- Strategy’s stock has tumbled 40%, mirroring Bitcoin’s struggles, while investor fears over valuation and ETF outflows intensify.

- Bitcoin’s surge lost momentum after a cautious Fed outlook, triggering heavy ETF withdrawals and fresh selling pressure.

MicroStrategy, now rebranded as Strategy, has been one of Bitcoin’s most vocal corporate supporters, but its aggressive investment strategy is coming under pressure. The company’s stock (MSTR) has plummeted 40% from its peak, mirroring Bitcoin’s struggle to stay above $90,000. The drop has triggered concerns among investors who once saw MSTR as a leveraged bet on Bitcoin’s success.

#MicroStrategy Cracks as #Bitcoin Tests $90K—Is a Deeper Drop Coming?

1-16) During my time in derivatives trading at Goldman Sachs and Morgan Stanley, we observed structural demand for yield products in Asia, where interest rates tend to be relatively low. These products rely… pic.twitter.com/XS1Jk3nk2B

— 10x Research (@10x_Research) March 8, 2025

Even with the sharp decline, Strategy’s stock still trades 60% above its fair value, though that gap is narrowing. Investors are beginning to question whether the premium is justified, especially as Bitcoin faces headwinds from Federal Reserve uncertainty and mounting ETF outflows. The fear of overvaluation is starting to weigh heavily on market sentiment.

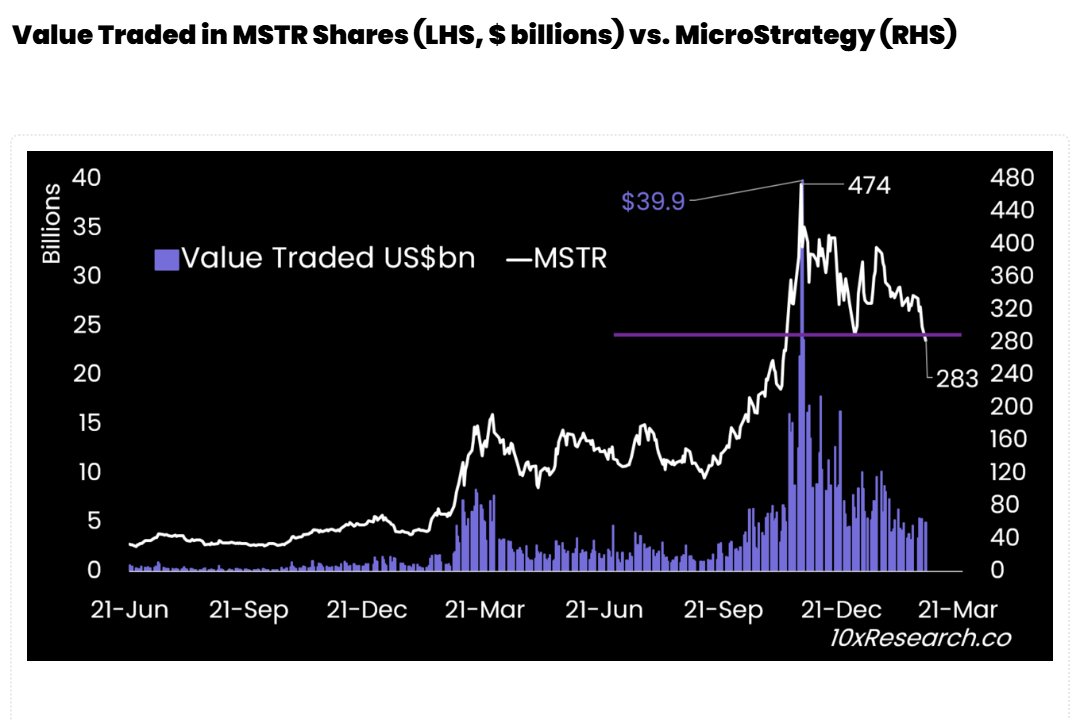

November 2024 saw a staggering $40 billion in MSTR trading volume when Bitcoin momentarily soared past $95,000. However, 10x Research analysts suggest that institutional players used that rally as an exit, selling at high prices to retail investors. Now, many retail traders are seeing losses despite Bitcoin holding near its late-2024 levels.

Bitcoin’s 96% Surge Faces Reality Check

Between September and December 2024, Bitcoin surged 96% as traders anticipated interest rate cuts by the Federal Reserve. But when the expected rate cut finally arrived in December, it came with a cautious outlook, signaling that future cuts might not come as easily. This dampened enthusiasm in the crypto market, leading Bitcoin into a prolonged consolidation phase.

Adding to the uncertainty, February 2025 has proven to be a brutal month for Bitcoin ETFs. Outflows have skyrocketed, with investors pulling out a massive $1.3 billion, the worst monthly withdrawal on record. The sharp reversal in ETF demand is intensifying Bitcoin’s struggle to maintain its footing above key price levels.

Much of the ETF-driven demand was fueled by hedge funds deploying short-term arbitrage strategies. Now, as funding rates decline, these trades are unwinding, triggering a fresh wave of selling pressure. The broader crypto market is feeling the heat, and Strategy’s stock is no exception.

MicroStrategy’s Valuation Under Pressure

Despite facing criticism, Strategy has maintained an aggressive BTC buying spree, adding $6 billion worth of Bitcoin since December. However, 10x Research highlights a worrying trend: Strategy’s stock is rapidly losing its premium over its net asset value (NAV), a key indicator of investor confidence.

At its peak, Strategy’s NAV premium was an astonishing 3.4x, but it has since crumbled to just 1.6x, suggesting a fair value of $156 per share. This stands in stark contrast to MSTR’s November 2024 high of $453 per share, when Bitcoin was trading at similar levels. Today, MSTR has slumped to $287, reflecting the evaporating premium that once fueled its rise.

Adding to the technical concerns, Bitcoin has broken below an ascending broadening wedge pattern, a bearish signal that could push prices lower. If Bitcoin fails to reclaim its lost momentum, analysts warn that it might test Strategy’s average Bitcoin purchase price of $66,300—a scenario that could spell further trouble for MSTR.