Catastrophic weather events in the U.S. are reshaping insurance premiums and real estate markets, which will inevitably drive up costs and worsen affordability.

Notably, hailstorms, the devastating wildfires in California and hurricanes in the Gulf Coast are reminders of the cost burdens associated with housing reconstruction and risk.

And just last week, a historic and rare Gulf Coast snowstorm resulted in all 50 states having already seen snow accumulations snow this winter. Southern and Gulf-adjacent states not used to snowfall faced devastating blows to travel and livelihoods. The storm resulted in airports closing, unsafe roadways and at least 11 deaths, ABC reported.

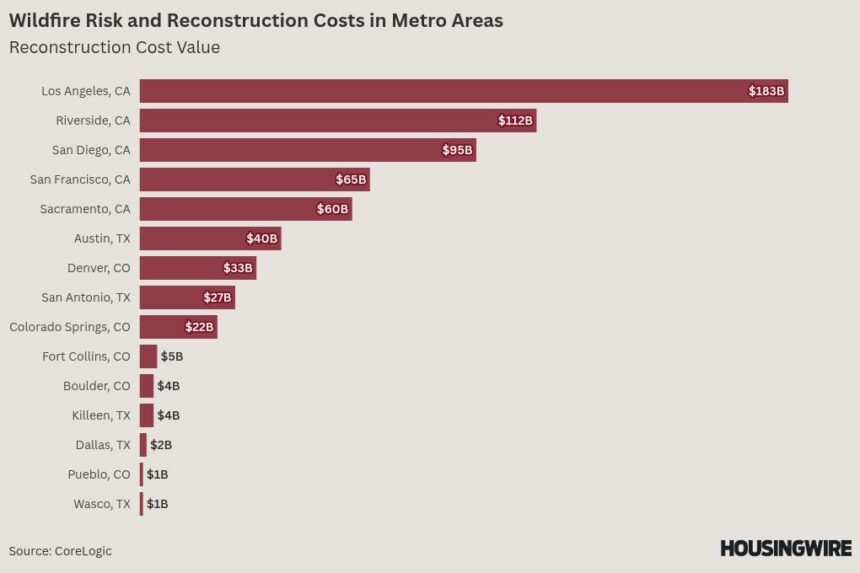

California’s battles with several wildfires over the past few weeks has resulted in the destruction of more than 57,000 acres and 16,000 structures as of Tuesday, according to CAL FIRE, with insured losses estimated at $45 billion.

Ruth Jones Nichols, executive vice president of local and national programs at Local Initiatives Support Corp. (LISC), a nonprofit organization that provides financial assistance and technical support to community development projects, said that the road to recovery in Los Angeles will widen the wealth gap.

Jones Nichols pointed out that homeownership rates for Latinos and Blacks in California were already well below that of white households.

“As such, for those with financial resources, recovery will be slow mainly due to building times as permitting processes have been eased with blanket waivers to expedite reconstruction,“ she said.

“… For those without adequate income or savings, largely those from majority-minority populations, the road to recovery will be riddled with financial barriers that will prohibit their return, leading to a loss of original ownership representation in fire-ravaged areas.”

Jones Nichols noted that in areas with preexisting affordability crises, like Los Angeles, the strain is felt more acutely by families without generational wealth.

“Some of the burnt-out communities, like Altadena, were places where Black families could thrive at a time when Blacks were not allowed to buy property west of Crenshaw or east of the 110 freeway. … Many of the elderly and middle-income families displaced by the wildfires will struggle to hold on to their properties, essentially ending the prospect of generational wealth transfers within those communities,” she said.

The soaring price of insurance, the costs associated with reconstruction, and resiliency upgrades related to climate change costs are straining households beyond California. The scale of destruction often delays remediation, ramps up costs, and creates tension in housing supply and demand. Policies designed to cover living expenses during a disaster might not cover prolonged displacement either.

“Rebuilding will help the supply-demand ratio, however, that doesn’t necessarily mean that prices will go back to where they were since homes will be brand new,” said Adam Hamilton, the CEO of REI Hub, a software company for rental property owners and real estate investors. “It will likely cause prices to continue to rise, potentially even pricing out current residents.”

Hamilton also pointed out that the 2028 Summer Olympics will be held in Los Angeles, which he said is likely to further increase the pressure to rebuild quickly.

Marty Smuin, CEO of proptech firm Arturo, said that wildfire risks, particularly in fire-prone areas, should be of concern to everyone. But there are practical measures to mitigate the impacts, and his company is using artificial intelligence (AI) to enhance disaster prevention and response.

“Proactive mitigation measures can significantly reduce the likelihood of damage and the cost of reconstruction. Steps like clearing roofs and gutters of dry debris, maintaining defensible space around homes, and using fire-resistant materials for roofs and siding can make properties more resilient,” Smuin said.

“AI plays a pivotal role in both preventing and responding to these disasters, including fire damage, offering speed, accuracy, and scalability that traditional methods often lack. At Arturo, we assess risks and recommend ways to improve resilience using advanced AI-driven property intelligence. In the aftermath of wildfires, our technology supports insurance companies and homeowners by evaluating damage, calculating reconstruction costs, and enabling faster, more accurate claims processing.”