Getting 80,000 to 100,000 points from a single credit card welcome offer is tough to beat. But we’ll do you one better: How does a 175,000-point bonus offer sound?

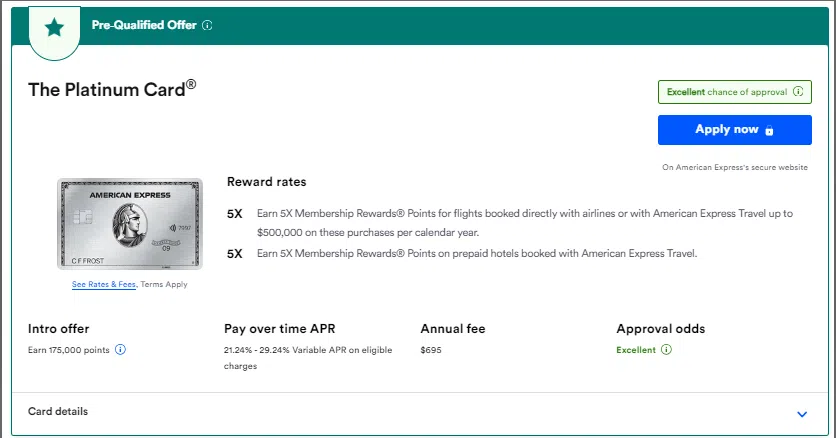

The Platinum Card® from American Express comes with a standard bonus of 80,000 points, but more and more customers are still being targeted for a much better offer: 175,000 points via CardMatch after spending $8,000 in the first six months (these offers are subject to change at any time).

That’s the biggest offer we’ve ever seen on the Platinum Card – and considering it’s more than double the standard bonus you’d get applying directly through Amex for the same spending requirement, it’s a big deal. You may also be able to get a 175,000-point welcome offer via personal referral links or by searching for the card in an incognito browser, but CardMatch should be your first stop for the best bonus.

At first glance, it may be hard to justify the Platinum Card’s $695 annual fee (see rates & fees), but earning 175,000 points right off the bat certainly takes some of the sting out of it! Not to mention the card comes packed with benefits like Delta Sky Club and Amex Centurion Lounge access, among countless other perks and credits.

Just know: Not everyone will be targeted for this massive welcome offer, but there’s no harm in checking – no hard credit pull is needed to see if you qualify. Just enter your details at CardMatch and see what comes up!

The Private Amex Platinum Card Offer Using CardMatch

New to American Express cards? That seems to be your best bet to qualify for this 175,000-point offer through CardMatch. That said, the Amex Platinum 175,000-point offer won’t be available for all users. Some may be targeted for lower offers like 125,000 or the standard offer of 80,000 points, while others may not see anything for the Platinum Card through CardMatch at all.

Not getting a bigger offer through CardMatch? You can get a 100,000-point bonus (plus earn a whopping 10x points per dollar spent on the first $25,000 spent at restaurants in six months) by applying for the Platinum Card through Resy! Otherwise, check for personal referral links or simply search for the Platinum Card in an incognito browser to see if you can get a bigger bonus.

After years of seeing bigger and bigger bonuses on the Amex Platinum, the standard offer has settled at 80,000 points after spending $8,000 in six months. But this new targeted CardMatch offer of 175,000 points easily takes the cake … if you can get it.

If you’ve never heard of CardMatch, it’s run by Creditcards.com to help prospective cardholders find targeted credit card offers. Every person will likely have different offers presented to them based on what cards they hold in their wallet. The best part is there is no hard credit pull to see what you’re targeted for.

No matter how many points you can get, just remember: Credit cards are serious business. All the points in the world aren’t worth it if it means you’d dig yourself into debt. You should only open a new credit card and spend the money to earn a big bonus if you can afford to pay off every dime, in full.

Check out some of the best ways to use your bonus from the Amex Platinum card!

Advantages of the Amex Platinum Card

The Platinum Card from American Express has long been a favorite of the Thrifty Traveler team and travelers across the globe. Beyond this incredible 175,000-point welcome offer, premium travel perks are the true reason for holding The Platinum Card.

It all starts with unrivaled airport lounge access, that includes Delta Sky Clubs, 1,400-plus Priority Pass Lounges, Escape Lounges (Centurion Studios), and the exclusive Amex Centurion Lounges, which are popping up at a growing list of airports around the world.

Plus, instant hotel status and more than $800 in travel credits can help offset the otherwise steep $695 annual fee (see rates & fees). Those credits include up to $200 a year in Uber Cash (split up into monthly installments), up to $200 for airline incidental fees, up to $200 in hotel credit, up to $240 of digital entertainment credit, up to $199 annually for a CLEAR® Plus membership, and more.

You also earn 5x points per dollar when purchasing airfare directly through airlines or through Amex Travel, the best return you’ll find on any travel card.

Platinum Card from American Express Card Benefits

Welcome Offer Bonus: bonus_miles_full But see if you’re targeted via CardMatch for a 175,000-point bonus offer with the same spending requirement first!

$199 Credit for CLEAR Plus: Get up to $199 annually to cover the cost of CLEAR Plus. Just pay for your membership with your Platinum Card and the credit should kick in automatically.

$240 Digital Entertainment Credit: Cardholders receive up to $240 in annual statement credits ($20 per month) for select entertainment services: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal.

$200 Annual Uber Cash: Get up to $200 of Uber Cash each year, broken down into increments of $15 each month, and $35 in the month of December.

$200 Airline Incidental Fee Credit: Each year you hold the Platinum Card, you also receive a $200 credit to use with one selected airline. The credit is intended to be used for things like checked bags, change or cancelation fees, seat assignments, lounge access, and more.

