- Santiment highlights how crypto whales control the market by holding large portions of supply, increasing risks for smaller investors.

- High concentration of crypto supply in a few wallets raises concerns about volatility, potential manipulation, and market stability.

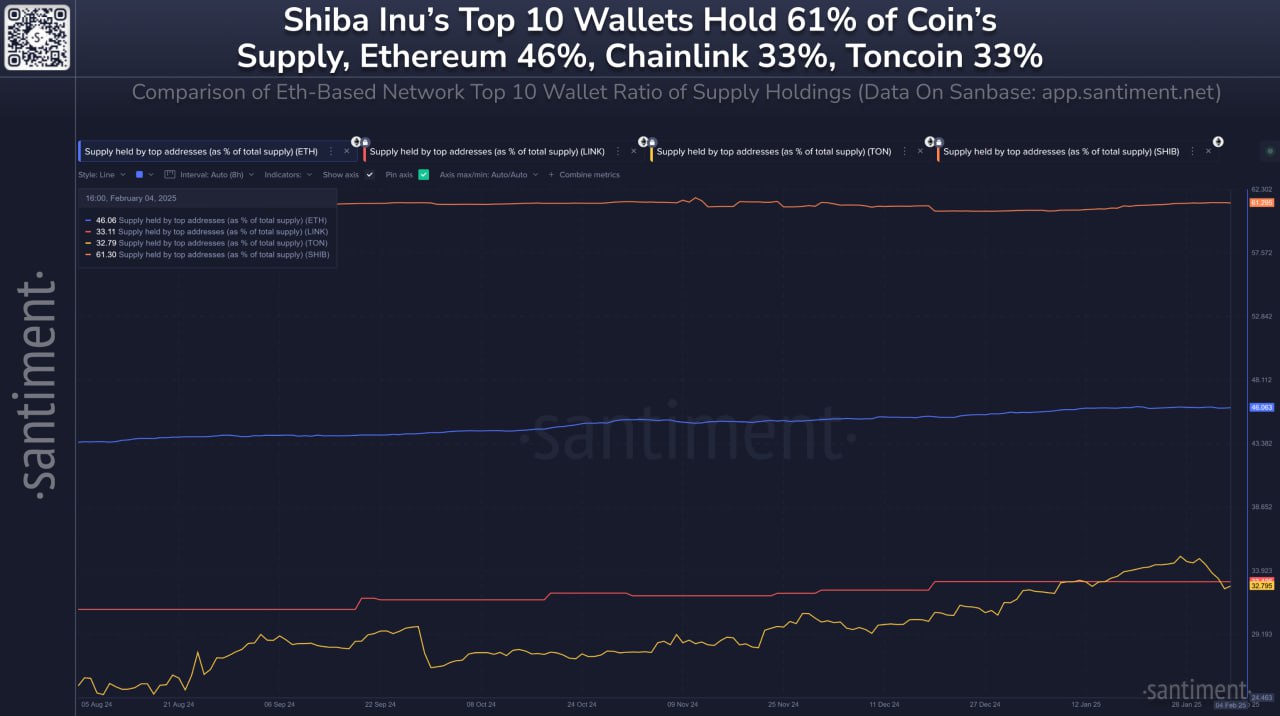

A recent report from Santiment revealed that a small number of wallets own a large percentage of the total supply of some of the largest crypto assets. This raises the question: is the dominance of a small number of holders more risky or beneficial for the market as a whole?

The Power of Big Wallets in Crypto Markets

Based on Santiment data, a sizable portion of the supply is controlled by the 10 biggest wallets for multiple different altcoins. With nearly 61% of its supply kept by the ten biggest wallets, Shiba Inu ranks highest on the list. Ethereum’s top 10 wallets hold 46.1% of the supply, while Chainlink and Toncoin stand at 33.1% and 32.8%.

When just a few wallets control a large chunk, it can go both ways. If they sell off, prices might tumble fast. But if they hold—or even buy more—it could mean they believe in the project’s future.

Compared to Shiba Inu, Ethereum, Chainlink, and Toncoin have a more balanced ownership distribution. A fairer spread like this is generally seen as healthier, as it reduces the risk of a few large players manipulating prices

Risks and Benefits of Supply Concentration

There are various things to take into account when a small group of wallets has a significant share of a cryptocurrency. Volatility rises as, should big wallets sell their assets in great numbers, the price may rapidly decline.

On the other hand, if big holders keep hoarding their coins, suggesting that they see long-term promise in the asset, trust in the enterprise can also grow. Concentrated ownership does, however, also raise the possibility of market manipulation, in which case a small number of powerful companies have significant influence over price fluctuations.

Besides that, Ethereum and other initiatives with more distributed ownership often show better stability since no one entity can significantly affect the market. Assets that depend less on the choices of a small number of owners usually inspire more confidence in investors.

Tron Wallet Security in the Spotlight

Although supply ownership is a big issue, in the crypto space, wallet security is equally rather important. Recent reports from Crypto News Flash (CNF) revealed that over 14,500 Tron network wallets were found with a vulnerability potentially exposing millions of crypto assets.

According to an AMLBot investigation, the fourth quarter of 2024 alone reportedly saw 2,130 wallets allegedly compromised, each containing roughly $31.5 million.

The UpdateAccount Permission function, intended to enhance wallet security by setting roles and transaction thresholds, has revealed a flaw. Without it, attackers could find ways to exploit user funds.

Typically, if a transaction requires a threshold of 10, and two keys hold a weight of five each, both must approve it. But in certain cases, hackers have managed to manipulate this process and access funds unlawfully.