Never one to rest on its laurels, Bilt Rewards is working on the next generation of the *Bilt Mastercard*.

After first teasing “Bilt Card 2.0” in an open letter to members late last year, the loyalty program recently sent out a survey to current cardholders soliciting feedback on six different new card options at three different price points.

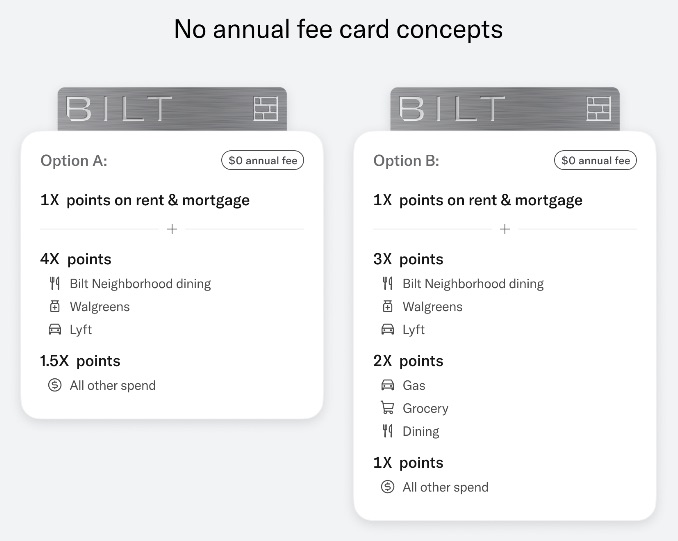

The card concepts proposed include two different versions of a no annual fee card, two costing $95 per year, and two premium cards at a whopping $550 per year. Each option includes different bonus categories, partner credits, and even a Priority Pass airport lounge membership on the $550 annual fee card.

One common denominator with all the cards? You’ll soon be able to earn points on your monthly mortgage payment in addition to rent – welcome news to many.

It’s unclear whether Bilt actually plans to offer three different cards or is just gauging interest at different price points through the survey process.

Bilt was also quick to note that these potential cards were created through member feedback, but they’re far from set in stone. “I do want to be clear that these are not locked in options, they are not finalized, they are not rigid, we have not committed to these, and there will be many, many more revisions.” Bilt’s VP of Travel, Richard Kerr, told Thrifty Traveler.

So what’s being proposed? Let’s take a look.

A Refreshed No Annual Fee Card

To kick things off, let’s start with the new-look no annual fee Bilt card concepts.

Both of these cards look … fine. But I’m not convinced either is better than the current *Bilt Mastercard*, which offers 3x points on dining, 2x on travel, and 1x on rent and all other purchases (but you must make a minimum of five transactions per billing period to earn rewards).

If I had to pick a winner between the two, I think Option A would be best for most people. Earning 1.5x Bilt points everywhere would put it on par with the popular no-annual-fee *chase freedom unlimited*. Getting 4x at Bilt Neighborhood dining restaurants, Walgreens, and Lyft is also nice for anyone who regularly spends in these categories, though the appeal is much more limited.

With Option B, you’d earn 2x points on gas, groceries, and dining – all common spending categories – but a less impressive 3x points on Bilt Neighborhood dining, Walgreens, and Lyft. Considering all other purchases earn 1x points, you’d need to spend big on gas, groceries, and dining to make up for the less impressive base earning.

But one thing to note, even on the newly proposed no annual fee card options, cardholders would still have the ability to earn points on both rent and mortgage payments.

$95 Annual Fee Card

For $95 per year, Bilt is upping the ante with additional bonus categories and up to $170 in partner credits. Once again, both of these cards look fine – not necessarily better than cards currently available from other banks at a similar price point.

I think the winner here is Option A. This is essentially a souped-up version of Option B from the no annual fee list, with increased 5x point-earning at Bilt Neighborhood dining, hotels booked through Bilt, Lyft, and Walgreens. You’d also earn 2x Bilt points on dining, grocery, and gas, while all other purchases earn 1x points, including rent and mortgage payments.

Both card concepts include $170 in annual partner credits to be used with Bilt Fitness, Walgreens, and Bilt Hotels. And if these “money-saving” statement credits look familiar, you probably have an Amex card in your wallet. It looks like Bilt is stealing a page straight out of Amex’s playbook by leaning heavily on partners to offset the card’s annual fee.

It’s anyone’s guess exactly how these credits would play out, but if you divide $60 per year into 12-monthly allotments, you’d be looking at $5 per month to spend with both Bilt Fitness and Walgreens. I doubt it’s a coincidence that math works out so cleanly. Meanwhile, the $50 per year in Bilt Travel hotel credits is much more likely to be available in one fell swoop, though there are often drawbacks to booking hotels through third-party online travel agencies like Bilt Travel.

So, while the addition of up to $170 in partner credits would surely help offset either card’s $95 annual fee, the likelihood of these credits coming in drips and drabs makes them much less appealing.

$550 Annual Fee Card

At $550 per year, Bilt is proposing two card concepts to compete in the crowded premium card space with the likes of the *chase sapphire reserve* and the *venture x*. Both card designs include even more bonus categories, $380 in annual partner credits, and a Priority Pass lounge membership.

Stop me if you’ve heard this before, but both of these proposed cards are completely OK. They’re not bad by any stretch of the imagination, but there’s also no marquee benefit that’s going to make me race out to apply.

If I’m picking favorites, I think Option B moves the needle more with its juiced-up earnings on rent and mortgage payments. If you live in an expensive apartment building or have a big mortgage payment, earning 1.25x points on these payments over the normal 1x points could be huge.

Option B also earns 5x points with Lyft, Walgreens, and hotels booked through Bilt and 4x points on Bilt Neighborhood dining. More traditional bonus categories include earning 3x points on direct flight bookings, 2x points on grocery and gas purchases, and 1x points on all other spending.

To help offset the $550 annual fee, you’d get $200 per year in Bilt Travel hotel credit, $120 in Bilt Fitness credit, and $60 Walgreens credit. Again, there’s no telling how these credits would shake out but it wouldn’t be surprising to see them split up into monthly or semi-annual allotments.

Finally, both of these premium card options include a Priority Pass lounge membership, which will get you into 1,400-plus airport lounges around the world. While this is certainly a nice benefit to have, it’s far from unique. If lounge access is what you’re after, most travelers would be better off with the $395 per year *venture x* over either of these premium Bilt Cards.

However, it’s worth noting that the current Bilt Card is issued by Mastercard and when it comes to Priority Pass memberships, that matters. That’s because the Priority Pass that comes with Mastercards typically includes up to $28 per person to spend at Priority Pass restaurants. This is admittedly a bit of a stretch, but if one of these $550 Bilt cards make it to market issued by Mastercard, it could very well include Priority Pass restaurant access, which would be a differentiator.

Bottom Line

A recent survey went out to current Bilt cardholders showing six different “Bilt Card 2.0” concepts, ranging from no-annual-fee versions to premium $550 per year cards. It’s important to note that none of these designs are finalized and things will continue to change over the next several months, but it does give us a sense of what Bilt is planning.

One thing that’s clear from each of these card designs is that no matter which card you have, you’ll continue earning points on rent – and soon mortgage payments, too.