the end of the fourth quarter, the spread between the FHA and conventional delinquency rates reached 841 basis points, while the VA and conventional spread was 208 basis points.”

On Thursday at the MBA Servicing Solutions Conference & Expo in Austin, Walsh presented additional context on the variance of delinquent rates by loan type. Specifically, conventional loans are performing much better than Federal Housing Administration and U.S. Department of Veterans Affairs loans. The seriously delinquent rate (loans that are at least 90 days overdue, plus those in foreclosure) for FHA loans is 4.12%, roughly three times higher than the 1.14% rate for conventional loans.

The seasonally adjusted mortgage delinquency rate for all outstanding loans increased compared to the third quarter of 2024. By stage, the 30-day delinquency rate decreased 9 bps to 2.03%, the 60-day rate increased 3 bps to 0.76%, and the 90-day rate jumped 11 bps to 1.19%.

“Six months ago, we were at an all-time low delinquency rate since 1984, but that was driven a lot by conventional loans … and those conventional loans are staying very, very strong,” Walsh said during her presentation.

“But the basis-point spread between the FHA delinquency rate and conventional, as well as the VA delinquency rate and conventional, has picked up. We’re talking about almost 850 basis points of spread between those delinquencies for FHA. And likewise, it’s gone up for VA.”

By loan type, the past-due rate for conventional loans decreased between the third and fourth quarters by 1 bps to 2.62%. The rate for FHA loans increased by 57 bps to 11.03%, and the rate for VA loans rose by 12 bps to 4.70%.

The higher delinquency rates for FHA and VA loans are attributed to borrowers with lower credit scores and higher debt-to-income ratios. They tend to be more vulnerable to economic stressors like job losses or inflation.

Walsh added in her presentation that delinquency rates were particularly elevated for the 2022 and 2023 origination vintages, as borrowers were on the edge of affordability when mortgage rates began to rise.

“I do think it’s a matter of just overall affordability,” Walsh said about the elevated vintages. “These are homeowners that just squeaked into their loan, they may have a down payment assistance program that they’re on that they just managed to qualify. … But any adversity, whether it comes to a temporary job loss, whether it comes to an increase in their taxes, condo fees, needing to make repairs to the home, those factors cause enormous stress that sends them into delinquency.”

The non-seasonally adjusted seriously delinquent rate was 1.68% at the end of 2024, up 13 bps from the prior quarter and up 16 bps from one year ago.

The seriously delinquent rate increased 5 bps for conventional loans, 49 bps for FHA loans and 32 bps for VA loans from the previous quarter. Compared to a year ago, the 90-day delinquency rate was up 2 bps for conventional loans, 70 bps for FHA loans and 57 bps for VA loans.