- Standard Chartered predicts Bitcoin could hit $500,000 by 2028, driven by regulatory improvements, spot ETF demand, and Trump’s pro-crypto policies boosting institutional adoption.

- Bitcoin’s market value may surpass Apple and Microsoft, with estimates suggesting a 50% chance of exceeding $500,000 by 2030 due to growing demand.

Standard Chartered, a major British multinational bank, has made a bold prediction: Bitcoin could reach an eye-popping $500,000 before Donald Trump’s presidency comes to an end. The bank attributes this dramatic surge to improving regulatory conditions and easier access for investors.

If Standard Chartered’s prediction comes true, Bitcoin will rise over 400% from current levels, pushing its total market value to an estimated $10 trillion. That would place it ahead of tech giants Apple and Microsoft and bring it to nearly half of gold’s $19.5 trillion market cap.

“The ETFs have attracted a net $39 billion of inflows so far, supporting the theory of pent-up demand being unleashed by increased access,” Geoff Kendrick, Global Head of Digital Assets Research at Standard Chartered, stated in a release. The rise of Bitcoin spot ETFs, introduced in the U.S. in January 2024, is seen as a key factor driving this rally.

Milestones Ahead: $200K in 2025, $500K by 2028

Looking ahead, Standard Chartered expects Bitcoin to reach $200,000 by the end of 2025, followed by a steady climb to $300,000 in 2026, then $400,000 in 2027, before finally hitting the $500,000 mark in 2028. The bank anticipates some stability in price after that peak.

Kendrick also highlighted that the U.S. regulatory landscape is shifting in Bitcoin’s favor. He pointed to the repeal of Staff Accounting Bulletin (SAB) No. 121, which previously forced companies to record digital assets as liabilities. This change removes a major barrier for institutional investors looking to hold Bitcoin on their balance sheets.

Trump’s policies could further boost Bitcoin’s legitimacy. His January 23 directive to assess a national digital asset reserve has raised speculation that central banks might consider Bitcoin as part of their holdings.

“Trump’s January 23 order that the administration evaluate a potential national digital assets stockpile is also important, as this could encourage other central banks to consider Bitcoin investments,” Kendrick added.

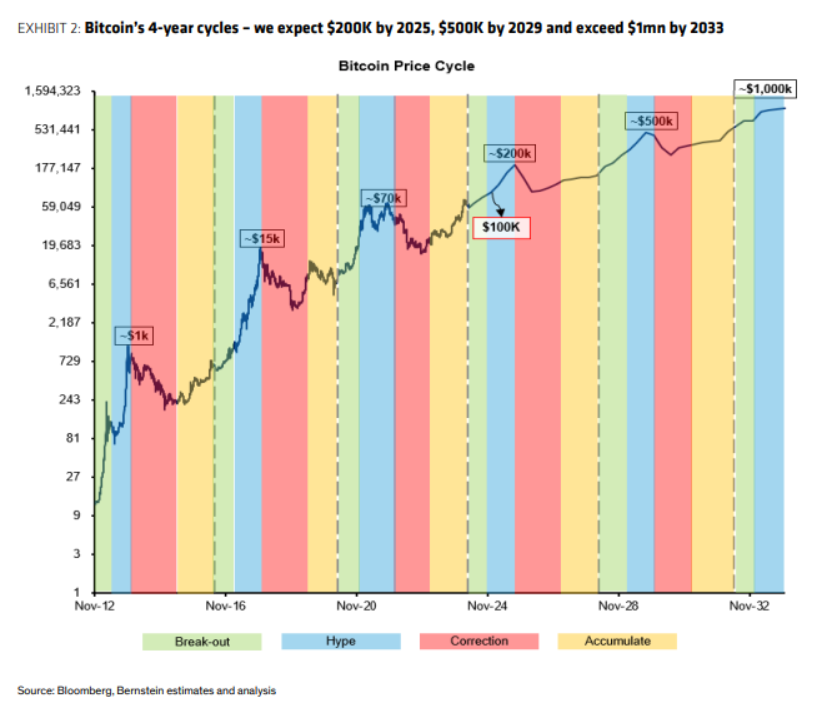

Bernstein Predicts $200,000 by 2025

Beyond Standard Chartered’s outlook, research firm Bernstein also sees a massive upside for Bitcoin. Analysts there project a climb to $200,000 by the end of 2025, citing multiple catalysts driving demand. This aligns with Standard Chartered’s forecast and further strengthens the case for Bitcoin’s long-term growth.

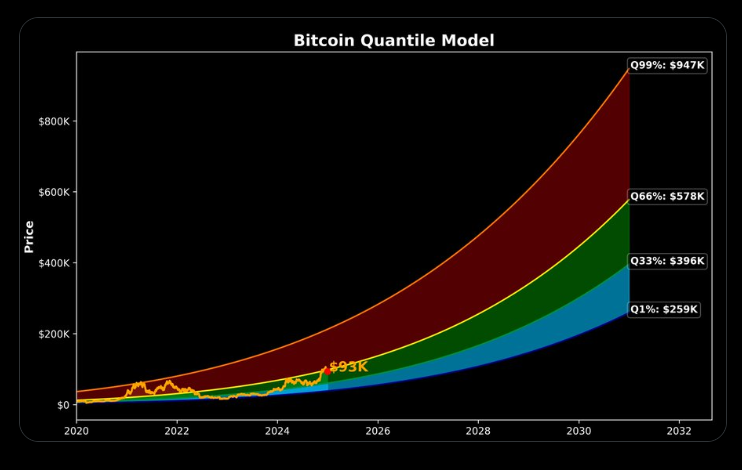

Long-term models suggest Bitcoin could soar even higher in the coming decade. The Bitcoin Quantile Model, which analyzes historical trends using quantile regression, outlines a price range for the digital asset. While the highest estimate places Bitcoin at $947,000 by 2032, more conservative projections suggest it could land somewhere between $444,000 and $578,000 by 2030.

Bitcoin’s long-term trajectory remains a subject of debate. While the probability of reaching $1 million by 2030 sits below 1%, some models indicate that Bitcoin has nearly a 50% chance of surpassing $500,000. This optimistic outlook is fueled by growing adoption, tightening supply, and increasing institutional participation.