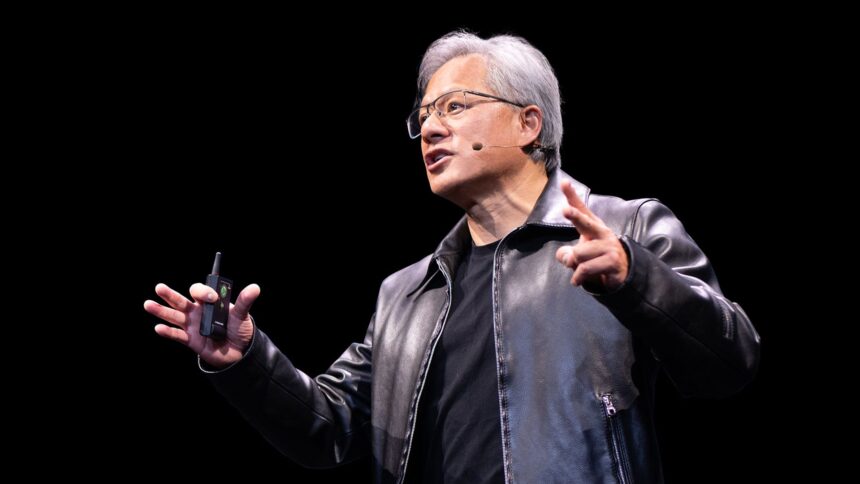

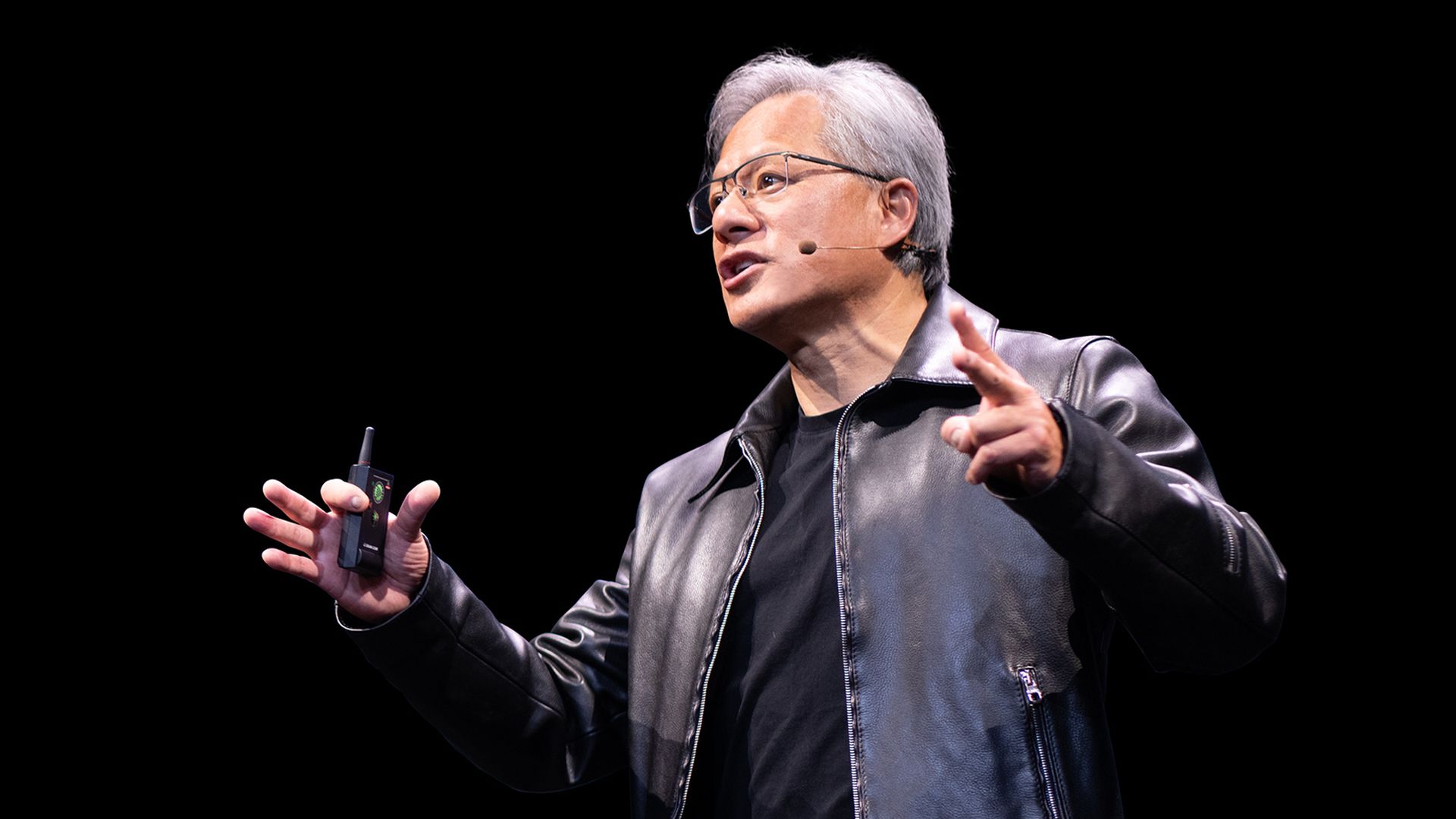

Nvidia (NVDA) CEO Jensen Huang announced significant developments for the company during the CES 2025 technology conference held on January 7. He revealed that data center operators are expected to invest $1 trillion over the next four years to enhance their infrastructure for artificial intelligence (AI) development, a segment that currently represents 88% of Nvidia’s total revenue.

Nvidia’s CEO announces $1 trillion AI investment at CES 2025

Nvidia has positioned itself for the autonomous vehicle market, with its automotive business now gaining traction after more than two decades of relative obscurity. Major global automotive brands, including Mercedes-Benz, Hyundai, BYD, Volvo, and Toyota, are adopting Nvidia’s Drive platform to advance their self-driving technologies. The Drive platform offers comprehensive hardware and software solutions essential for autonomous driving, utilizing Nvidia’s latest chip, Thor. This chip processes data from a vehicle’s sensors to determine optimal actions on the road.

Nvidia stock slides 2% amid new AI export limits: Should you be worried?

Alongside the Drive platform, Jensen Huang indicated that automotive companies are investing in DGX data center systems equipped with Nvidia’s GB200 GPUs based on the Blackwell architecture. These GPUs are vital for continuously training self-driving software. Additionally, Nvidia introduced Cosmos, a multimodal foundation model that allows companies to conduct millions of real-world simulations using synthetic data, which serves as a basis for software training.

Huang emphasized that the autonomous vehicle sector could emerge as the first multitrillion-dollar opportunity in the robotics field. Technologies like autonomous ride-hailing could generate $14 trillion in enterprise value by 2027, primarily benefiting autonomous platform providers such as Nvidia.

Nvidia’s fiscal year 2025 will conclude at the end of January, and the company has reported $1.1 billion in automotive revenue over the first three quarters. When extrapolated, this could result in approximately $1.5 billion in full-year revenue. Huang projected that in fiscal 2026, Nvidia’s automotive revenue could escalate to an impressive $5 billion.

Current focus on data center chips

