Donald Trump has paused his proposed tariffs on Mexican and Canadian goods, but he is planning a new tariff on steel and aluminum imports.

The president is expected to impose a 25% tariff on all steel and aluminum imports on Monday, thrusting homebuilders back into a situation where a tariff on building materials could raise the cost to construct new homes.

The new tariffs come a week after Trump agreed to pause tariffs on all Mexican and Canadian goods until March 1 as the three countries continue to negotiate a broader deal on trade, immigration and drug trafficking.

According to the The New York Times, Canada was the largest supplier of steel in the U.S. in January, followed by Brazil and Mexico, respectively. The steel tariff adds another variable to negotiations with the North American neighbors.

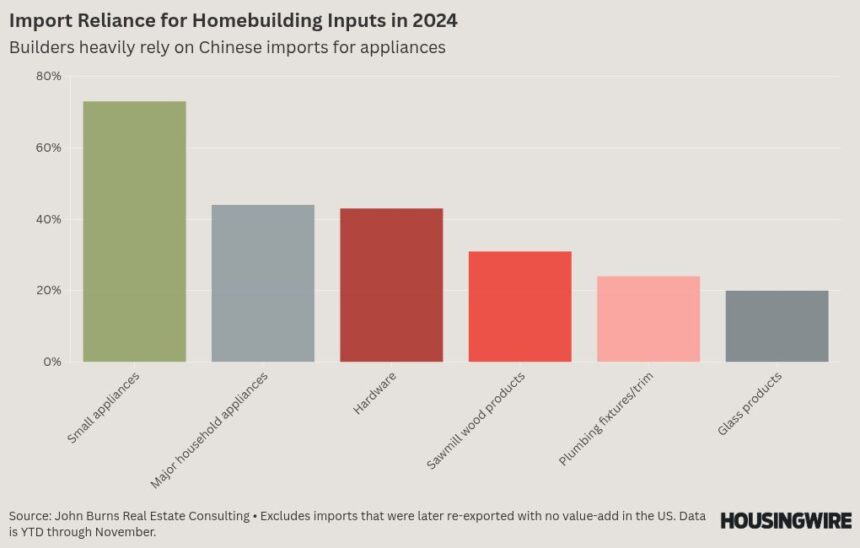

The tariff dance once again provides homebuilders with a fresh reason to worry after the reprieve from tariffs that impact other building materials. The U.S. imports 31% of its sawmill products, and 73% of these imports come from Canada.

Mexico has a similar hold on hardware imports. The U.S. imports 43% of its hardware products, and 20% of these imports come from Mexico.

The Trump administration continues to offer a mixed bag for homebuilders. Tariffs and a crackdown on undocumented migrants were central to Trump’s’ campaign message, and he’s following through on promises related to these positions.

Tariffs appear to be an issue for the foreseeable future. While the pause on Mexican and Canadian tariffs give a brief reprieve, homebuilders will be forced to deal with them if the U.S. fails to reach a deal with its neighboring countries.

While it’s difficult to quantify the impact of mass deportations, undocumented migrants account for a substantial share of construction labor, and depleting the labor supply with deportations could raise the cost of labor and delay new construction.

But the Trump administration has said it wants to reduce regulations that affect many industries, including homebuilders. On the first day into his second term as president, Trump issued an executive order calling for emergency price relief on housing, including a review of regulations related to homebuilding.

A study from the National Association of Homebuilders (NAHB) concluded that 25% of the cost of building a home is related to regulation. But most of that regulation comes at the local level, and the federal government has a limited number of levers for reducing these impacts.

NAHB doesn’t oppose every regulation related to homebuilding, but Jim Tobin, the trade group’s president and CEO, said that some of the rules imposed during the Biden administration are restrictive and costly.

“We have to balance regulations with the cost of housing because it’s equally important to put shelter over your head every night,” Tobin said. “[Tariffs] may be a short-term blip, but we’re also trying to take a holistic approach. The whole economic and regulatory posture of this administration is going to continue to change over the next several months.”

Prior to the announcement of the Mexican and Canadian tariffs, NAHB sent a letter to the Trump administration asking for a tariff exemption on building materials. Given that imports from Canada, Mexico and China account for a substantial portion of these building materials, any exemptions would get caught up in Trump’s broader posture to tariffs.

The tariff on steel and aluminum comes amid the attempt by Japan’s Nippon Steel to buy U.S. Steel. Trump’s position on whether to block the deal has shifted a few times, but his most recent comments suggest that Nippon will take an ownership stake in U.S. Steel rather than purchase it outright. Officials in Japan say Nippon will make another offer that’s a broad revision of the one that’s been on the table.