Homebuilders may have more on the line than any sector of the real estate industry under Donald Trump’s presidency, as the new administration’s most aggressive policy positions directly impact the cost of building a home.

Homebuilders heavily rely on imports from Canada, Mexico and China, the three countries Trump has targeted for substantial tariffs. In addition, the president’s promise of mass deportations has the potential to reduce the construction labor supply as undocumented migrants are either deported or go into hiding.

The pause on Canadian and Mexican tariffs allowed builders to breathe a sigh of relief, and the deportation operation doesn’t yet appear to be having the impact that some feared. However, the short-term wins don’t end the long-term risks that still loom as Trump settles into office.

“There isn’t enough certainty,” said National Association of Home Builders President and CEO Jim Tobin. “Are we going to be back in the same cycle a month from now? We’re in a pause rather than either going forward with tariffs or doing away with them.”

Tariffs on Canada and Mexico

Last weekend, Trump spooked the homebuilders and related markets by implementing a 25% tariff on both Canadian and Mexican goods. But the tariffs weren’t in place for very long. Trump paused the duties on both countries for one month after extracting minor concessions from Canada and Mexico on items related to border security and fentanyl trafficking.

Those pauses are particularly impactful. According to data from John Burns Real Estate Consulting (JBREC), homebuilders imported 31% of their sawmill products in 2024, and 72.9% of those imports came from Canada.

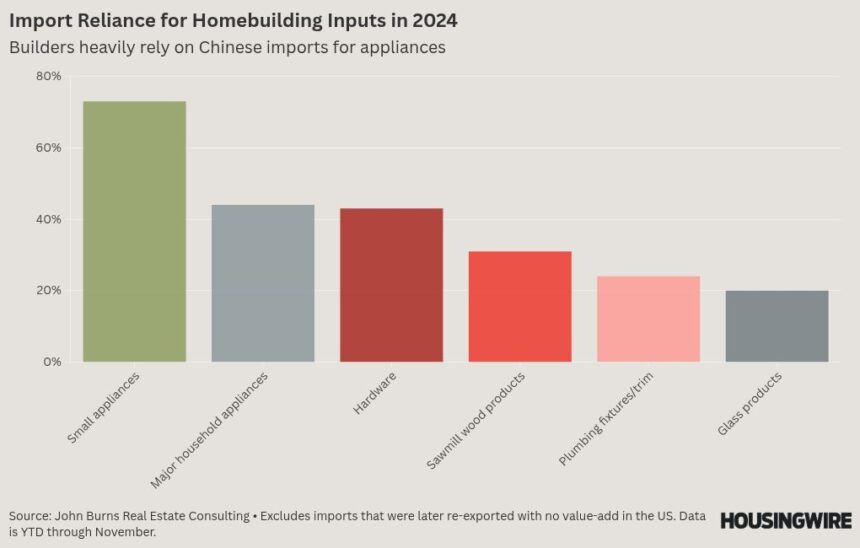

Mexico is similar. The U.S. imports 44% of its major appliances, 43% of its hardware and 20% of its glass. Mexico is a key trade partner with these goods. The country accounts for 33% of major appliance imports, 23% of glass and 20% of hardware.

While the month-long pause is positive news for builders, it won’t take long for prices to rise should a long-term deal not materialize with Canada and Mexico after the pause ends on March 1.

When the Canadian tariffs went into effect, the price of lumber immediately spiked. On Feb. 3, the price of 1,000 board feet jumped from $591 to $626. When the pause was announced the price sank back down. This shows that even a short-term tariff can have a big impact.

“Based on this historical precedent, it looks like consumer prices do respond quite quickly to when tariffs are put in place,” said Matthrew Saunders, a building products researcher at JBREC. “When there was a tariff put on washing machine imports in 2018, there was an immediate jump in consumer prices. If we go to 2019 when there was a tariff on Chinese imports of furniture, we also saw a jump.”

A tariff on China

This is bad news with regard to the 10% tariff placed on China, which remains in place. The building input most affected by the tariff is small appliances. The U.S. imports 73% of its small appliances, and China provides 67% of them.

