Whether you’ve got a simple side hustle or are the CEO of a major company, having a business credit card is a great way to manage your expenses and extend your company’s purchasing power – all while earning valuable points and miles to fuel your work (or personal) travel.

Just like with personal cards, getting ahead with a business credit card is all about timing: Getting a new card when the welcome bonus is at its highest is what it’s all about. If you’re in the market for a business credit card, this is the place to start.

Not sure if you’re eligible for a business credit card? You might be surprised to find out just what the banks consider a small business.

When it comes to picking out a new business card, there are plenty of options. To help you make your decision, we’ve assembled a list of the absolute best business card offers available right now. And with tax season upon us, now is one of the best times of year to pick up a new card and earn a big bonus for making your annual tax payment.

But remember: Credit cards are serious business. You should never apply for a credit card if you’re already in debt, and never charge more to a credit card than you can afford to pay off immediately. However many points and miles you can earn, they’re not worth it.

For more information on the best current offers, make sure to head to our Top Credit Cards Page.

1. Chase Ink Business Preferred® Credit Card

Current Offer

The *chase ink preferred* gives new cardmembers the opportunity to earn a big bonus: bonus_miles_full

These points are worth a minimum of $1,125 for future travel when redeemed through Chase Travel℠ – if not much, much more.

Annual Fee: annual_fees

Learn more about the *chase ink preferred*.

Why This Offer Makes the List

First off, the card is a good one for racking up Chase Ultimate Rewards points well beyond the initial welcome offer. It earns bonus points in several key business categories, such as travel, shipping expenses, phone & internet bills, and online advertising.

On top of that, it offers some rock-solid travel benefits and other protections for your business. And when it comes time to reap your rewards, the Ink Preferred allows you to redeem Chase Ultimate Rewards in a variety of ways.

You can use them to book travel at 1.25 cents per point in the Chase travel portal, or they can be transferred at a 1:1 ratio to any of Chase’s transfer partners. That means if you use them towards travel, this huge 90,000-point offer is worth a minimum of $1,125. If travel isn’t your goal, Ultimate Rewards can also be cashed out at a rate of 1 cent per point, applied to your bill as a statement credit, or even used for gift cards.

The lucrative points-earning opportunities, versatility when redeeming rewards, and a low annual fee are just some of what makes this card so valuable.

Check out our full review of the Chase Ink Business Preferred!

2. The Capital One Venture X Business

Current Offer

The *venture x business* is currently offering new cardmembers the opportunity to earn bonus_miles_full.

Annual Fee: *$395*

Learn more about the *venture x business*.

Why This Offer Makes the List

With the Venture X Business Card, Capital One essentially hit copy and paste on the personal *venture x* that’s chock full of premium travel benefits: Access to Capital One Lounges, Priority Pass lounges, Plaza Premium lounges; a $300 annual Capital One Travel credit, a credit for Global Entry or TSA PreCheck, and more.

While the spending requirement to earn the big welcome bonus is larger than most, you’ll be hard-pressed to find a better bonus on a business card right now.

And with a price tag of just *$395* a year, that automatically makes this card a compelling alternative to premium competitors which can cost nearly double that.

Sure, a *$395* annual fee may immediately turn off many travelers. But in practice, it’s actually far cheaper. Consider that you get an automatic $300 credit a year towards travel booked through the Capital One Travel portal. Then, starting in year two, you get a 10,000-mile bonus every year: these miles are worth a minimum of $100.

Are you the kind of person who plans to spend $300 a year or more on travel? If so, do the math and you’ll see that in reality, you’re paying $95 a year for this card – or much less when you add in the other perks and welcome bonus.

Read our full review of the Venture X Business Card

3. The Chase Ink Business Cash® Card

Current Offer

The *chase ink cash* is currently offering new applicants the ability to earn up to $750 in bonus cash back (or 75,000 Ultimate Rewards). Here’s how it works: *ink cash bonus*

And all that cash back is actually awarded in the form of Chase Ultimate Rewards points. This means you can combine your cash back with the Ultimate Rewards earned from one of Chase’s premium travel rewards cards like the *chase ink preferred* or the *csp* to transfer them to travel partners.

Annual Fee: None

Learn more about the *chase ink cash*.

