- Shiba Inu’s absence from the altcoin ETF filings has sparked calls for action, with market lead Lucie urging asset managers to push for a SHIB exchange-traded fund.

- Despite the lack of an ETF, institutional interest in Shiba Inu is growing, as Coinbase Derivatives introduced SHIB futures contracts for mainstream financial adoption.

A fresh wave of altcoin ETF filings has stirred excitement in the cryptocurrency world, but Shiba Inu remains notably absent from the mix. Shiba Inu market lead Lucie recently called for action, urging asset managers to take steps toward launching a Shiba Inu exchange-traded fund (ETF).

In a recent X post, Lucie pressed issuers and sponsors to set the approval process in motion for a fund that would track the price of Shiba Inu. The move comes as institutional investors continue to explore new ways to gain exposure to digital assets beyond Bitcoin and Ethereum.

“Wen SHIB ETF?” Lucie asked.

While other meme coins like Dogecoin, Bonk, and Official Trump have already seen ETF applications, Shiba Inu, the second-largest meme coin by market capitalization, has yet to receive similar treatment.

Meme Coin ETFs Gain SEC Attention

The push for a Shiba Inu ETF follows a string of filings for alternative cryptocurrency funds. After the approval of Bitcoin and Ethereum ETFs, asset managers turned their attention to meme coins and other altcoins. Notably, Dogecoin, Bonk, and Official Trump saw ETF applications filed by Osprey Funds and REX Shares in January, surprising many in the crypto space.

The U.S. Securities and Exchange Commission (SEC) recently confirmed that meme coins are not considered securities. That clarification has fueled optimism that the approval process for meme coin ETFs may move forward without major hurdles.

NEW: The @SECGov Division of Corporation Finance has just put out guidance on memecoins saying they are NOT securities and are akin to collectibles.

“It is the Division’s view that transactions in the types of meme coins described in this statement, do not involve the offer…

— Eleanor Terrett (@EleanorTerrett) February 27, 2025

The SEC’s acknowledgment of a Grayscale Dogecoin ETF filing has also contributed to the growing expectation that institutional investment in meme tokens could soon become a reality.

A petition on Change.org has further amplified calls for a Shiba Inu ETF. The petition urges Grayscale Investments to introduce an ETF for SHIB, citing strong market demand and the potential benefits of offering a regulated investment vehicle. If successful, the effort could push Shiba Inu closer to institutional recognition.

Shiba Inu’s Institutional Progress with Futures Contracts

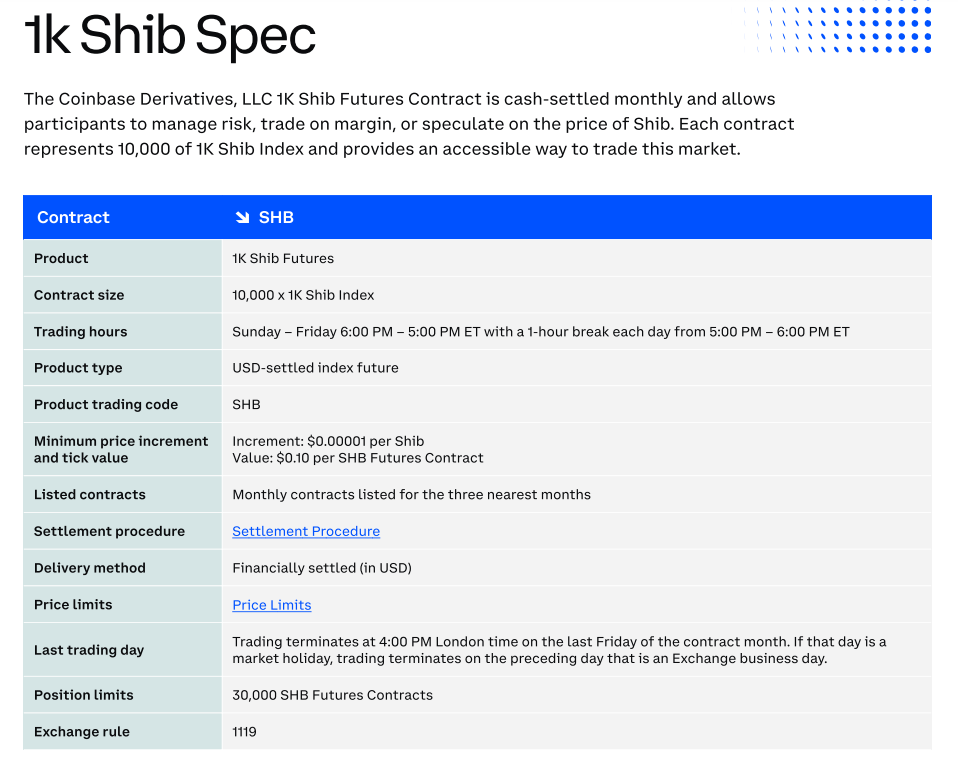

Despite the absence of an ETF, Shiba Inu has made significant strides toward mainstream financial adoption. On June 28, 2024, Coinbase Derivatives announced the introduction of five new futures contracts for cryptocurrency, including one for SHIB. The initial announcement was later amended on July 10 under Market Notice 24-14.1, confirming the listing of SHIB futures alongside Polkadot (DOT), Avalanche (AVA), and Chainlink (LNK) on July 15.

Coinbase Derivatives’ SHIB futures contract allows traders to speculate on the future price of Shiba Inu without directly owning the tokens. Each contract represents 10 million SHIB and is based on an index reflecting 1,000 times the current SHIB price. Investors can use these contracts to take long or short positions on SHIB’s price movements, with settlement occurring in cash.

The launch of SHIB futures signals growing institutional interest in Shiba Inu, even in the absence of an ETF. With Bitcoin’s price surge fueled by ETF-driven inflows, many in the SHIB community believe a similar investment product could push the meme coin to new heights.