Starknet has unveiled a bold plan to bridge Bitcoin and Ethereum. Here’s How.

Many of you likely entered the Web3 world through your exposure to Bitcoin. Well that’s understandable since it remains the largest cryptocurrency by market cap, currently standing at approximately $1.6 trillion, followed closely by Ethereum.

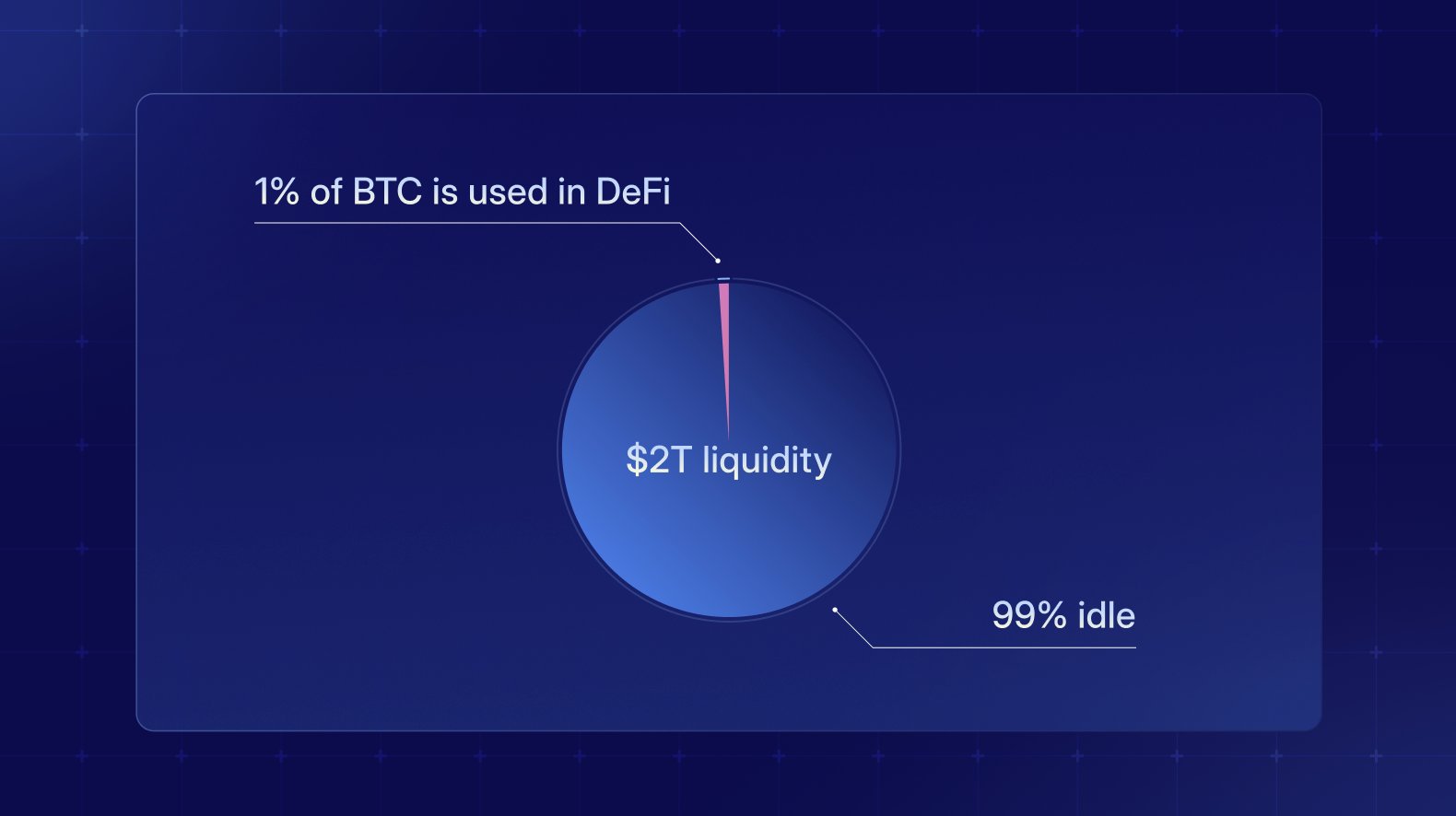

However, what if I told you that only about 1% of Bitcoin’s circulating supply is actively utilized in Web3 applications, including DeFi and other innovative initiatives, while the vast majority of BTC remains largely unused within traditional wallets and exchanges?

Historically, Bitcoin and Ethereum have operated in largely separate domains: Bitcoin as a store of value and Ethereum as the foundation for decentralized applications (dApps).

In a groundbreaking move to bridge this gap, Starknet, a leading Layer-2 scaling solution for Ethereum, has unveiled an ambitious plan to integrate Bitcoin and Ethereum, enhancing scalability, interoperability, and liquidity across both networks.