Why This Offer Makes the List

If your business doesn’t regularly spend big, the Ink Cash is a great option for you. With the current tiered bonus, you’d only need to spend $1,000 per month (on average) to get the full bonus. But even if you just have a big one-time expense and are able to earn the first $350 bonus (or 35,000 points), that’s certainly nothing to scoff at.

Beyond that introductory bonus, you’ll continue racking up rewards in a hurry. You’ll get 5% cash back (or 5x Ultimate Rewards) for purchases at office supply stores – and on internet, phone, and cable charges (up to $25,000 in combined spending each account anniversary year). You can also earn 2% cash back (or 2x Ultimate Rewards) on restaurant and gas station purchases (up to $25,000 in combined spending each account anniversary year). All other purchases earn an unlimited 1% cash back (or 1x Ultimate Rewards) for every dollar spent.

Add in some travel and purchase protections – perks you don’t often see on no-annual-fee cards – and it’s easy to see why this card could make sense for so many small business owners.

Having trouble deciding which Ink card is right? Read our comparison of the Ink Business Cash vs the Ink Business Unlimited.

4. The Chase Ink Business Unlimited® Card

Current Offer

The *Ink Unlimited* is currently out with a nice bonus offer: bonus_miles_full

And even though this card earns cash back, it’s actually rewarded in the form of Chase Ultimate Rewards points. This means you can combine your cash back with the Ultimate Rewards earned from one of Chase’s premium travel rewards cards like the *chase ink preferred* or the *csp* to transfer them to travel partners.

Annual Fee: None

Learn more about the *chase ink unlimited*.

Why This Offers Makes the List

It’s hard to overstate just how good this current, limited-time bonus offer is. Getting the chance to earn $750 cashback (or 75,000 Ultimate Rewards) on a card that doesn’t even charge an annual fee is pretty much unheard of. But beyond that, this card is really rewarding and will make a lot of sense for business owners who spend big in a variety of categories.

The Chase Ink Unlimited Card earns a flat 1.5% cash back (1.5x Chase Ultimate Rewards) on every purchase. There is no cap on your earnings with this card so if your business doesn’t spend a lot in a bonus category, this can be a really good option for ensuring you’re getting a good return on all purchases.

You can also add additional employee cards without a fee, which can help you streamline your business spending and allow you to earn rewards even faster.

Read our full review of the Chase Ink Business Unlimited!

5. The Business Platinum® Card from American Express

Current Offer

*biz platinum* has a standard welcome offer of 150,000 Membership Rewards® points after you spend $20,000 on eligible purchases with your card within the first three months of card membership.

While this is a fantastic offer on its own, it might not hurt to try searching for “Amex Business Platinum” in an incognito browser, where offers as big as 250,000 points have been reportedly popping up.

Annual Fee: $695 (see rates & fees)

Learn more about *biz platinum*

Why This Offer Makes the List

Beyond the initial welcome offer of at least 150,000 Membership Rewards points, the Business Platinum is a great card to use when purchasing flights. If your business spends a lot on airfare, this card will pay for itself time and time again. You’ll earn an unprecedented 5x Membership Rewards points on prepaid flights and hotels booked through Amex Travel.

On top of earning additional points for flights booked through Amex, Business Platinum cardholders will also earn an extra 1.5x Membership Rewards on purchases made in select business categories and large purchases with any merchant over $5,000 (up to $2 million in purchases each year). The categories where you’ll earn points at a rate of 1.5x per dollar spent are electronic goods retailers, software and cloud service providers, U.S. construction materials, hardware supplies, and shipping providers.

Alright, enough about earning points. Let’s get to the real reasons you should have this card: Travel perks and business credits.

Much like *amex platinum*, the Business Platinum comes packed with travel perks, benefits, and credits that make it a mainstay in many business owners’ wallets. Seriously, this card comes with so many statement credits for different travel and business-related expenses that you might need to hire another employee just to manage it all. And if you do, be on the lookout for an opportunity to earn additional Membership Rewards for adding them as an authorized user!

