Premium travel perks like airport lounge access, rental car elite status, and top-notch travel insurance make the *venture x* a no-brainer for most travelers. But if you ask me, a couple of under-the-radar benefits make it a must-have card for anyone headed abroad.

At $395 per year, the Venture X isn’t exactly cheap – but if you’d otherwise spend $400 per year on travel, the card’s annual $300 Capital One Travel credit and a 10,000-mile anniversary bonus (worth $100 or more) make that price tag a lot easier to stomach. When you combine features like instant push notifications, solid point-earning, and wide acceptance abroad with all the Venture X’s other benefits, it becomes the perfect card for any international traveler.

Read on to see why the Venture X deserves a spot in your wallet for your next trip abroad.

Real-Time Spending Notifications

In general, Capital One has done a better job than nearly every other bank at leaning into technology and investing in a helpful, user-friendly mobile app. This makes managing your account and using your card’s benefits super easy, whether you’re at home or on the go.

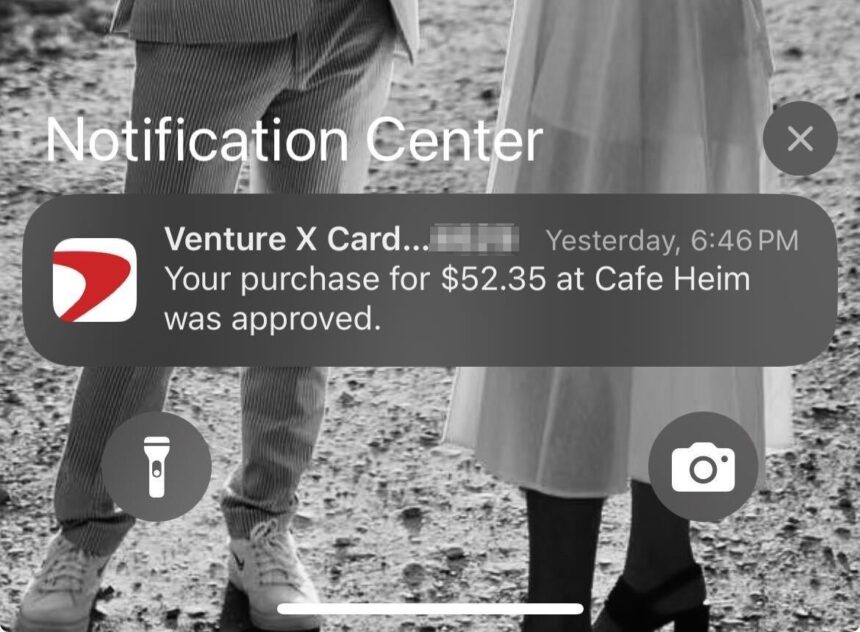

In my opinion, one of the best features of the Capital One mobile app is a relatively minor one: real-time purchase notifications. With these alerts turned on, you’ll get notified anytime your card is used – both in person and online. The notification includes the total transaction amount, time, and merchant name – especially helpful information when traveling abroad.

Getting instantly notified of what you’re spending – in U.S. dollars, no less – takes all the guesswork out of currency conversions and allows you to keep better tabs on your total costs. It also allows you to confirm that the conversion was done at a fair market rate instead of a marked-up percentage.

Thrifty Tip: Assuming you’re using a card with waived foreign transaction fees, always pay your bill in the local currency and let your bank convert it to U.S. Dollars for the best exchange rate.

Unlimited 2x Miles Everywhere

The Capital One Venture X earns unlimited 2x miles on all purchases, making it a really rewarding card no matter where you’re spending.

Sure, other cards on the market earn better rewards in specific categories like dining, travel, and supermarkets, but when you’re traveling abroad, it can be a bit of a guessing game as to what category you’re spending in.