But like Mexico, China exports a number of building materials to the U.S. Plumbing fixtures and trim from China accounts for 55% of imports, in addition to large shares of glass (33%), major appliances (30%) and hardware (29%).

Builders stocked up on materials before Trump’s second term

Trump’s pro-tariff position has been telegraphed for 10 years, so builders have had ample opportunity to prepare. Builders bought lumber ahead of time to lock in lower prices should Canadian tariffs remain in place for a long period of time.

This has resulted in elevated lumber inventory as builders head into the spring season. A silver lining to the stagnant housing market is that low demand — caused by high prices and stubborn mortgage rates — means the existing inventory will last longer than it otherwise would.

“The current inventory needs to clear and I’m not sure folks need that much in the near-term,” said lumber trader Stinson Dean. “But a medium-term reset of what ‘cheap’ lumber costs will likely be set $100 higher than pre-tariff. We are due for many many more headlines around these tariffs. There’s a very good chance we trade on either side of $600.”

Builders have also been diversifying their supply lines so they’re not as reliant on one country or source, which took on added importance during the pandemic when foreign supply lines shut down, particularly in China.

That effort has led to Vietnam becoming an increasingly important trade partner. In the 1980s, Vietnam opened its economy to direct foreign investment, which has ushered in a previously unthinkable level of wealth to the country and forged an unlikely alliance with the United States. The U.S. has even provided military support to Vietnam in hopes of detouring China.

This shows up in JBREC data. In 2010, Vietnam exported $11.3 million in small appliances, the building input that the U.S. relies on China for the most. That number has since ballooned to $1.1 billion. China exported $10.5 billion in small appliances to the U.S. in 2024, though that number has been largely stagnant since 2018.

Vietnam also exports $549 million in major appliances, $167 million in glass and $167 million in plumbing products. While Vietnam still makes up a small percentage of American building imports, the dollar amounts for those goods was almost nonexistent as recently as 2015.

The threat of mass deportations

The impact of mass deportations on construction labor is impossible to quantify because it’s not known whether any given deported immigrant works in construction labor, nor is it clear how many undocumented immigrants are actually getting deported.

Axios reported Thursday that Immigration and Customs Enforcement (ICE) has used the “catch and release” program to free some from custody because the U.S. does not have the facilities to detain the number of arrests Trump has requested.

The administration is looking for other methods for detention. It’s flying migrants to the prison at Guantanamo Bay in Cuba that’s been used to house people suspected of ties to Al-Qaeda. Trump has also expressed interest in sending migrants — and American citizens — to a prison in El Salvador, which was offered by the country’s president Nayib Bukele.

But even if deportations accelerate, it’s possible the impact on homebuilders would be limited. Videos circulated on Twitter showing half-built subdivisions in Fort Worth that appear to be abandoned, with the implication that the laborers are in hiding. However, these are unverified videos and even possibly manufactured.

Trump seems receptive to homebuilders’ requests

While things will remain uncertain for the foreseeable future, NAHB CEO Tobin believes the White House has been receptive to the trade group’s communications, which included a request for a tariff exemption on building materials.

He’s also optimistic that Trump’s housing price relief memo could bring regulatory relief. An NAHB study in 2021 estimated that 25% of the cost of building a home is the result of regulations at various levels of government, a number Trump cited in the memo.

While the federal government is quite limited on what it can do to help bring down home prices, Tobin points to regulations implemented by former president Joe Biden that he believes are unnecessary or excessive.

Excessive regulation

One is the 2021 International Energy Conservation Code, which requires that FHA borrowers purchase homes compliant with the code. Tobin says this raises the cost of housing for a class of borrower that can’t afford it.

Tobin says he supports many efforts to keep water clean, but also believes a Supreme Court decision on the Clean Water Act adds time, effort and cost to the process of building homes, trapping homebuilders in a “regulatory morass.”

But despite all the headwinds, homebuilders remain confident that it can navigate the uncertainty to achieve positive outcomes for builders and homebuyers alike.

“We have to balance regulations with the cost of housing because it’s equally important to put shelter over your head every night,” Tobin said. “[Tariffs] may be a short term blip, but we’re also trying to take a holistic approach. The whole economic and regulatory posture of this administration is going to continue to change over the next several months.”