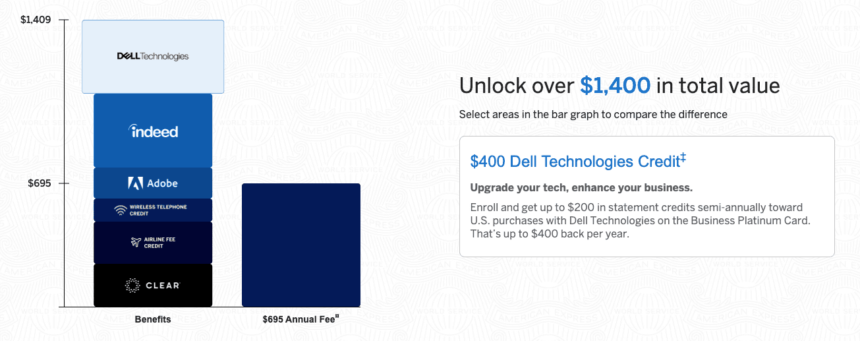

By simply using this card for your expenses, you can earn over $1,400 each year in statement credits for different business and travel-related purchases. Here’s how it shakes out: You’ll get up to $200 per calendar year for airline incidental fees at one airline; up to $189 annually for CLEAR Plus enrollment; up to $400 annually ($200 twice per year) for U.S. purchases at Dell; up to $10 per month ($120 per year) to spend with U.S. wireless telephone providers; up to $360 annually ($90 per quarter) to spend on Indeed hiring and recruiting products; and $150 each year to spend on select Adobe purchases.

And then there are all the travel perks that you get with this card. I’m talking about things like airport lounge access, car rental elite status, and hotel elite status. In fact, this card is widely considered the best credit card for airport lounge access because it’ll get you into Amex Centurion Lounges, Delta Sky Clubs (when flying Delta), Escape Lounges, and Priority Pass lounges.

When it comes time to use your points, you’ve got some great options. For starters, you can send them to the excellent stable of Amex transfer partners. But there’s also arguably the card’s best perk of all: Book flights through the Amex Travel portal using points, and you’ll get 35% of your points back for any first or business class flights – plus all flights booked with one airline of your choice. Redeeming your points like this makes them worth just over 1.5 cents each.

While the card’s annual fee might seem high at first glance, it’s relatively easy to come out ahead with this one … even if you only use half of the card’s statement credits each year.

Read more: Earn a Big Bonus With the Business Platinum Card® from American Express

6. The American Express® Business Gold Card

Current Offer

The *biz gold* currently has a big welcome offer: bonus_miles_full

But much like the Business Platinum Card, you might be able to find a much bigger bonus of 150,000 points to as much as 200,000 points by opening a link for the Business Gold Card in an incognito window.

Annual Fee: $375 (see rates & fees)

Learn more about the *biz gold*.

Why This Offer Makes the List

The 100,000 Membership Rewards point welcome offer is a great reason to get the *biz gold*, but you’ll probably want to keep it year after year due to its ongoing point-earning. Seriously: You’ll be hard-pressed to find a more rewarding business credit card than the Amex Business Gold Card.

With this card, you’ll earn 4x Membership Rewards points in your top two spending categories each billing cycle, up to a combined $150,000 in spending across all categories each year. All other eligible purchases outside of your top two categories and after reaching $150,000 in combined spending will earn unlimited 1x points.

Amex recently made some big changes to the Business Gold Card, including adding some new eligible spending categories. Here’s a look at all the spending categories in which you could earn 4x Membership Rewards points.

- U.S. purchases for advertising in select media (online, TV, radio)

- U.S. purchases made from electronic goods retailers and software & cloud system providers

- Monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S.

- U.S. purchases at gas stations

- U.S. purchases at restaurants, including takeout and delivery

- Transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses & subways

If your business spends a lot in any of those six categories, you can earn up to 600,000 Membership Rewards points each year with the Amex Business Gold Card. And just like the Membership Rewards earned with the Business Platinum Card, these points are super valuable and can be used in a variety of ways, including transfers to travel partners for award bookings.

Along with that recent refresh, Amex added a new flexible monthly statement credit that will be sure to help your business save up to $240 each year on common expenses.

You can use this credit for purchases at the following retailers:

- FedEx

- Grubhub

- Office Supply Stores

In order to take advantage of this new credit, you must enroll for the monthly benefit. Once you get your card, you can do this by heading to the benefits tab in your Amex online account.

