- Hedera (HBAR) shows potential for a 22% rally, with price surging 18% this week but trading volume dropping 30%.

- On-chain data reveals $4.84M HBAR outflow, signaling long-term holder confidence despite cautious short positions among traders.

The crypto market is showing signs of recovery, with Hedera (HBAR) gaining momentum. With a potential 22% rally on the horizon, HBAR is drawing interest from both investors and traders. Over the past week, HBAR’s price surged by over 18%, hitting $0.3329. However, the trading volume declined by 30% in the last 24 hours.

On-chain data provided by Coinglass reveals some intriguing trends. In the past day, $4.84 million worth of HBAR was pulled out of exchanges. The outflow suggests long-term holders are moving assets to private wallets, signaling confidence in the altcoin’s future. For those looking at the bigger picture, this could hint at an accumulation phase, often seen before price breakouts.

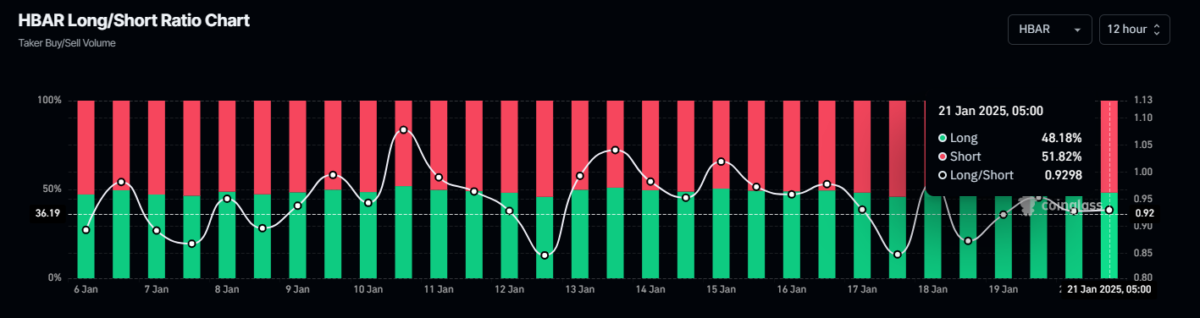

However, not everyone shares the same optimism. The Long/Short Ratio for HBAR sits at 0.9298, with 51.82% of top traders holding short positions. This indicates that while long-term investors are bullish, traders remain cautiously bearish.

HBAR Targets 22% Rally — Key Resistance at $0.4012

HBAR retested a bullish symmetrical triangle pattern, a technical move that often precedes significant upward momentum. Despite mild resistance around the $0.4012 mark, the formation of a large green candle and a bullish engulfing pattern indicates that further gains may be on the horizon.

If HBAR successfully closes above the $0.4012 resistance level, historical price movements suggest a rally of up to 22% could be in play. That would bring the altcoin closer to its all-time high of $0.5701. While there are no guarantees, analysts are closely watching this critical threshold.

Adding to the optimism, Hedera’s technical indicators, such as its Relative Strength Index (RSI), show promise. Currently, at above 56, the RSI suggests the possibility of a rebound if overall market conditions remain favorable. Breaking through $0.4012, however, will require sustained momentum from both retail and institutional investors.

Long-Term Prospects Hints $5 by 2025?

Looking beyond the short-term, some analysts have made bold predictions for HBAR. Crypto Kip, a notable voice in the space, believes HBAR could reach $5 by 2025. He cites the platform’s compliance with ISO 20022 standards as a key factor. That compliance positions Hedera as a favorite among institutions and regulatory bodies, potentially opening doors to integration with traditional financial systems.

Hedera’s focus on scalability, efficiency, and compliance provides it with a solid foundation for growth. While the current market conditions remain challenging, the long-term outlook for HBAR is far from bleak. Hedera might become a key player in the evolving blockchain landscape amid mainnet upgrade, tokenization, and Coinbase prime custody, as we reported earlier.

HBAR’s path forward will not be without hurdles. Overcoming the $0.4012 resistance level and sustaining its momentum will require more than technical strength. Broader market sentiment, adoption rates, and continued innovation will play crucial roles in shaping its trajectory.