- Spot Bitcoin ETFs have been predicted to surpass the 2024 record inflow to hit $50 billion as institutional adoptions are expected to significantly improve.

- An analyst believes that the expected run of the ETFs could be a major catalyst for Bitcoin to hit $200,000 by the end of 2025.

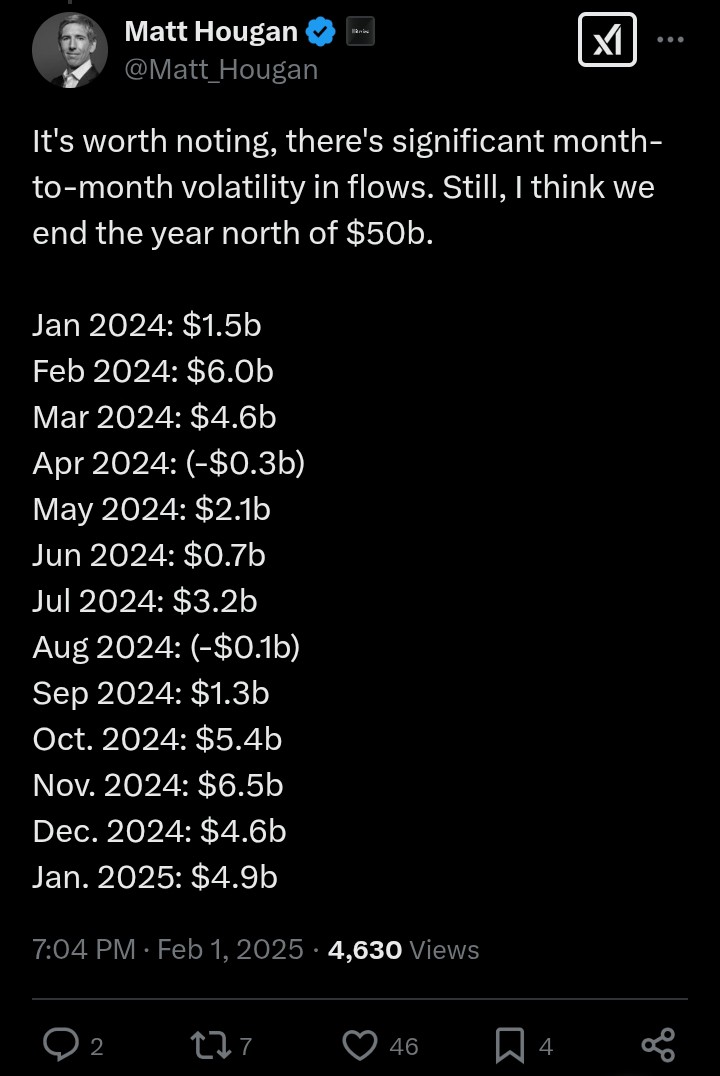

Spot Bitcoin Exchange Traded Funds (ETFs) have been predicted to have their moments in 2025, with incredible inflows eclipsing the 2024 fiscal year by a considerable margin. According to Bitwise investment chief Matt Hougan, this product would pull in about $50 billion by the end of the year. Putting this in perspective, the Bitcoin ETFs recorded inflows of $35.2 billion in 2024, doubling experts’ estimations of up to $15 billion.

Adding to his thesis, Hougan pointed out that Bitcoin ETFs had $4.94 billion in inflows in January 2025, annualizing this to around $59 billion. As indicated in our earlier discussion, the inflows reached around $900 million in the first week. Out of the January 2025 cumulative value, BlackRock’s iShares Bitcoin Trust ETF (IBIT) maintained an incredible share with a total inflows of $3.2 billion.

The nearest ETF with the highest inflow was Fidelity Wise Origin Bitcoin Fund (FBTC) which had almost $1.3 billion. Meanwhile, the Bitwise Bitcoin ETF (BITB) and the Grayscale Bitcoin Mini Trust ETF only managed to pull in $125 million and $398.5 million, respectively.

Shedding more light on this report, Hougan explained that ETFs mostly struggle in their first years, citing gold as an example. According to him, the gold ETFs recorded $2.6 billion after their debut in 2004. In 2005, this value more than doubled to $5.5 billion. Meanwhile, the expert believes that institutional adoption would play a crucial role in this significant level of inflows this time.

