- Long-time Cardano supporter Dan Gambardello predicts that ADA could reach $2 in the near term, with the potential to hit $3 by January 2025.

- His outlook is bolstered by recent price recovery and favorable signs in the derivatives market, where ADA’s open interest has risen by 4.03%.

Cardano’s (ADA) price has recently dropped sharply, dipping over 21% over the last week. The crypto that changed hands at $1.30 one week ago plunged to a low of $0.911. However, the ADA price registered a massive rebound today.

Currently, ADA price stands at $1.07, implying a surge of 8.57% over the last 24 hours. This sharp bounceback has prompted analysts to offer a bullish outlook concerning the direction of Cardano’s price.

Bullish Cardano Price Predictions

Dan Gambardello, a long-time Cardano proponent, is optimistic regarding ADA’s future. He expects the token to hit $2 in the near term, reported CNF. Further extending his prediction, Gambardello believes that ADA could hit $3 by January 10, 2025, using historical patterns from late 2020 to early 2021.

He presented January 24, 2025, as a possible date for ADA to hit $3, which is a conservative estimate, per the CNF report. This is his usual tendency of overestimating the speed at which market movements happen.

His prediction seems to be fruitful soon as the Cardano price has seen a strong recovery lately. Moreover, the derivatives market also shows favorable signs for ADA. Today, Cardano’s open interest soared 4.03% to $837.89 million, according to Coinglass data.

Near-term Challenges & Bearish Sentiments

However, other analysts are less positive about ADA’s short-term recovery. Ali Martinez identified some serious challenges that might prevent ADA from regaining bullish momentum. According to his analysis, there is a critical support level near $1.20, where 93,000 wallet addresses collectively hold 2.54 billion ADA. This level is crucial for maintaining price stability.

Martinez warns that a sustained break below the $1.20 support could lower the price to below $1. His analysis also points to bearish market sentiment, as 64.68% of ADA holders now face unrealized losses. This situation could trigger additional selling pressure during minor price recoveries.

On the positive side, Martinez highlights a demand zone between $0.98 and $1.02 as a safety net. In this zone, 41,720 wallet addresses hold 1.03 billion ADA, which may limit further loss.

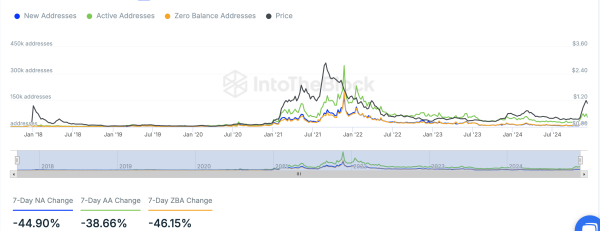

Meanwhile, on-chain data reflects declining activity within the Cardano network. Metrics from IntoTheBlock show that the creation of new addresses has dropped by 44.90% in the past week.

While active addresses have decreased by 38.66%, zero-balance addresses fell by 46.15% over the same period, signaling diminished network engagement. This decline in activity further underlines the challenges Cardano’s price faces amidst the crypto market uncertainties.

Also, despite the ADA rebound and surge in open interest, long liquidations increased to $4.30 million in the last 24 hours. It could also weigh on the Cardano price action in the short term.