Most banks roll out bigger, limited-time welcome bonuses on their travel cards once or twice a year — to get the biggest bonus, just apply when the time is right. But American Express has an entirely different playbook.

Just how many points you can earn varies wildly depending on where and when you apply for a new American Express card. So you may see a welcome offer on *amex platinum* of 80,000 points after spending $8,000 in six months directly with Amex or through sites like ours … only to open that same page in an incognito browser and see a bonus of double the points. Two people can open the same link twice (at the same time!) and see different sums. Referral links from friends and family and special offers through partners like Resy, CardMatch, and travel websites complicate things further.

That’s not a glitch – it’s by design. Amex’s own Chief Financial officer, Christophe Le Caillec, confirmed that at the recent UBS Financial Services Conference.

“Most of the offers that we want to put on the market now are personalized, individualized,” Christophe Le Caillec said last month. “We want to find the exact point that will take you over and make you react to an offer – not below, not too high, just the perfect offer.”

That welcome bonus guessing game has spread to small business owners eyeing *biz platinum*. While 150,000 points is common, we’ve spotted offers as high as 200,000, 250,000, or even 300,000 points – it just depends on where and when you apply. Offers are always changing from person to person.

The same goes for the popular *amex gold card*, where the standard is a 60,000-point bonus offer for spending $6,000 in the first six months. But that pales in comparison to the 75,000-point bonus you can earn through CardMatch … or the up to 100,000 points you can earn through some referral links.

So while other banks use bigger bonuses as a blunt instrument to lure in tons of new cardmembers, Amex is using a more surgical approach. And Amex insists that they’re using technology and data to fine-tune – even personalize – those offers even more.

“This is a technology that we’re developing that will generate efficiencies, so the goal is to just not increase the (amount we’re spending on welcome offers), the goal is to make those dollars work harder and harder and harder,” Le Caillec said.

So what does this mean for travelers like you and me hoping to score a bigger bonus? Only time will tell, but let’s game this out a bit.

If Amex leaves its budget for new cardmember acquisition – a.k.a “how much we’re spending to fund those big welcome offers on our cards” unchanged, it could mean bigger bonuses for those who know where to look. That’s what travelers have been benefitting from for the last few years with American Express.

So let’s say Amex set out to spend $250 million on customer acquisition for the Gold Card this quarter. Every person who applies for a paltry 40,000-point welcome offer frees up Amex to give 80,000 (or more) to someone else who, through whatever data they’ve got, they believe will only apply if presented with that larger offer. If you’re in the know and recognize that a better offer is out there, the technology could eventually tell Amex that 40,000 or even 60,000 points won’t cut it. It’s time to try a bigger bonus, and then you win.

The downside is that in order for that to happen, uninformed travelers will need to accept an inferior offer … which isn’t great for the masses.

But down the road, there could be trouble. American Express could simply decide that those savvy travelers who are just out for a bigger bonus – and know to hold out for 100,000 points or more – are not worth the extra money. Whether the technology and data are (or ever will be) powerful enough for Amex to make that kind of targeted choice is an open question.

Regardless, now, more than ever: Stay informed on what offers are out there before clicking apply on any Amex card. Amex is banking on the hope that you won’t realize there’s a better bonus out there.

Tips For Getting the Biggest Welcome Offer You Can

It’s up to you to seek out the biggest bonus on an Amex card – and try, try, and try again to get it. Here are some of the go-to methods we use.

Use CardMatch

If you’re unfamiliar with CardMatch, it’s a tool from creditcards.com that shows current credit card offers that you’re likely to get approved for often … with bigger bonuses than what’s available through public channels.

Over the years, there have been a few larger, targeted offers available through CardMatch for the Amex Platinum Card. It’s possible for CardMatch users to pull up a 100,000, 125,000, and 150,000-point offer for a similar spending requirement to what’s publicly available. Recently, some have reported even getting a 175,000-point offer!

To generate all your available offers, CardMatch does a soft pull on your credit. This might sound scary but it’s really not: Soft credit inquiries don’t impact your credit score because they aren’t attached to a specific application for credit. Just keep in mind that it’s not guaranteed you’ll be approved for the options CardMatch pulls in … but it does improve your odds.