As a Zero-Knowledge Rollup (ZK-Rollup) that enhances Ethereum’s scalability by processing transactions off-chain before settling them on the Ethereum mainnet, it is planning to expand its reach by utilizing Bitcoin’s network for added security and decentralization.

Notably, in a similar step aimed at bringing Bitcoin into DeFi, Bitlayer too recently announced partnerships with prominent blockchains, viz., Base, Arbitrum, Plume, in order to scale BTC by its BitVM.

Starknet: The first L2 to settle on both Bitcoin and Ethereum

In a March 11 X post, it has revealed that Bitcoin’s scope lies more than beyong existing application of HODLing.

Though Bitcoin has been restricted in its application due to limited programmability, Starknet is aiming to allow developers to build a variety of DeFi apps on Bitcoin though it’s smart contracts functionality. In order to achieve that, it is aiming to advance from its current throughput of 13 transactions per secon, to thousands of transactions in order to be able to scale Bitcoin.

5/ Starknet as a Bitcoin L2 will improve performance and utility dramatically:

– 7 TPS → thousands of TPS (and constantly growing)

– 10 minutes block time → 2 seconds

– $2 gas fees → $0.002

– Bad UX → a smooth web2-like UX pic.twitter.com/g0sBoYT6DV— Starknet

(@Starknet) March 11, 2025

Currently it is targeting applications such as staking, borrowing and lending, leveraged trading, and yield farming, making them natively possible on Bitcoin via Starknet.

The integration will be facilitated through a Bitcoin reserve mechanism, allowing Bitcoin to be used as a settlement layer while maintaining Starknet’s existing functionalities on Ethereum. This hybrid approach will enable Bitcoin-backed transactions on Ethereum’s DeFi ecosystem while leveraging Starknet’s advanced cryptographic technologies.

Notably, following the announcement, in a March 11 X space discussing Starknet’s plan, Ethereum co-founder Vitalik Buterin too backed the idea saying a proper Bitcoin L2 that can satisfy the needed security properties would “make crypto payments great again, and all those use cases can work.

Starknet to Continue Supporting OP_CAT Research

Hilighting its earlier connection with Bitcoin with Professor Eli Ben-Sasson, CEO and Co-Founder of StarkWare, pioneering the idea of using ZK proofs to scale Bitcoin, it is also pushing for OP_CAT update. It is a proposed Bitcoin update that would allow users to set spending conditions for BTC and enable zero-knowledge proofs, which are cryptographic techniques for verifying transactions without revealing personal data.

OP_CAT, a Satoshi-era opcode for unlocking programmability on Bitcoin that was disabled over security concerns, can allow Starknet to settle on the Bitcoin blockchain. It will till then take support from the BitVM-powered bridge, calling it “the most secure Bitcoin bridge possible today:.

Xverse Partnership and BTC Reserve

A key component of this initiative is Starknet’s partnership with Xverse, a prominent Bitcoin wallet provider.

Through this collaboration, Bitcoin holders will be able to interact with Ethereum’s DeFi ecosystem seamlessly. The partnership has also introduced a BTC Reserve that will act as collateral for cross-chain transactions, ensuring liquidity and security for users engaging in decentralized finance.

Implications for the Crypto Industry

The integration of Starknet with Bitcoin and Ethereum is expected to have far-reaching implications for the cryptocurrency market. Some key benefits include:

- Bitcoin’s robust security model combined with Ethereum’s smart contract functionality will create a more scalable blockchain infrastructure.

- The BTC Reserve and cross-chain functionality will enable greater liquidity flow between Bitcoin and Ethereum-based assets.

- Bitcoin holders will gain access to DeFi applications on Ethereum, increasing Bitcoin’s utility beyond being a store of value.

- Notably, the use of Starknet’s roll-up technology will reduce fees associated with cross-chain transactions.

Challenges and Future Outlook

While the announcement has been met with optimism, there are challenges ahead. Ensuring security in cross-chain transactions remains a priority, as bridging solutions have been a target for exploits in the past. Additionally, regulatory considerations surrounding Bitcoin’s integration into DeFi could pose hurdles.

Despite these challenges, Starknet’s initiative represents a bold step toward a more interconnected blockchain ecosystem. The move is expected to attract developers, institutions, and investors eager to explore the potential of a unified Bitcoin-Ethereum framework.

As the integration unfolds, Starknet plans to launch testnet phases in the coming months, with a full mainnet deployment anticipated by late 2025. If successful, this initiative could redefine the way Bitcoin and Ethereum interact, setting a precedent for future blockchain collaborations.

The post Starknet to Bridge Bitcoin and Ethereum – Establishes BTC Reserve, and Partners with Xverse Wallet appeared first on CoinGape.