Mortgage rates decreased again today on weak economic data, following last Friday’s similar drop in the 10-year yield. Furthermore, the mortgage spreads in today’s pricing are favorable. According to the latest quote from Mortgage News Daily, mortgage rates are now around 6.89%. This represents a decline of 0.37% from the most recent high of 7.26%, which was recorded on Jan. 13.

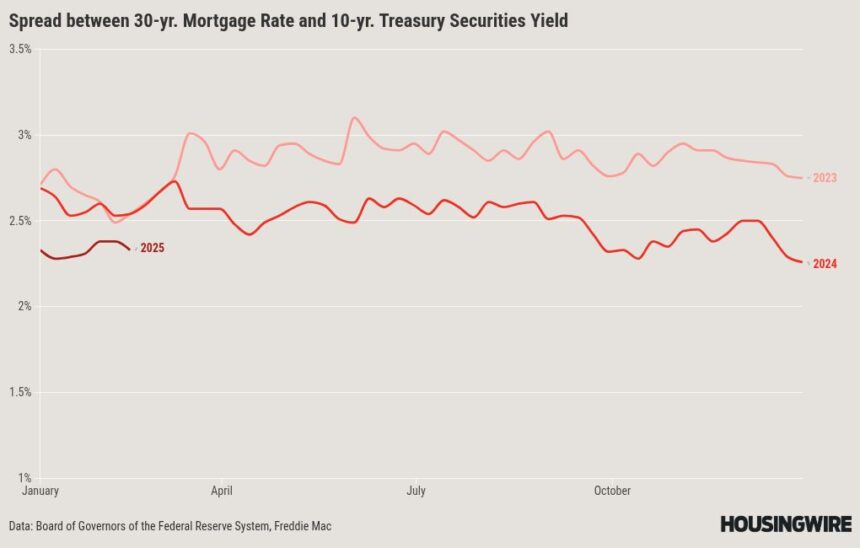

Many might be taken aback by this drop, especially given ongoing tariff talks, rising inflation expectations in surveys, and the Federal Reserve adopting a more hawkish stance — all hinting that mortgage rates could be inching toward 8%. Yet, as we’ve pointed out before, the recent improvement in mortgage spreads has remarkably kept rates from soaring too high, effectively putting a ceiling at around 7.25%. It’s an interesting twist in the market dynamics!

Today, the ISM service sector data experienced a significant decline, dropping into negative territory for growth. The Michigan Confidence Index also decreased, along with existing home sales.

Additionally, this week has witnessed job losses due to federal government layoffs, which means less money circulating in the economy. I discussed this on today’s episode of the HousingWire Daily podcast, posing the question: Is this what the White House truly wants when they discuss lowering the 10-year yield?

Looking ahead to my 2025 forecast, I initially projected that the 10-year yield would peak at 4.70% while mortgage rates would peak at 7.25%. Earlier this year, we briefly eclipsed that 4.70% mark, and as I write this, we’re hovering around 4.43% on the 10-year yield.

For the yield to climb above that 4.70% threshold or for mortgage rates to exceed 7.25%, the economy would need to outperform expectations. If economic data starts coming in weaker than anticipated — like when retail sales fell short last week — it wouldn’t be surprising to see bond yields dip as weaker economic data tends to lower bond yields.

Primarily working from elevated levels in my forecast, it’s a low bar for yields to head lower than, let’s say the 10-year yield at 3.80%. Despite this, we’re still hanging on at the upper end of the mortgage rate forecast, and it’s worth noting that the housing market has shown signs of improvement only when mortgage rates approach the 6% mark.

I know it’s been a whirlwind of headlines lately that have left many questioning the future of the economy and the housing market. That’s why we’ve put together our weekend Housing Market Tracker — to ensure everyone stays in the loop with the latest housing data. I prioritize tracking the overall economic cycle first, and I’m committed to keeping you informed, especially during these unpredictable times. Keeping it simple, today economic data came in weaker, stocks are falling, money went into bonds and mortgage rates fell.