While the automotive segment promises long-term growth, Nvidia’s immediate focus remains on data center operations. Wall Street analysts forecast that Nvidia could achieve total revenue of $196 billion during fiscal 2026, making the automotive sector’s anticipated $5 billion contribution comparatively minor.

Nvidia has commenced shipping its new Blackwell GB200 GPUs, with rapid sales growth anticipated. By April, revenue from Blackwell chips is expected to surpass that from the prior generation of Hopper architecture chips, signaling a swift evolution in Nvidia’s business operations.

The GB200 NVL72 system delivers AI inference capabilities up to 30 times faster than its predecessor, the H100 GPU system. This advancement is expected to facilitate the development of the most sophisticated AI models to date. The demand for Blackwell chips currently exceeds supply, likely bolstering Nvidia’s revenue and profit in fiscal 2026. Reports suggest a new version, referred to as “Rubin,” may be introduced later this year, further solidifying Nvidia’s dominance in the data center GPU market.

Nvidia’s stock has experienced a dramatic increase of 830% since the beginning of 2023, boosting the company’s market value from $360 billion to approximately $3.3 trillion. Despite this substantial growth, Nvidia’s shares may still be undervalued, trading at a price-to-earnings (P/E) ratio of 53.6. This figure is lower than its 10-year average P/E ratio of 59. Analysts estimate Nvidia’s earnings per share in fiscal 2026 could reach $4.44, leading to a forward P/E ratio of 30.6.

In order to align with its 10-year average P/E ratio of 59, Nvidia’s stock would need to increase by 92% within the next year. Historically, Nvidia has exceeded Wall Street estimates, indicating potential for further stock value increases. However, investors should remain vigilant of emerging competition from other chip manufacturers, such as Advanced Micro Devices, which plans to launch a rival to the Blackwell chips in the coming months.

Disclaimer: The content of this article is for informational purposes only and should not be construed as investment advice. We do not endorse any specific investment strategies or make recommendations regarding the purchase or sale of any securities.

Featured image credit: Nvidia