Just remember: The best offers won’t be available to all CardMatch users.

Or Seek Out a Personal Referral

If you want to get the best offer currently available on the Amex Gold Card, you’ll need to phone a friend.

Some (but not all) current Gold cardholders are able to generate referral links within their Amex account for a 90,000-point welcome offer. That’s 50% more points than the standard 60,000-point offer, making this bonus a no-brainer if you can get it! We’ve even seen offers as high as 100,000 points in the past.

Thrifty Tip: If you don’t see the elevated offer at first, try opening the link in an incognito window, on another browser, or even via mobile instead.

Try an Incognito Browser

Sometimes, the key to getting the best bonus is simple: Just open an incognito window on your web browser and search for the card you want.

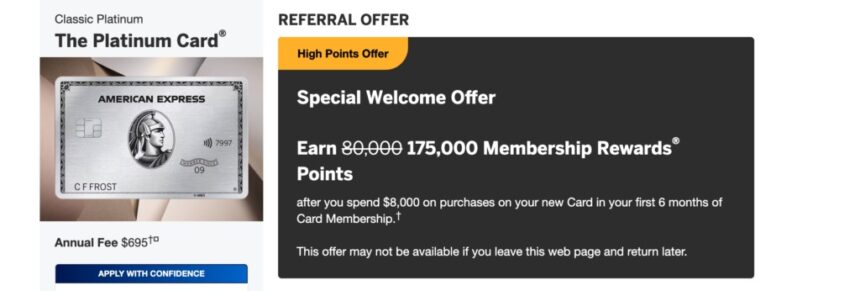

For example, a search for “Amex Platinum Card” in my normal browser window yielded the standard, 80,000-point bonus. But I did the exact same thing in an incognito window immediately afterward just this morning and look what I found!

It’s a bit silly, isn’t it? Try to open an Amex Platinum Card in a normal browser window and you’d get an 80,000-point bonus after spending $8,000 in six months. Open that same page in an incognito browser and you could earn almost double the points.

To be perfectly clear, this strategy is very hit-or-miss. Some members of the Thrifty Traveler team did the same and saw offers for 80,000 points or 100,000 points. But it’s easy to check and surely worth a shot!

Check With Resy

Not familiar with Resy? It’s a website and mobile app that allows users to discover new restaurants and make dining reservations. Back in 2019, American Express acquired Resy with plans to integrate exclusive dining access and rewards into the bank’s mobile app. Just last year we saw Amex introduce a new Resy dining credit on the Amex Gold Card and two of the Delta SkyMiles cards.

But the best part of this acquisition is that it has led to increased welcome offers for both the Platinum and Gold cards through Resy’s website.

Unlike some of the other tips and tricks on this list, this one doesn’t actually require playing any games. The offers you see here are what’s available to everyone – no need to open the link incognito or get a special referral code.

Apply at Checkout

Finally, if none of those options work for you or you’re still on the hunt for a different bonus, you can always try applying when booking travel with any of Amex’s co-branded card partners.

For example, when searching for Delta flights you’ll often be presented with a credit card offer at checkout. Today, I went to “book” a flight from Minneapolis-St. Paul (MSP) to New York City (JFK) and was presented with an offer for 50,000 SkyMiles and a $500 statement credit for Delta purchases. I put “book” in quotes … because you don’t actually need to go through with the reservation to apply for the card.

Given the increased bonuses Amex is currently offering on its portfolio of Delta SkyMiles cards, this arguably isn’t the best offer currently available. But it would no doubt be more appealing to some of you out there. And we even see these elevated offers available at checkout when Amex is offering a paltry welcome bonus on its Delta SkyMiles card.

This same tip often works for other co-branded partners like Hilton and occasionally Marriott.

Bottom Line

American Express has turned the pursuit for a big welcome bonus into a guessing game. That’s no accident.

Amex officials say they’re using technology to intentionally tailor welcome offers to individuals, meaning bonuses can vary widely depending on where and when you apply. While this could lead to bigger bonuses for savvy travelers who know where to look, it also means uninformed applicants might settle for less.

Now more than ever, doing your research before applying is key to maximize your points.