President Donald Trump escalated the tariff tit-for-tat with Canada on Tuesday by announcing on social media that he will impose an additional 25% duty on imports of steel and aluminum, two critical construction materials that have been tariff targets.

This tariff is in addition to the 25% tariff already scheduled to take effect Wednesday. Should Trump allow it to take effect, it would bring the total duty on these imports to 50%.

The move came in response to Ontario Premier Doug Ford placing a 25% tax increase on electricity exports to New York, Minnesota and Michigan. Ford was responding to the slew of tariffs and harsh rhetoric toward Canada.

Trump also said he will “substantially increase” tariffs on Canadian auto exports, which last week he paused until April 2 after consultation with U.S. manufacturers.

The president cited a number of actions that Canada must take to avoid additional tariffs, including the removal of what he said is a triple-digit tariff on U.S. dairy exports. The “only thing that makes sense,” according to Trump, is for Canada to become part of the U.S.

CNN reported that because of the way dairy tariffs are structured under the United States-Mexico-Canada Agreement (USMCA), the NAFTA replacement that Trump implemented in July 2020, Canada does not actually have a tariff on U.S. dairy.

Trump’s escalating trade war has been a headache for homebuilders seeking clarity and consistency on the president’s planned tariffs on construction materials.

The back and forth with Canada kicked off in earnest when Trump threatened a 25% tariff on Canadian and Mexican imports after assuming office for his second term. But he paused these duties for one month in exchange for minor concessions on immigration enforcement and fentanyl trafficking.

After the one-month pause ended on March 4, Trump allowed them to take effect. But two days later, he announced a one-month pause on Canadian and Mexican imports that are covered by the USMCA, allowing his own trade agreement to take precedence over his shifting rhetoric.

While he signed an executive order calling for increased lumber production in the U.S., Trump has also directly targeted lumber imports from Canada. Last week, he floated a reciprocal tariff on Canadian lumber that would have the U.S. match Canada’s tariff on U.S. lumber.

The U.S. currently has a 14.5% tariff on Canadian lumber. Canada does not have a tariff on American lumber, so Trump’s reciprocal tariff would effectively remove the U.S. tariff on Canada, not increase it.

Trump’s various pauses and deadlines have made April 2 a critical day for the U.S. economy, which has been roiled by the president’s shifting approach to trade policy. The pause on Canadian and Mexican duties not covered by the USMCA expires on that date. Trump’s global reciprocal tariffs and auto tariffs are also scheduled to begin April 2.

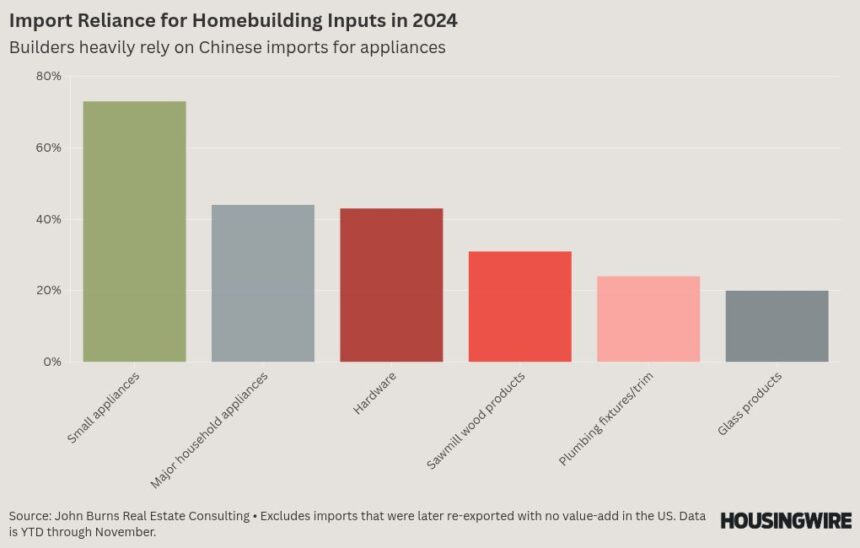

The tariff threats on Canadian lumber are particularly problematic for homebuilders. According to data from John Burns Research & Consulting (JBREC), 73% of lumber imports come from Canada and JBREC warns that tariffs could raise borrowing costs for homebuilders as well.

The National Association of Homebuilders (NAHB) has made no secret of its opposition to tariffs on construction materials. The trade group asked the Trump administration for an exemption on building materials, warning that Trump’s trade policy contradicts his day-one executive order calling for emergency home-price relief.

Builders are expressing uneasiness over the trade war, as the NAHB/Wells Fargo Housing Market Index (HMI) for February fell five points compared to January.

Economists worry that the tariff threats alone could cause inflation to accelerate since businesses have little clarity on the policies and will raise their prices just to be safe. The NAHB estimated that Canadian lumber tariffs could cause duties to approach 60% and builders are baking in an additional $7,500 to $10,000 for the cost to build a home.

In Tuesday’s social media post, Trump called Canada an “abusive threat” and “anti-American farmer,” but added that he will allow the Canadian national anthem to play should Canada join the U.S.