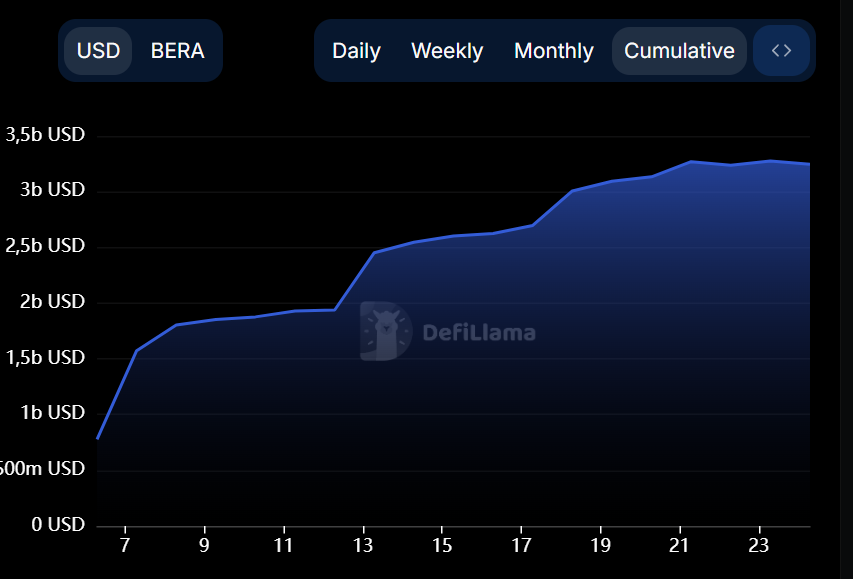

- Berachain’s Total Value Locked (TVL) surged to $3.25 billion, surpassing Base and Arbitrum in DeFi dominance.

- The platform faces community concerns over airdrop distribution and insider trading speculation despite its rapid ecosystem growth.

Berachain has emerged as a promising contender in the highly competitive blockchain space, outperforming the major players. Rising above Base and Arbitrum, the layer-1 platform has now recorded a total value locked (TVL) of $3.25 billion, according to DefiLlama. This number not only ranks it as a top blockchain but also ranks it eighth globally based on TVL.

A Rapidly Growing Ecosystem: DeFi and Stablecoins on Berachain

Berachain launched on February 6 and has expanded shockingly quickly since then. Its DeFi ecosystem, which has exploded right away, is one of the key causes of this development. Operating on the network, the liquid staking platform Infrared Finance now controls assets valued over $1.29 billion. With an asset value of $1.15 billion, the decentralized exchange Kodiak is likewise not to be outmatched.

On the other hand, the function of stablecoins in the Berachain ecosystem is likewise growing more important. Stablecoins traded on the network have a market valuation of $930 million, suggesting strong demand for more steady assets among the volatility of the crypto market.

Community Backlash Over Token Distribution

Berachain’s route has not been quite clear, though. A few users voiced dissatisfaction at the airdrop distribution, which was deemed not as expected. While some said they got fewer tokens than promised, others said the main creators sold a lot of tokens almost right away after the release. This set off selling pressure that sank BERA’s price 63% from its highs.

Still another objection arose from conjecture about insider trading possibilities. Blockchain tracks significant transactions from wallets thought to be connected to the development team, therefore intensifying the community argument.

Momentum Still Strong

Data indicates that trading activity in the Berachain ecosystem is still rather high notwithstanding the several problems that have surfaced. Trading activity on the network’s dispersed exchange last week came at $375 million, a 60% rise over the week before. This still suggests great enthusiasm for this project.

At press time, the BERA token is swapped hands at about $6.77, corrected 5.77% over the last 24 hours. This decline is in line with the bearish trend that is currently enveloping the major crypto market.