$200 Hotel Credit: Get up to $200 annual statement credit for prepaid hotel bookings through the Amex Travel booking portal. This credit applies to Fine Hotels + Resorts® or Hotel Collection properties (minimum two-night stay required).

Earn 5x Points on Airfare purchased directly with an airline or through the American Express Travel (amextravel.com) on up to $500,000 in purchases per calendar year, then 1x.

Lounge Access: Get complimentary access to the Amex Centurion Lounges, Delta Sky Clubs (when flying Delta), Priority Pass Lounges, and other Lounge networks like the Escape lounge. Starting Feb. 1, 2025, Delta Sky Club visits will be capped at six visits per year for unless you spend $75,000 (or more) in a calendar year.

Application Fee Credit for Global Entry or TSA PreCheck: If you apply for either Global Entry or TSA PreCheck and pay with the Platinum Card, the application cost will be reimbursed (up to $120 for Global Entry and $85 for TSA PreCheck). You can use this credit once every four years for Global Entry, and four and a half years for TSA PreCheck. Membership in either program is good for five years.

$100 Saks Fifth Avenue Credit: Each year of card membership, you will receive two $50 credits to be used at Saks Fifth Avenue. One $50 credit will be available from January through June, with another available from July through December.

$155 Walmart+ Credit: Get up to a $12.95 monthly Walmart+ membership with a statement credit after you pay for Walmart+ each month.

Hilton Honors & Marriott Bonvoy Gold Elite Status: Get complimentary Marriott Bonvoy and Hilton Honors Gold Elite status. While Marriott Gold status isn’t worth much, we think Hilton Honors Gold is the best mid-tier hotel status, getting you and a guest free breakfast during your international travels or a daily on-property credit in the U.S.

Trip Delay & Cancellation Coverage: If you pay for your round-trip flight with the Platinum Card – or put the taxes and fees from an award flight on it – you will be eligible for trip cancellation and trip delay coverage. Read more about Amex’s travel coverage here.

Annual Fee: $695 (see rates & fees).

The Best Ways to Maximize Amex Points

There are no shortage of ways to use a stash of 175,000 American Express Membership Rewards points. Below, we’ll highlight a couple of our favorites.

Fly to Europe and Back in Business Class for 100K Points

Japan’s All Nippon Airways (ANA) is one of the best airlines in the world and it’s got an underrated mileage program, too. In fact, it might just be one of the best ways to book business class flights … to Europe for just 100,000 miles roundtrip.

Yes, you read that right. Using miles from a Japanese airline to fly business class to Europe is one of the best workarounds in points and miles, as you can do it for roughly half the miles that other airlines charge. Consider this: United would charge 154,000 miles or more for these exact same transatlantic flights.

You’re not flying ANA itself, but merely using its miles to book other partner Star Alliance airlines like United, Air Canada, or SAS that fly nonstop across the pond. And Amex points transfer 1:1 to ANA miles. That means one Amex point is equal to one ANA mile. Membership Rewards are currently the only credit card points currency that transfers to ANA.

It’s an incredible deal, but booking with ANA Mileage Club miles isn’t always straightforward – especially if you’re unfamiliar with its rules and quirks. Check out our full booking guide below for everything you need to know.

Read more: How to Fly Business Class to Europe for 100K Points Roundtrip

Book the World’s Best Business Class: Qatar’s Qsuites

Thanks to Qatar Airways’ adoption of Avios, the floodgates are open to book Qatar’s world-leading Qsuite business class seats using Amex points.

Here’s the easiest route: You could book a simple nonstop from many cities in the U.S. over to Doha (DOH) for just 70,000 British Airways Avios. That means you’d have more than enough Amex points for a roundtrip to the Middle East.

Check out our full review of Qatar Qsuites

Sadly, both Qatar and British Airways recently raised taxes and fees on these business class redemptions. What was once a $100-or-so charge has increased to roughly $235 – but that’s a small price to pay to fly the world’s best business class, if you ask us.

We send Thrifty Traveler Premium members award alerts when they can book the world’s best business class using their points, plus cheap cash fares too!

If you want to take it next level and connect elsewhere – Dubai (DXB) or Muscat (MCT) in the Middle East, Cairo (CAI), or maybe even the Maldives (MLE) or down to Cape Town (CPT) in South Africa – you’ll want to turn to Qatar Airways Avios. And even though Amex isn’t offering this bonus on transfers to Qatar, you can easily combine your Avios balances between British Airways and Qatar.

And these multi-segment awards wind up being much cheaper by booking through Qatar itself than British Airways. Booking through Qatar, you could fly in Qsuites to …

- Middle Eastern destinations like Dubai (DXB), Abu Dhabi (AUH) or Muscat (MCT) for 75,000 miles

- Other destinations like Amman (AMM) and Cairo (CAI) as well as major Indian cities go up to 80,000 miles each way

- Getting to the Seychelles (SEZ) or Maldives (MLE) will run you 85,000 miles each way

- Both Southeast Asia and South Africa typically cost 95,000 miles each way

All those flights except the longest routes to Southeast Asia and South Africa are in reach with this monster 175,000-point welcome offer.

Thrifty Tip: Book a flight that connects onward to the Middle East so you can access Qatar’s incredible Al Safwa Lounge during your layover. You won’t regret it.

Read our full guide on the best ways to book Qsuites!

Bottom Line

There’s currently a targeted 175,000-point welcome offer available on the Amex Platinum Card through CardMatch. This increased offer is one of the biggest and best bonus offers we’ve seen. If it makes financial sense for you, this is a great opportunity to earn a boatload of points to fund your future travels.

Be sure to check CardMatch’s offers right away as they could pull this offer at any time.