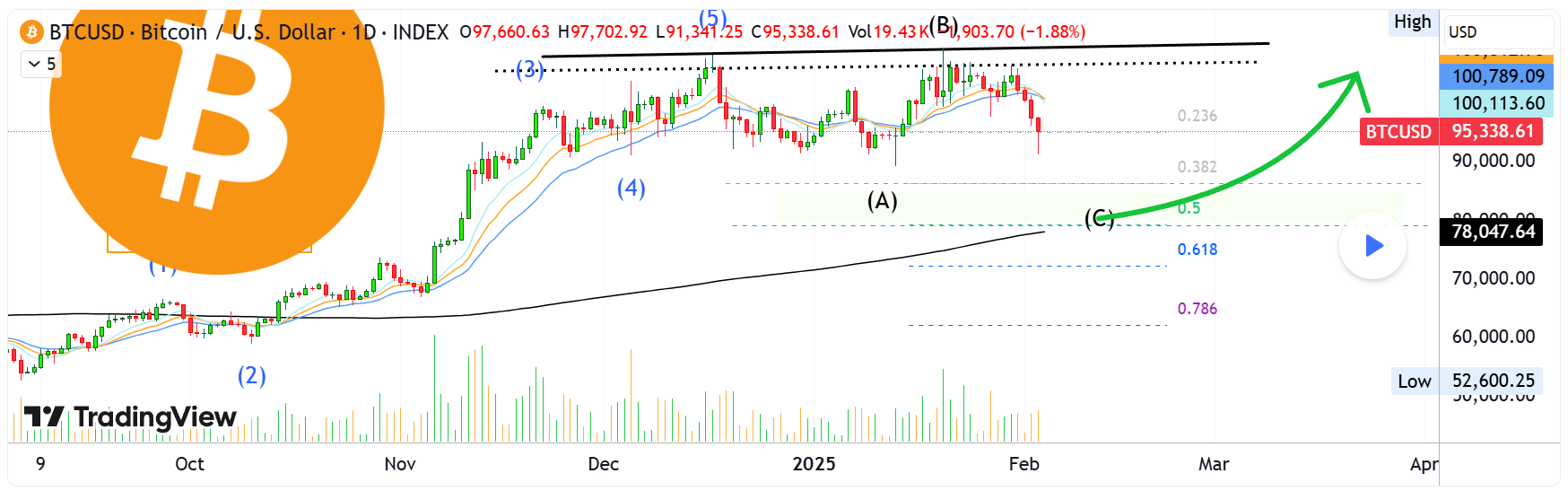

- A market analyst predicts Bitcoin will hit bottom on February 4, 2025, followed by a slow recovery before a rapid surge around February 23.

- Altcoins are expected to recover faster, with some potentially surging 200%-300% in hours after Bitcoin finds its bottom.

Bitcoin has resurfaced in the headlines after crypto analyst Alan Santana made his latest prediction on TradingView. After a wave of liquidations worth billions of dollars, Bitcoin will lowest point on February 4, 2025, claims him. The recuperation that follows, nevertheless, will take place gradually before suddenly rising. It won’t go straight forward.

Will Bitcoin Rebound or Drop Further?

Santana clarified in his analysis that two different situations exist. First, Bitcoin might show a modest comeback before declining more, creating a trend that will pull the price down until February 14, 2025. Strong recovery will thereafter follow.

Conversely, based on him, a more plausible situation is that Bitcoin reach its bottom today, February 4, 2025, then starts a long recovery process. According to his analysis, modest development would define the February 4–23 period before the price leaps rapidly on February 23, 2025.

“Once February 23 arrives, somehow, the price of Bitcoin will go up at bullet speed,” Santana said. The same is claimed to happen to the crypto market overall.

Early Altcoin Surge Signals a Bigger Market Shift

Interestingly, Santana thinks that altcoins will bounce back before Bitcoin. He claimed that some altcoins would spike by 200% or 300% in a matter of hours after Bitcoin reaches its lowest point. Considered as a “pre-boom-boom bull-market wave,” this signals the start of a massive crypto market surge.

One thing is noteworthy, though. The market has not therefore seen a 100% increase in tiny pairings thus far, which he argues indicates Bitcoin has not really struck the bottom. Santana stresses the long-term consolidation trend of Bitcoin and underlines that a significant change in market dynamics results whenever the upper and lower limits of this pattern are broken.

Meanwhile, as of press time, BTC is swapped hands at about $99,487.82, up 4.01% over the last 24 hours, and daily high is $102,420. Concurrently, geopolitics and US economic policies affect market volatility by various other means.

US Sovereign Fund: A Game Changer for Crypto?

On the other hand, a CNF report indicates that Donald Trump has directed the creation of a US sovereign wealth fund, which fuels rumors over the inclusion of Bitcoin into the investment plan. The fund intends to “invest in great national efforts for the benefit of all Americans,” the White House verified.

If such is the case, this legislation may significantly affect the crypto market and maybe throw off Bitcoin’s 4-year cycle, a main pattern of price movement.

Tariff Delay Triggers Crypto Market Volatility

Besides that, the US tariff delay on Mexico and Canada has added to financial market volatility. According to our prior report, this led to $552.80 million in crypto liquidations within 24 hours.

The unexpected price fluctuation caused significant losses for both long and short traders, which resulted in a large wave of liquidations on several cryptocurrency markets. This indicates that the market is still in a time of high uncertainty and that major fluctuations are likely in store not too far forward.