BlackRock’s IBIT Dominance and Bitcoin Price Struggles

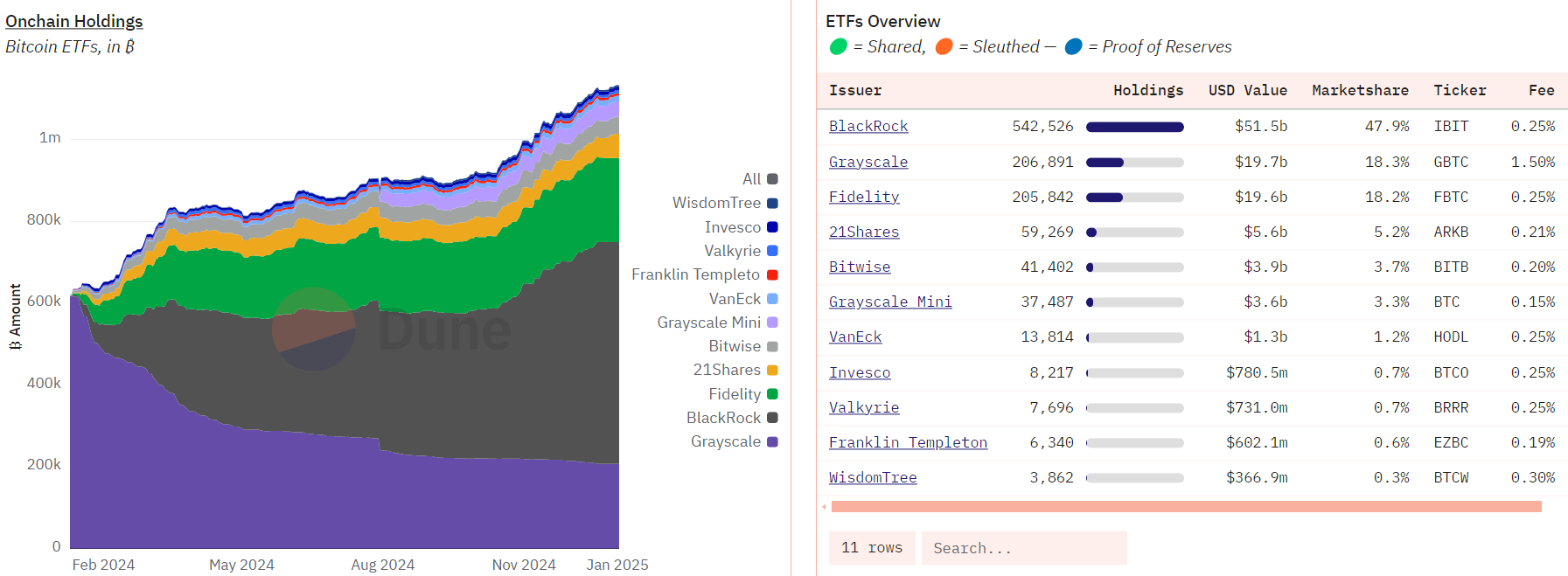

In early January, Dune Analytics data highlighted the pacy growth of the Bitcoin ETFs as it highlighted that it was just $2.2 billion away from crossing $110 billion in cumulative holdings.

According to that report, BlackRock’s iShares Bitcoin Trust ETF held more than 542,000 BTC ($51.5 billion). Specifically, this implied that BlackRock held 47.9% of all market shares among US-based Bitcoin ETFs. Globally, BlackRock’s fund occupied the 34th position in both crypto and traditional finance products.

Amidst the backdrop of this prediction, Bitcoin appears struggling as it breaks below a crucial support level to reach its 2025 low of $91k. At press time, the asset had slightly rebounded to stabilize at $94k. However, its 24-hour gains remain 6% down. Bitcoin investors have also lost 4.6% on their weekly investments as its market capitalization declined to $1.8 trillion. Meanwhile, trading Volume remains incredibly high as $96.4 billion changes hands at press time.

Commenting on this, the chief analyst at Bitget Research, Ryan Lee, has estimated that Bitcoin could reach $200 million in 2025. According to him, the explosive run to this level may be fueled by the new ETF milestone. Fascinatingly, this aligns with the $145k to $250k prediction by CryptoQuant analysts, as outlined in our recent blog post.

Long-term projections suggest sustained growth, with some forecasts placing Bitcoin’s value at $200,000 by 2025. However, the trajectory will be influenced by regulatory developments, market dynamics and broader economic conditions.

On the contrary, some analysts, including Lark Davis, believe that massive acquisition of Bitcoins by the ETFs, which exceed the quantity mined, could strain the supply at bull markets. As featured in our recent coverage, ETFs holding about 10-20% of the supply may not be good for the market during the bullish period.