- Geoff Kendrick predicts Bitcoin could reach $200,000 by 2025 and $500,000 before Trump leaves office.

- He believes institutional adoption and regulatory clarity will drive growth.

Geoff Kendrick, the head of digital asset research at Standard Chartered, is quite bullish on Bitcoin’s long-term outlook. In a recent CNBC interview, he noted that institutional acceptance and regulatory guidance are the significant factors behind the Bitcoin price increase.

As noted by Kendrick, huge firms, including BlackRock and Standard Chartered, are increasingly adopting Bitcoin to traditional systems. This increases the legitimacy of the asset and the amount of institutional investment that it will receive. With these financial majors increasing their operations, prevalence risk becomes reduced which in turn translates to more stability on a larger note of investment.

The increasing participation of significant financial entities in the Bitcoin market shows that Bitcoin is viewed as a mainstream asset. Also, the institutional support increases, market assurance, and a firm foundation for future growth and development.

Bitcoin to $500K

Kendrick has made a daring forecast of the possibility of Bitcoin soaring in the future. He predicts that BTC will be trading at $200,000 by the end of 2025 and $500,000 by the end of Trump’s term.

“That should add to that medium-term, top-side potential, which for me is Bitcoin up to $200,000 this year, and $500,000 before Trump leaves office,” Kendrick said.

Kendrick also highlighted other areas of concern such as security threats, especially in light of a recent $1.4b Bybit attack. He further added that clear regulations for institutional investors in the U.S. would increase prices due to increased investors’ participation.

“As the industry becomes more institutionalized, it should be safer,” Kendrick noted.

Bitcoin’s worst February

Bitcoin price has come much under pressure and has fallen from a high of $95,700 to below $80,000. The decline has been partly attributed to whales who have had to sell off their large amounts of BTC. This continued selling pressure has added more doubts in the market concerning the possibility of the market recovering.

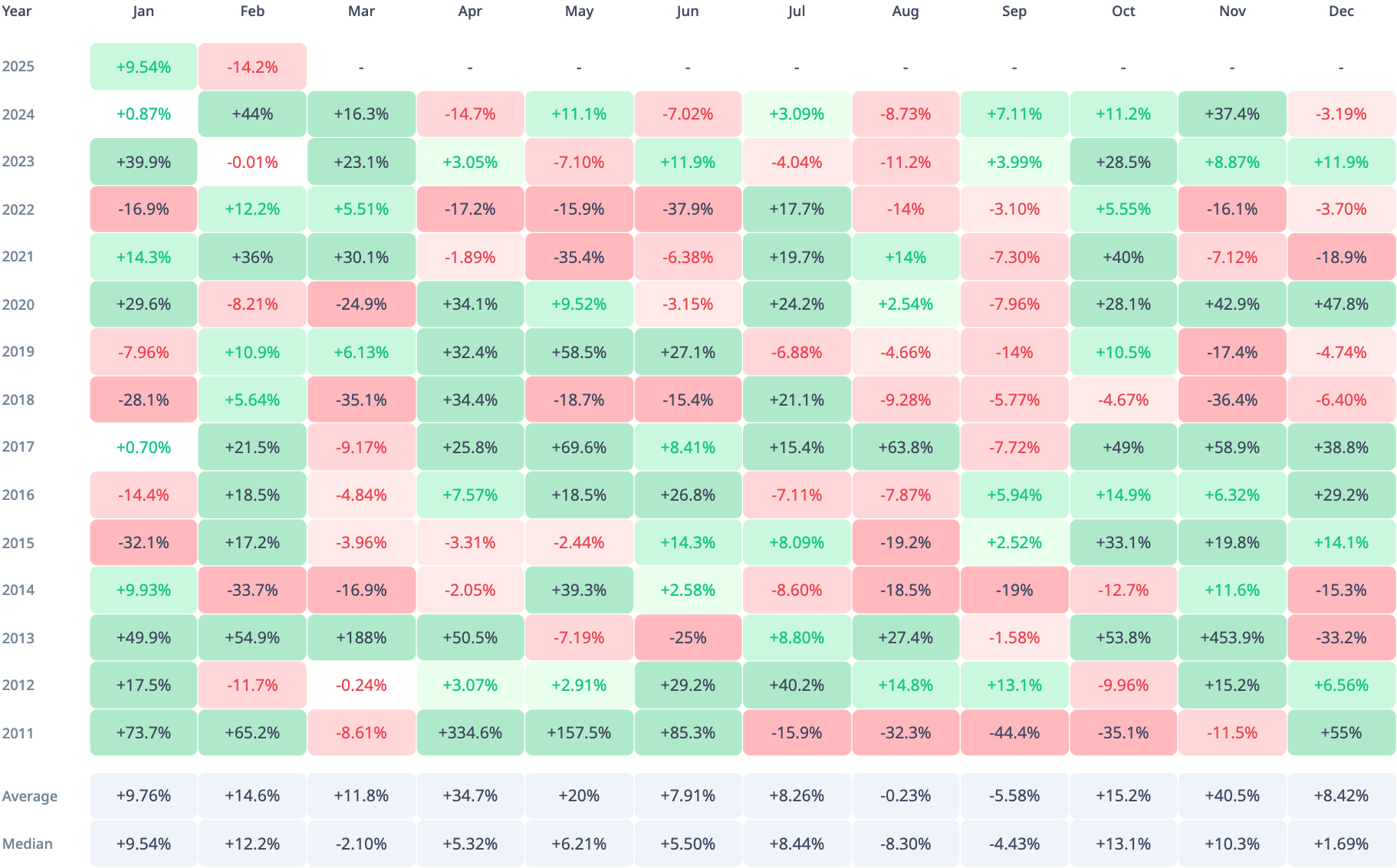

According to historical data, February 2024 was the worst February for Bitcoin in the last 11 years. CryptoRank indicates that the last correction similar to the current one was in 2014 when BTC shed 33.7% in value. Since then, the Bitcoin rate has not shown such a severe decline.

There are mixed signals for March, looking at historical trends. The average return as of March stands at 11.8%, while the median return is negative, -2.10%. This data illustrates how volatile the cryptocurrency market is, which means that past trends do not always guarantee future performance.

Despite the decline, there is still optimism among traders. According to a report from Santiment, the level of investor positivity remains high across several social media trading platforms. Some predict that the current downtrend is favourable for investment since they believe the price of Bitcoin will rise in the next few months. As of this writing, Bitcoin is currently trading at $79,734, registering a 24-hour decline of 8%.