7. World of Hyatt Business Credit Card

Current Offer

With the *world of hyatt business* you can earn *world of hyatt business bonus offer*

This limited-time offer is a good one because of the added ability to earn a valuable Category 1-4 free night award. These can be used at several great Hyatt properties around the globe.

Annual Fee: $199

Learn more about the *world of hyatt business*.

Why This Offer Makes the List

This card comes packed with travel benefits like automatic Discoverist elite status, annual Hyatt credits, and travel insurance – making it a winner for any Hyatt fan.

Aside from the big 60,000-point welcome offer bonus and the ability to earn a category 1 – 4 free night award, holding this card is all about earning Hyatt’s elite status. With the World of Hyatt Business Credit Card, you’ll earn five tier-qualifying night credits for every $10,000 you spend on the card in a calendar year.

Hyatt’s top-tier Globalist status can be earned by staying 60 nights at Hyatt hotels. That means spending $120,000 on the card each year would earn you enough tier-qualifying nights for Globalist elite status. While that’s a lot to spend, trust us when we say that Hyatt’s Globalist status can easily be worth it – in fact, it’s a big reason why we think that World of Hyatt is the best hotel rewards program.

If earning Hyatt points is your ultimate goal, you can get a better return on some of your business spending with the *chase ink preferred*.

The Ink Preferred Card technically earns Chase Ultimate Rewards points. But Hyatt is a Chase Transfer partner – meaning you could transfer those points directly into your world of Hyatt account on a 1:1 basis (1 Chase point equals 1 Hyatt point). With an annual fee of only $95, the Chase Ink Preferred is also a more economical option.

Though the World of Hyatt Business Credit Card has a $199 annual fee, if you regularly stay at Hyatt hotels, you can recoup up to $100 of that easily with the $100 Hyatt credit benefit starting in your second year with the card.

8. Delta SkyMiles® Reserve Business Card

Current Offer

The *Delta Reserve Biz* is Delta’s highest-priced business card but it also comes with the biggest bonus: bonus_miles_full

With the ability to earn 80,000 SkyMiles and 2,500 Medallion Qualifying Dollars (MQDs), now could be the perfect time to add this card to your wallet.

Annual Fee: annual_fees (see rates & fees)

Learn more about the *Delta Reserve Biz*.

Why This Offer Makes the List

SkyMiles get a bad rap and may not be the best for booking fancy business class seats, but they’re far from worthless.

From domestic roundtrips for 9,000 SkyMiles to Europe and back for less than 30,000 SkyMiles, we’ve seen a steady stream of Delta SkyMiles flash sales over the last year or so. There’s even been a recent resurgence in cheaper Delta One business class award fares!

But the real reason to get a Delta card has nothing to do with the SkyMiles you’ll earn: It’s all about the perks and benefits that come with the card … and with the Delta Business Reserve Card, there’s lots to love.

For starters, you’ll get an annual companion ticket – good for BOGO travel (including first class) within the U.S. and even down to Mexico and the Caribbean. You’ll also get benefits like a free checked bag on every Delta flight – a savings of at least $70 on each roundtrip – can go a long way to offset card’s high annual fee. Plus, you’ll get some other nice perks like a 15% discount on award tickets, priority boarding, and a $250 statement credit for booking hotels through Delta Stays.

But the absolute best reason to pick up the Delta Reserve is that it will help you earn Delta Medallion status quicker, thanks to the MQD Headstart benefit and bonus MQD earning on purchases. You’ll also get access to Delta Sky Clubs when flying Delta – though you’ll be limited to just 15 visits per year, beginning Feb. 1, 2025.

If your business regularly spends big – or has a big tax payment coming up – you can get around the new Sky Club limit by spending $75,000 in a calendar year. Doing so would also earn you Delta Gold Medallion status and a boatload of SkyMiles in the process.

Bottom Line

The banks are out with some show-stopping welcome offers on their best business credit cards right now. Having one of these cards can be a great way to manage your business expenses, all while earning a ton of points and miles in the process.

If you’re interested in opening one of these cards but unsure if your small business or side hustle qualifies, be sure to check out our guide to determining business eligibility beforehand.