Perhaps it looks like a restaurant … but they also sell produce and other items to cook at home. Does that make it a restaurant or a grocery store? With the Capital One Venture X, you don’t have to wonder. You can swipe it everywhere you go and rest easy knowing you’re earning solid rewards on each and every purchase.

Widely Accepted

While most people probably don’t put much stock in what network their credit card runs on (why would you?), this is a key detail that makes the Capital One Venture X perfect for international travelers.

Since it’s a Visa Infinite card running on the Visa payment network, you shouldn’t have trouble using it, no matter where your travels take you. If the merchant you’re shopping with takes cards at all, odds are, they’ll accept your Capital One Venture X Card.

Visa cards are accepted in over 200 countries and at more than 150 million merchants around the globe, making it the best option for international travelers. This is in contrast to cards issued by American Express, Discover, and, to some extent, even Mastercard, where you may be turned away or have to use cash if the business doesn’t accept your card.

It’s worth noting that the *capital one venture card*, which earns the same Capital One Miles but offers fewer benefits at a $95 annual fee, is a Mastercard and not a Visa. That means if you are deciding between Venture & Venture X and have plans to travel internationally, this difference could be a helpful deciding factor. While you won’t run into many issues with a Mastercard abroad, you’ll definitely be able to use your Venture X card at more merchants abroad.

All the Other Good Stuff

Those are all relatively minor features of the Capital One Venture X, but when you add them to more noteworthy perks like airport lounge access, an annual $300 Capital One Travel credit, and best-in-class travel protections, it makes the card even more appealing.

With the Venture X, you not only get into the Capital One-branded lounges domestically, but you’ll also get a Priority Pass Select membership, which unlocks the door to an additional 1,400-plus lounges around the globe. And here’s the thing: Priority Pass lounges in the U.S. can be pretty hit-or-miss, but that’s generally not the case when traveling abroad.

For example, when traveling through Bogotá (BOG) a few years back, we visited the El Dorado Lounge with our Priority Pass membership. Here, you’ll find a full bar, buffet, and ample seating – as well as other unique amenities like a barber shop and children’s play area.

Or consider the VIP Lounge in Terminal B of the Punta Cana (PUJ) in the Dominican Republic, which has a pool, allowing you to take a quick dip before your flight home. That’s an uncommon amenity in any airport lounge.

What’s more, the Priority Pass membership that comes with the Venture X is better than what you get with most other cards because it allows you to bring in unlimited guests with you, assuming there’s space available. If you’ve got a big family, or lots of friends, being able to bring the whole gang into the lounge with you can save a ton on food and drinks while sitting in the airport.

Other features, like the card’s annual $300 travel credit, can come in handy when you’re traveling overseas and need to book a hotel night but can’t find anything with one of the major chains. Going through the Capital One Travel portal, you don’t have to worry about sacrificing any elite benefits or missed point-earning – just be sure to price shop before booking. You can also use your credit to book cheap flights if you’re trying to see multiple destinations while abroad.

And let’s not forget about the Venture X’s built-in travel protections. With this card, you’ll get trip delay coverage, lost (or damaged) baggage protections, and primary rental car coverage, to name a few.

This means if you’re traveling abroad and your flight home is delayed (or cancelled) due to maintenance, weather, or any other covered reason, you won’t be on the hook for an extra hotel night and added food costs. You can simply charge your room and dining expenses to your Venture X and file a claim when you get home. With this coverage, you get up to $500 (for each purchased ticket) if your trip is delayed by more than six hours or requires an overnight stay.

There’s lots more to love about the Venture X, but these key perks, coupled with the more under-the-radar features highlighted above, make it the perfect card for any international traveler.

Bottom Line

The *capital one venture x* has quickly built a reputation as one of the best travel rewards credit cards on the market — but it’s a practical must for international travelers. With underrated perks like instant purchase notifications, unlimited 2x mileage-earning, and wide acceptance on the Visa payment network, this card deserves a spot in your wallet for your next trip abroad.

Learn more about the *capital one venture x*